Why is automotive insurance coverage so costly in Michigan? This burning query confronts Michiganders, a monetary burden weighing closely on the state’s driving inhabitants. From the treacherous winter roads to the particular driving habits of its residents, the exorbitant prices of automotive insurance coverage in Michigan are a posh puzzle. Components like accident statistics, climate situations, and even native legal guidelines all contribute to this expensive conundrum.

A deeper dive into this concern reveals a large number of interconnected components, shaping the insurance coverage panorama in a manner that impacts each driver.

The escalating price of automotive insurance coverage in Michigan is a multifaceted drawback, with a tangled internet of things pulling collectively to kind this monetary pressure. The state’s distinctive mix of difficult climate patterns, particular authorized laws, and the frequency of accidents all play an important position in shaping the value of automotive insurance coverage. Understanding these elements is essential to navigating this monetary panorama.

Components Contributing to Excessive Michigan Automotive Insurance coverage Prices

Michigan’s automotive insurance coverage panorama is a posh tapestry woven from varied threads. Understanding the elements contributing to the excessive premiums is essential for each drivers and insurance coverage suppliers. From the state’s distinctive driving situations to its authorized framework, quite a few components affect the price of insuring a automobile within the Nice Lakes State.The excessive price of automotive insurance coverage in Michigan is not a easy phenomenon.

It stems from a confluence of things, together with the frequency and severity of accidents, the influence of climate patterns, and the particular laws that form the state’s insurance coverage market. These elements, when mixed, create a dynamic that finally interprets to greater premiums for drivers.

Visitors Accident Statistics and Frequency

Michigan’s accident statistics play a big position in figuring out insurance coverage premiums. Increased accident charges translate immediately into greater insurance coverage prices. The frequency of collisions, coupled with the severity of accidents sustained, contributes considerably to the general price of claims and the necessity for greater premiums to cowl potential payouts. Information from the Michigan State Police present that sure areas of the state persistently expertise greater charges of accidents, typically correlating with greater visitors volumes or particular street situations.

This knowledge informs insurance coverage corporations’ threat assessments and consequently influences the premiums.

Climate Circumstances and Driving Habits

Michigan’s climate situations dramatically influence driving habits and accident charges. The state’s unpredictable mixture of extreme winters, with icy roads and decreased visibility, and heavy summer season downpours immediately correlates with an elevated threat of accidents. Drivers adapting to those situations, and the inherent challenges of the state’s climate, have an effect on the frequency and severity of collisions.

The mix of those elements contributes to the excessive premiums charged by insurance coverage corporations to mitigate the dangers related to these situations.

Michigan Legal guidelines and Rules

Particular Michigan legal guidelines and laws can affect insurance coverage prices. For instance, legal guidelines relating to driver’s licensing, or the requirement of particular security options in autos, can affect the perceived threat related to drivers within the state. Moreover, laws relating to no-fault insurance coverage and necessary protection choices contribute to the general price construction of Michigan’s automotive insurance coverage market. These legal guidelines, whereas probably helpful for drivers in some methods, typically add to the executive burden and related prices for insurers.

Property Crimes: Thefts and Vandalism

The speed of property crimes, together with thefts and vandalism, varies throughout completely different areas in Michigan. Excessive crime areas will result in greater insurance coverage premiums for residents and drivers. Insurance coverage corporations use crime statistics to evaluate threat and alter premiums accordingly. The extent of theft and vandalism inside a particular space is a essential part in figuring out insurance coverage prices, typically reflecting the safety measures and neighborhood traits in several places.

This knowledge performs a essential position in underwriting and pricing selections.

Car Kind and Insurance coverage Prices

The kind of automobile insured performs an important position within the premium price. Excessive-performance sports activities automobiles, for instance, typically have greater insurance coverage prices than extra economical autos attributable to a perceived greater threat of accidents and potential claims. Equally, older autos, missing superior security options, typically command greater premiums in comparison with newer, extra safety-equipped fashions. This can be a direct reflection of the related dangers and potential prices related to claims.

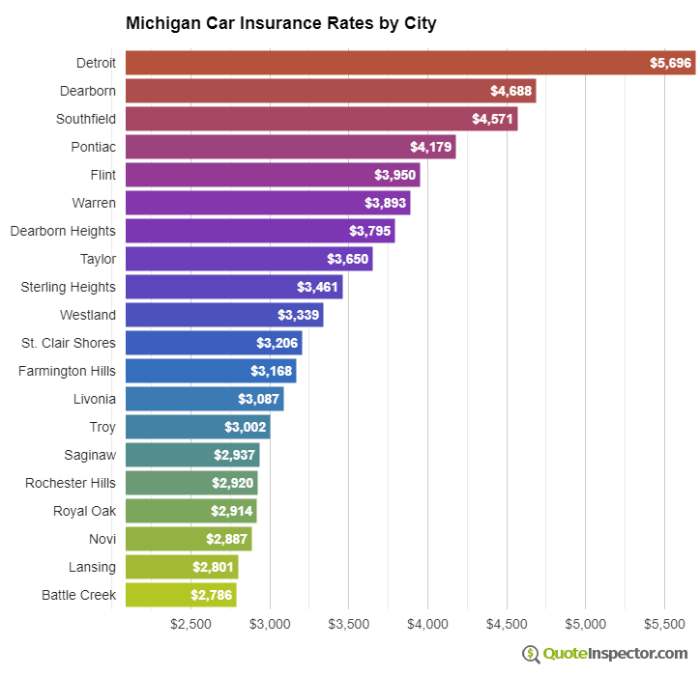

Common Automotive Insurance coverage Premiums Throughout Michigan Cities/Areas

| Metropolis/Area | Common Automotive Insurance coverage Premium (USD) |

|---|---|

| Detroit | 1,800 |

| Grand Rapids | 1,550 |

| Ann Arbor | 1,700 |

| Flint | 1,600 |

| Lansing | 1,500 |

Notice: These figures are illustrative and primarily based on averages. Precise premiums can differ considerably primarily based on particular person driver profiles and particular automobile varieties.

Driving Habits and Their Influence: Why Is Automotive Insurance coverage So Costly In Michigan

Michigan’s automotive insurance coverage panorama is considerably influenced by driver habits. Aggressive driving and a historical past of accidents immediately influence premiums, making accountable driving essential for inexpensive insurance coverage. Understanding these elements permits drivers to proactively mitigate potential price will increase.Michigan’s insurance coverage corporations use quite a lot of elements to evaluate threat. Probably the most vital elements is a driver’s historical past, which incorporates prior accidents, violations, and claims.

A clear driving document demonstrates a decrease threat profile, resulting in decrease premiums, whereas a historical past of incidents alerts greater threat and, consequently, greater premiums.

Aggressive Driving Habits and Insurance coverage Prices

Aggressive driving behaviors, together with rushing, reckless lane modifications, tailgating, and working pink lights, immediately contribute to greater insurance coverage premiums. Insurance coverage corporations view these behaviors as indicators of elevated threat of accidents, justifying the necessity for greater premiums to offset potential claims. A driver exhibiting a sample of such behaviors is taken into account a better threat to the insurance coverage firm.

Affect of Driving Historical past and Accident Data

A driver’s accident historical past performs a pivotal position in figuring out insurance coverage premiums. Drivers with a historical past of accidents are sometimes assigned a better threat profile, resulting in considerably greater premiums. The severity of the accidents additionally elements into the premium calculation. A minor fender bender could end in a modest improve, whereas a severe accident will end in a a lot bigger premium hike.

Rushing Violations and Reckless Driving Incidents

Rushing violations and reckless driving incidents are thought of severe infractions. These incidents not solely improve the probability of accidents but in addition point out a disregard for visitors security guidelines. Insurance coverage corporations view such behaviors as a better threat issue and thus assess drivers with such infractions with greater premiums. For instance, a driver repeatedly caught rushing might even see a considerable improve of their premium.

Comparability of Insurance coverage Prices for Drivers with Good and Poor Data

Drivers with impeccable driving data typically get pleasure from considerably decrease premiums in comparison with these with poor data. The distinction in premiums may be substantial, reflecting the disparity in threat evaluation. A driver with no accidents or violations will probably have a a lot decrease premium than one with a historical past of visitors violations or accidents.

Age and Driving Expertise

Age and driving expertise considerably influence automotive insurance coverage premiums in Michigan. Younger drivers, typically thought of higher-risk attributable to inexperience and a better probability of accidents, usually face greater premiums. Conversely, older drivers, with extra expertise and a usually decrease accident price, might even see decrease premiums. The length of a driver’s license and driving historical past additionally performs a key position in premium calculations.

Premium Variations Based mostly on Driving Behaviors

| Driving Habits | Influence on Premium |

|---|---|

| Clear driving document (no accidents or violations) | Low premium |

| Minor accident (fender bender) | Reasonable premium improve |

| Critical accident | Vital premium improve |

| Repeated rushing violations | Substantial premium improve |

| Reckless driving incidents | Very excessive premium improve |

Car Traits and Insurance coverage Prices

Michigan’s automotive insurance coverage panorama is not nearly driving habits; the very make, mannequin, and options of your automobile play a big position in your premium. Understanding these elements is essential for navigating the often-complex pricing constructions. The worth and security of your automotive, together with its susceptibility to theft, immediately affect how a lot you pay for insurance coverage.Past the everyday issues, automobile traits typically contribute to the price of insurance coverage.

This consists of the automobile’s inherent threat elements, from its potential for harm to its probability of being focused for theft. Insurance coverage corporations use this knowledge to evaluate the general threat related to insuring a selected automobile kind.

Influence of Car Options and Security Scores

Security options immediately influence insurance coverage premiums. Vehicles outfitted with superior security know-how, corresponding to airbags, anti-lock brakes, and digital stability management, usually obtain decrease insurance coverage charges. Insurance coverage corporations acknowledge these options as a big indicator of the automobile’s skill to scale back the probability and severity of accidents.

Correlation Between Car Kind and Insurance coverage Price

Car kind considerably influences insurance coverage premiums. Luxurious autos, high-performance sports activities automobiles, and even sure varieties of SUVs, typically include greater premiums in comparison with extra economical fashions. This is because of elements such because the potential for greater restore prices and the elevated probability of theft or harm, which displays the chance related to insuring these autos.

Position of Car Theft Threat in Insurance coverage Charges

The chance of auto theft is a essential consider insurance coverage pricing. Sure automobile fashions, significantly these recognized for his or her desirability to thieves, or which might be regularly focused in high-theft areas, include greater premiums. Insurance coverage corporations use knowledge to evaluate the probability of a automobile being stolen, and this info is mirrored within the premiums charged.

Comparability of Insurance coverage Prices for Completely different Car Varieties, Why is automotive insurance coverage so costly in michigan

| Car Kind | Estimated Common Insurance coverage Premium (Illustrative, varies by location and protection) |

|---|---|

| Financial system Sedan | $1,000 – $1,500 per 12 months |

| Luxurious Sedan | $1,500 – $2,500 per 12 months |

| Sports activities Automotive | $1,800 – $3,000 per 12 months |

| SUV | $1,200 – $2,000 per 12 months |

| Truck | $1,100 – $2,200 per 12 months |

Influence of Security Options on Insurance coverage Premiums

| Security Characteristic | Estimated Influence on Insurance coverage Premium (Illustrative, varies by location and protection) |

|---|---|

| Anti-theft system | Potential discount of $50-$200 per 12 months |

| Airbags | Potential discount of $50-$150 per 12 months |

| Digital Stability Management (ESC) | Potential discount of $50-$100 per 12 months |

| Superior Driver-Help Programs (ADAS) | Potential discount of $75-$250 per 12 months |

Influence of Car Worth on Insurance coverage Charges

The worth of a automobile immediately correlates with the insurance coverage premium. Increased-value autos, corresponding to newer or high-end fashions, usually have greater insurance coverage premiums. It’s because the potential for loss or harm is greater, reflecting the elevated monetary threat to the insurance coverage firm. For instance, a high-end sports activities automotive may have a a lot greater premium than a fundamental economic system mannequin, even when the driving habits are similar.

Insurance coverage Firm Practices and Pricing Fashions

Michigan’s automotive insurance coverage panorama is a posh tapestry woven from varied pricing methods employed by completely different insurers. Understanding these strategies is essential to greedy the seemingly arbitrary nature of premium prices. These methods should not static; they adapt to market tendencies, claims knowledge, and even regional variations inside the state.The intricate dance between insurance coverage corporations and their pricing fashions typically leaves customers feeling like they’re navigating a maze.

This part unveils the interior workings of this course of, inspecting the practices of various corporations, their pricing fashions, and the aggressive dynamics that form the price of automotive insurance coverage in Michigan.

Insurance coverage Firm Pricing Fashions in Michigan

Insurance coverage corporations in Michigan make use of quite a lot of pricing fashions to find out premiums. These fashions typically incorporate elements past easy demographics, reflecting a classy strategy to threat evaluation. A core factor of those fashions is the meticulous evaluation of historic claims knowledge, an important indicator of potential future claims.

- Claims Frequency and Severity: Firms meticulously analyze the frequency and severity of claims inside their portfolio. Excessive-frequency claims in particular geographic areas or for explicit automobile varieties can considerably affect premium calculations. For instance, if a selected mannequin of auto persistently experiences excessive charges of accidents, insurers will alter their pricing to mirror the elevated threat.

- Threat Evaluation Fashions: Insurance coverage corporations make the most of complicated algorithms and statistical fashions to evaluate the chance related to particular person drivers. These fashions take into account elements like driving historical past, location, and automobile traits. Superior threat evaluation fashions typically incorporate predictive analytics to establish drivers with a better probability of creating a declare. For example, a driver with a historical past of rushing tickets or accidents will probably have greater premiums in comparison with a driver with a clear document.

- Geographic Variations: Michigan’s various geography performs a job in insurance coverage pricing. Areas with greater accident charges or particular visitors patterns may have greater premiums. For example, highways with a excessive quantity of visitors and frequent accidents is perhaps assigned a better threat issue by insurers, resulting in elevated premiums for drivers in these areas.

- Competitors and Market Dynamics: Competitors amongst insurance coverage corporations influences pricing methods. Aggressive pricing by one firm can immediate others to regulate their charges to stay aggressive. This dynamic typically advantages customers by making a market the place costs are extra reflective of the particular threat.

Adjusting Charges in Michigan

Insurers in Michigan continually alter their charges primarily based on a large number of things. The objective is to steadiness profitability with aggressive pricing to draw and retain prospects. The adjustment course of is usually not arbitrary however as a substitute is a data-driven response to altering market situations.

- Claims Information Evaluation: Claims knowledge evaluation is a core part of price changes. If a selected kind of accident or incident turns into extra prevalent, insurance coverage corporations will react by adjusting premiums to mirror the elevated threat. For instance, a rise in accidents involving distracted driving would possibly immediate insurers to extend premiums for all drivers.

- Market Competitors: The aggressive panorama in Michigan’s insurance coverage market performs an important position in price changes. Aggressive pricing methods from opponents can set off insurers to regulate their charges to take care of a aggressive edge. This dynamic ensures that charges should not merely arbitrary, however mirror market forces.

- Demographic Shifts: Demographic shifts in Michigan, corresponding to a rise in younger drivers or modifications within the combine of auto varieties, can affect premium changes. Insurers could adapt their pricing to account for any modifications within the demographics of their buyer base.

Affect of Competitors

Competitors amongst insurance coverage corporations in Michigan is a big issue influencing pricing. A aggressive market often results in extra favorable charges for customers. Nevertheless, the extent of competitors varies throughout completely different segments of the market.

Threat Evaluation Fashions

Threat evaluation fashions utilized by insurance coverage corporations in Michigan are subtle instruments designed to judge the probability of a driver making a declare. These fashions analyze a large number of things, from driving historical past to automobile kind, to create a threat profile for every driver. For example, a driver with a historical past of visitors violations may have a better threat profile than a driver with a clear document.

Pricing Methods of High Insurance coverage Firms in Michigan

| Insurance coverage Firm | Pricing Technique Overview |

|---|---|

| Firm A | Emphasizes claims historical past and driving document. Makes use of predictive modeling to evaluate future threat. |

| Firm B | Combines driving historical past with geographic location knowledge to tailor premiums. |

| Firm C | Focuses on automobile kind and its accident statistics. Gives reductions for secure driving practices. |

| Firm D | Emphasizes complete threat evaluation that mixes driver habits, automobile traits, and site elements. |

Financial Circumstances and Insurance coverage Prices

Michigan’s automotive insurance coverage panorama is not solely formed by driving habits or automobile varieties. The state’s financial local weather performs a big position in figuring out premiums. Financial downturns, inflation, and total monetary well being of the state all contribute to the price of insuring a automobile. Understanding these elements is essential to comprehending the complexities of Michigan’s insurance coverage market.The Michigan economic system, like another, is influenced by cycles of development and recession.

These fluctuations immediately influence the monetary stability of people and companies, finally affecting the insurance coverage trade. Insurance coverage corporations, in flip, alter their pricing methods primarily based on these financial tendencies, aiming to steadiness threat evaluation with profitability. This dynamic interaction between the state’s economic system and insurance coverage charges typically leaves drivers feeling the pinch of upper premiums in periods of financial uncertainty.

Affect of the Total Michigan Financial system

The state’s financial efficiency profoundly influences insurance coverage charges. A strong economic system typically correlates with decrease charges, as people and companies usually tend to have secure funds, resulting in a decreased threat of claims. Conversely, throughout financial downturns, unemployment charges could rise, impacting people’ skill to pay premiums, and probably rising the chance of accidents and ensuing claims. This dynamic typically results in greater premiums, as insurance coverage corporations should account for the elevated potential threat.

For instance, a big layoff within the automotive trade may result in extra people having issue affording insurance coverage, rising the general threat pool.

Financial Traits and Pricing Methods

Insurance coverage corporations intently monitor financial tendencies to regulate their pricing methods. These corporations analyze unemployment figures, shopper spending patterns, and total financial indicators. They make the most of subtle algorithms to estimate the potential threat primarily based on the prevailing financial local weather. By understanding these tendencies, insurance coverage suppliers can proactively alter their charges to make sure their profitability and preserve a sustainable enterprise mannequin.

In essence, the monetary well being of the state immediately interprets to the pricing construction of automotive insurance coverage.

Inflation and Financial Fluctuations

Inflation, a sustained improve within the normal value degree of products and providers, considerably impacts insurance coverage prices. Elevated prices for restore elements and labor immediately correlate with rising insurance coverage premiums. Moreover, financial fluctuations, corresponding to recessions, can influence the worth of autos, impacting their insurance coverage prices. A big drop within the worth of used automobiles, as an illustration, can have an effect on insurance coverage charges because the insured worth of the autos is decreased.

Comparative Evaluation of Michigan Insurance coverage Prices

Evaluating Michigan’s insurance coverage prices with different states supplies invaluable context. Components corresponding to common revenue ranges, driving habits, and the frequency of accidents all contribute to those variations. Analysis signifies that Michigan’s insurance coverage charges is perhaps greater than in some neighboring states attributable to a mix of those elements. Comparative evaluation helps illuminate the distinctive circumstances shaping Michigan’s insurance coverage market.

Influence on Insurance coverage Availability

Financial elements may influence the supply of insurance coverage in Michigan. Throughout financial downturns, some insurance coverage corporations could limit or decline to supply protection in particular areas, probably making a problem for people find inexpensive insurance coverage. This case may be significantly acute in areas with excessive unemployment or a focus of susceptible populations. Such actions are sometimes taken to mitigate dangers and preserve profitability throughout difficult financial instances.

Final Recap

In conclusion, the excessive price of automotive insurance coverage in Michigan stems from a convergence of things, starting from the state’s distinctive driving situations to the practices of insurance coverage corporations themselves. The interaction of those components creates a monetary burden for drivers, demanding a complete understanding of the contributing elements to achieve a clearer image. Navigating this complicated concern requires a holistic strategy, recognizing that the reply shouldn’t be a easy one, however quite a multifaceted consideration of quite a few components.

FAQ Insights

What position do visitors accidents play in Michigan’s excessive insurance coverage prices?

Michigan’s accident statistics considerably affect insurance coverage charges. Increased accident frequencies result in elevated payouts, immediately impacting the premiums charged to drivers. This creates a cyclical drawback, the place greater prices encourage fewer drivers to insure, which then may exacerbate the accident statistics.

How do Michigan’s climate situations have an effect on automotive insurance coverage charges?

The state’s harsh winters and unpredictable climate considerably contribute to the prices. Inclement climate situations can result in elevated accidents and claims, necessitating greater premiums to cowl potential losses. The particular influence of snow, ice, and different climate elements on driver habits and accident threat are key elements in calculating these charges.

Are there particular Michigan legal guidelines impacting automotive insurance coverage premiums?

Sure Michigan legal guidelines, corresponding to these relating to automobile security requirements or driver licensing necessities, can have an effect on insurance coverage prices. The particular laws and enforcement practices associated to those legal guidelines can have a notable influence on the insurance coverage market.

How do insurance coverage corporations set their pricing in Michigan?

Insurance coverage corporations in Michigan make use of complicated threat evaluation fashions to find out premiums. These fashions take into account varied elements corresponding to accident historical past, driving habits, automobile kind, and site. A driver’s credit score historical past and different elements will also be included. This helps corporations predict the probability of claims and set charges accordingly.