Stolen automobile insurance coverage payout calculator helps you perceive how a lot your insurance coverage will cowl in case your car is stolen. This information particulars the elements influencing payouts, from car worth and protection sort to the declare course of and potential pitfalls. It additionally supplies a comparability of various insurance coverage suppliers and suggestions for maximizing your payout. Navigating the complexities of a stolen automobile declare could be difficult, however this complete useful resource goals to simplify the method.

Understanding the intricacies of a stolen car declare is essential. This calculator and information will present a transparent roadmap that will help you navigate the often-confusing means of receiving compensation. The method includes a number of steps, from preliminary reporting to remaining settlement, every with particular necessities and potential hurdles. We’ll cowl the assorted elements that have an effect on the payout quantity, serving to you anticipate and put together for the potential consequence.

Introduction to Stolen Automotive Insurance coverage Payouts

Getting your automobile again after a theft is a disturbing expertise. Fortunately, stolen automobile insurance coverage payouts will help you get again in your toes. These payouts are designed to compensate for the lack of your car and generally related bills. Understanding how these payouts work is essential to navigating the method easily.Stolen automobile insurance coverage payouts are a monetary reimbursement out of your insurance coverage firm after your automobile is stolen.

The payout quantity relies on the particular protection choices you could have bought and the circumstances of the theft. The method usually includes submitting a declare, offering documentation, and ready for the insurance coverage firm to evaluate the declare and approve the payout.

Stolen Automotive Insurance coverage Declare Course of

Submitting a stolen automobile declare usually includes these steps:

- Report the Theft to the Police: That is essential. It supplies official documentation of the theft, which is important to your insurance coverage declare.

- Contact Your Insurance coverage Firm Instantly: Inform them concerning the theft and comply with their directions for submitting a declare. They’re going to probably information you on the mandatory documentation.

- Collect Required Documentation: This will likely embody your insurance coverage coverage, police report, car registration, and another supporting paperwork requested by the insurance coverage firm.

- Full the Declare Kind: Rigorously fill out the insurance coverage declare kind, offering correct details about the theft and your car.

- Anticipate the Insurance coverage Firm’s Evaluation: The insurance coverage firm will examine the declare and decide the payout quantity primarily based in your protection.

Sorts of Protection Concerned in a Stolen Automotive Declare

Several types of automobile insurance coverage cowl completely different features of a stolen automobile declare. Understanding these coverages will assist you to decide what you are eligible for.

| Protection Sort | Description | Typical Payout Eventualities |

|---|---|---|

| Complete Protection | Covers damages to your car from perils aside from collision, equivalent to theft, vandalism, or climate occasions. | In case your automobile was stolen, complete protection will probably cowl the complete substitute value of your car, doubtlessly as much as the coverage’s limits. |

| Collision Protection | Covers damages to your car ensuing from a collision with one other object or car, together with theft-related damages if the thief triggered harm to the automobile throughout the theft. | Collision protection could also be concerned if the automobile was broken earlier than or throughout the theft. The payout will rely on the extent of the harm. |

| Uninsured/Underinsured Motorist Protection | Protects you if the one that stole the automobile has no or inadequate insurance coverage to cowl your losses. | This protection pays to your car’s worth if the accountable occasion is not adequately insured. |

| GAP Insurance coverage | A supplemental coverage that covers the distinction between your car’s mortgage worth and its precise money worth (ACV) in case of a complete loss, equivalent to a stolen car. | In case your automobile is stolen and the insurance coverage payout does not absolutely cowl the mortgage quantity, GAP insurance coverage will help bridge the hole. |

Elements Influencing the Payout Quantity

A number of elements affect the ultimate payout quantity:

- Coverage Limits: The utmost quantity your insurance coverage coverage can pay for a lined loss. It is a essential issue, as payouts can not exceed these limits.

- Car Worth: The present market worth of your car on the time of the theft. Value determinations and up to date gross sales of comparable automobiles are used to find out the honest market worth.

- Deductibles: A pre-determined quantity you are liable for paying earlier than your insurance coverage firm begins paying. This quantity reduces the payout.

- Extra Bills: Some insurance policies could cowl further bills associated to the theft, like towing or momentary rental charges.

Elements Affecting Payout Quantities

Getting your stolen automobile insurance coverage payout can really feel like navigating a maze. Understanding the elements influencing the quantity you obtain is essential. This part will demystify the method, explaining how varied parts impression your remaining payout. From the worth of your car to the nuances of your coverage, we’ll break down every thing you’ll want to know.

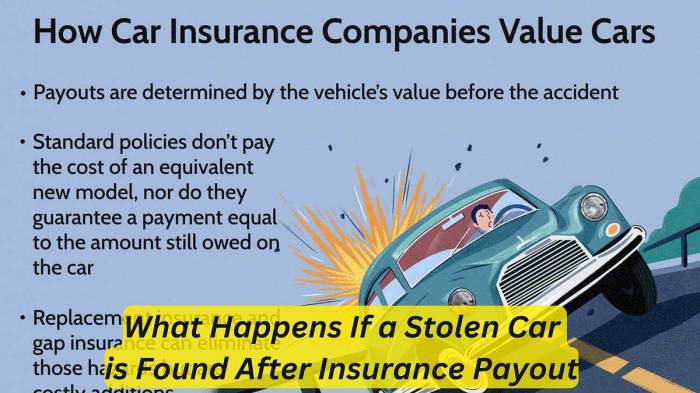

Automotive Worth and Depreciation

Probably the most important issue is the automobile’s worth on the time of theft. Insurers usually base payouts on the car’s honest market worth, which is influenced by make, mannequin, 12 months, situation, and mileage. Depreciation performs a key function right here. A more moderen, higher-value automobile depreciates sooner than an older mannequin. This implies a payout for a stolen newer automobile could be decrease than the unique buy worth, particularly if it has been just a few years since buy.

It is a essential ingredient to contemplate when calculating your anticipated payout.

Deductible and Protection Sort

Your coverage’s deductible and protection sort considerably impression the payout quantity. The deductible is the quantity you pay out-of-pocket earlier than the insurance coverage firm steps in. For instance, a $500 deductible means you will pay $500, and the insurance coverage firm will cowl the remaining. Totally different protection varieties, equivalent to complete or collision, additionally have an effect on the payout. Complete protection often covers theft, whereas collision usually does not.

The specifics of your coverage will decide the extent of the protection.

Police Report and Proof of Theft

A proper police report is usually necessary for insurance coverage claims. The report particulars the circumstances surrounding the theft, offering essential proof to your declare. Supporting proof, equivalent to photographs of the harm or any safety footage, can bolster your declare and doubtlessly affect the payout. The accuracy and completeness of the police report, together with any corroborating proof, instantly impression the insurance coverage firm’s analysis of your declare.

Decreased or Denied Payouts

Whereas insurance coverage firms goal to pretty compensate policyholders, a number of conditions can result in lowered or denied payouts. Failure to file a well timed declare, offering inaccurate data, or having a historical past of fraudulent claims can set off a evaluation or denial. Moreover, if the theft occurred attributable to your negligence, equivalent to leaving the automobile unlocked in a high-crime space, your payout could be lowered or denied.

That is usually attributable to elements exterior the everyday circumstances lined by normal insurance coverage.

Affect of Elements on Payout

| Issue | Excessive Affect | Medium Affect | Low Affect |

|---|---|---|---|

| Automotive Worth | Greater automobile worth, larger payout | Common automobile worth, common payout | Decrease automobile worth, decrease payout |

| Deductible | Greater deductible, decrease payout for the insurance coverage firm | Common deductible, common payout | Decrease deductible, larger payout for the insurance coverage firm |

| Protection Sort | Complete protection, larger payout | Collision protection, decrease payout for theft | Restricted protection, decrease payout |

| Police Report/Proof | Full, detailed report with proof, larger payout | Incomplete report, barely decrease payout | No report/proof, payout denied or considerably lowered |

Understanding Coverage Phrases and Situations: Stolen Automotive Insurance coverage Payout Calculator

Navigating the wonderful print of your automobile insurance coverage coverage can really feel like deciphering a secret code. However understanding your coverage’s phrases and circumstances is essential, particularly when a declare like a stolen automobile comes into play. Understanding the specifics of your protection helps guarantee a smoother and extra predictable payout course of. This part dives deep into the language of your coverage, revealing the hidden treasures and potential pitfalls.

Significance of Reviewing Coverage Phrases and Situations

Your insurance coverage coverage is a legally binding contract. Completely reviewing it earlier than a declare is important. It Artikels precisely what your insurer covers and, equally importantly, what they do not. This proactive method prevents misunderstandings and potential disputes down the highway.

Key Clauses Associated to Automotive Theft Protection

Particular clauses inside your coverage dictate the extent of your theft protection. Search for clauses explicitly addressing the next: the definition of “theft,” the quantity of protection supplied, and any necessities for reporting the theft to the authorities. Totally different insurers use barely various language, so a cautious learn is critical.

Exclusions and Limitations of Protection, Stolen automobile insurance coverage payout calculator

Understanding what’s excluded from protection is simply as vital as understanding what’s included. Widespread exclusions embody acts of vandalism, or if the car was left in a high-risk space, or if the car wasn’t correctly secured. Limitations on protection may contain deductibles, most payout quantities, or timeframes for submitting claims. These particulars can considerably impression the ultimate payout quantity.

Deciphering Complicated Coverage Language

Insurance coverage coverage language could be dense and complex. To decipher it successfully, break down the clauses into smaller, manageable components. Search for key phrases and phrases and use on-line assets to seek out definitions of unfamiliar phrases. Seek the advice of with a monetary advisor or insurance coverage skilled if wanted, particularly for notably complicated clauses. Use a highlighter to mark vital factors and use a pocket book to notice any questions you could have.

Abstract of Key Coverage Phrases

| Coverage Time period | Relevance to Stolen Automotive Claims |

|---|---|

| Definition of “Theft” | This clause defines the circumstances beneath which your insurer considers the automobile to have been stolen. Understanding the particular circumstances ensures your declare aligns with the coverage. |

| Protection Quantity | This determines the utmost quantity the insurer can pay out. Understanding the particular limits prevents disappointment. |

| Reporting Necessities | Understanding the required steps to report the theft (e.g., contacting the police, offering documentation) is important. |

| Exclusions (e.g., vandalism, improper safety) | These clauses Artikel conditions the place the insurer is not going to pay out, equivalent to if the car was broken attributable to vandalism. |

| Deductible | The deductible is the quantity you will pay out-of-pocket earlier than the insurance coverage firm covers the loss. |

| Time Limits | This particulars the timeframe for reporting the declare. Lacking these deadlines could invalidate your declare. |

Comparability of Totally different Insurance coverage Suppliers

Insurance coverage firms aren’t all created equal, particularly in the case of stolen automobile payouts. Identical to evaluating completely different eating places, you’ll want to look past the menu (the coverage particulars) to see what really units them aside. This comparability will assist you to perceive the important thing variations in payout insurance policies, declare processes, and customer support to make an knowledgeable resolution.Totally different insurance coverage suppliers have various approaches to dealing with stolen automobile claims.

This usually leads to disparities in payout quantities and declare decision occasions. Some may supply larger payouts however with extra stringent declare procedures. Understanding these nuances is essential for getting the very best consequence when submitting a declare.

Payout Insurance policies Throughout Suppliers

Insurance coverage firms tailor their payout insurance policies primarily based on varied elements, together with the kind of protection, the worth of the car, and the particular circumstances surrounding the theft. This usually results in substantial variations within the quantities they’re prepared to pay out. Some firms may supply a better payout if the theft occurred in a high-crime space, whereas others could have a decrease payout cap whatever the location.

| Insurance coverage Supplier | Protection Quantity (Instance) | Declare Course of Complexity | Buyer Service Score (Common) |

|---|---|---|---|

| Acme Insurance coverage | $15,000 for a 2018 Sedan | Average (3-5 enterprise days to approve) | 4.2 out of 5 |

| Dependable Insurance coverage | $18,000 for a 2020 SUV | Excessive (7-10 enterprise days to approve) | 4.5 out of 5 |

| Safe Protect Insurance coverage | $12,000 for a 2022 Hatchback | Low (2-4 enterprise days to approve) | 3.8 out of 5 |

| United Insurance coverage | $16,500 for a 2021 Truck | Average (4-6 enterprise days to approve) | 4.1 out of 5 |

This desk supplies a fundamental comparability. Precise payout quantities can differ considerably relying on particular coverage particulars and the main points of the declare. Make sure to fastidiously evaluation your coverage and examine completely different suppliers primarily based in your particular wants. The common customer support rankings are primarily based on aggregated evaluations and ought to be used as a suggestion.

Declare Processes and Timelines

Declare processes differ tremendously between insurance coverage firms. Some firms have streamlined on-line portals for fast declare submissions and approvals, whereas others require extra paperwork and in-person interactions. The time it takes to obtain a payout may also differ significantly. For instance, an organization with a repute for fast declare processing may need a median declare settlement time of 2-4 weeks, whereas one other firm may take 6-8 weeks.

Buyer Service High quality

Customer support is a crucial side of the insurance coverage expertise, notably throughout a declare course of. Firms with sturdy customer support reputations are extra probably to supply well timed help and help. That is vital when coping with complicated claims or when dealing with disputes. Contemplate contacting customer support representatives instantly and studying on-line evaluations to evaluate the standard of service earlier than selecting an insurance coverage firm.

Customer support high quality is a subjective measure, and particular person experiences could differ.

Declare Course of and Documentation

Navigating the method of submitting a stolen automobile insurance coverage declare can really feel daunting, however understanding the steps concerned and the mandatory documentation could make the entire expertise smoother. This part breaks down the declare course of, from preliminary report back to remaining payout, that will help you really feel extra in management.

Submitting a Stolen Automotive Insurance coverage Declare

The declare course of typically begins with reporting the theft to the police. This report serves as essential documentation, offering a proper document of the incident. Afterward, you have to notify your insurance coverage firm as quickly as potential. This immediate notification ensures that the declare is initiated promptly and the insurance coverage firm can start the investigation.

Essential Documentation

A complete declare requires varied paperwork. The core paperwork often embody a police report, proof of possession (just like the car registration), and any related supporting proof. Pictures of the broken car (if any) and another proof associated to the theft, equivalent to safety footage or witness statements, can considerably strengthen your declare. Insurance coverage firms usually require particular kinds to be accomplished and submitted as a part of the declare course of.

Declare Timeline

The timeframe for receiving a payout varies primarily based on the insurance coverage firm’s procedures and the complexity of the declare. Some firms have a streamlined course of, whereas others could take extra time. Elements like the supply of supporting paperwork and the necessity for additional investigation can have an effect on the timeline. An estimated timeframe for a easy declare could be 4-6 weeks, whereas extra complicated circumstances might take longer.

For example, a declare involving intensive investigation or disputed valuation may stretch to 8-12 weeks.

Resolving Disputes

Disputes concerning payout quantities are potential, notably if the insurance coverage firm’s evaluation differs out of your expectations. If you happen to disagree with the supplied payout, contacting the insurance coverage firm’s claims division to elucidate your considerations and supporting proof is essential. Mediation or arbitration could also be accessible as different dispute decision choices if direct negotiations are unsuccessful. A transparent and detailed communication document is important all through the dispute decision course of.

Declare Course of Steps

- Report the theft to the police and procure a police report.

- Notify your insurance coverage firm instantly and supply the mandatory particulars, together with the car’s VIN and coverage quantity.

- Collect all required documentation, together with the police report, car registration, and any supporting proof (e.g., safety footage, witness statements).

- Full the insurance coverage declare kind precisely and submit it together with all supporting paperwork.

- The insurance coverage firm will examine the declare, which can contain contacting the police or conducting a valuation.

- As soon as the investigation is full, the insurance coverage firm will assess the declare and challenge a payout primarily based in your coverage phrases.

- If there is a dispute concerning the payout quantity, contact the claims division and supply supporting proof.

- If the dispute stays unresolved, take into account mediation or arbitration.

Declare Course of Desk

| Step | Description |

|---|---|

| 1 | Report Theft to Police |

| 2 | Notify Insurance coverage Firm |

| 3 | Collect Documentation |

| 4 | Full Declare Kind |

| 5 | Insurance coverage Firm Investigation |

| 6 | Payout Evaluation |

| 7 | Dispute Decision (if wanted) |

Ideas for Maximizing Payouts

Getting the utmost payout out of your stolen automobile insurance coverage declare is not nearly luck; it is about sensible preparation and a well-executed technique. Following finest practices all through the declare course of considerably will increase your possibilities of a beneficial consequence. This part Artikels key methods for maximizing your payout, from submitting the declare appropriately to navigating potential roadblocks.

Submitting a Declare Effectively

A clean declare course of begins with meticulous documentation and a transparent understanding of your coverage’s necessities. Thorough record-keeping ensures you could have all crucial data available when the insurer wants it. This consists of not simply the police report, but additionally any receipts, photographs, or movies associated to the theft and your car’s situation. The sooner you file a declare, the earlier you possibly can start the restoration course of.

- Submit a whole declare bundle: Guarantee all required paperwork, just like the police report, proof of possession, and any supporting proof (e.g., restore estimates), are included in your preliminary declare submission. An entire bundle streamlines the declare course of.

- Talk promptly and clearly: Preserve open communication together with your insurance coverage supplier all through the method. This includes responding to their inquiries promptly and precisely. Reply to all correspondence, emails, and cellphone calls promptly.

- Be practical concerning the declare course of: Perceive that claims take time to course of. Be ready for potential delays and preserve constant follow-up.

Guaranteeing Correct and Detailed Info

Offering exact and correct particulars about your stolen car is essential. This consists of the make, mannequin, 12 months, VIN (Car Identification Quantity), and any distinguishing options. The extra correct the knowledge, the sooner the declare course of will probably be and the extra probably it’s that the insurance coverage firm can precisely assess the car’s worth.

- Preserve detailed data: Maintain copies of all correspondence, restore estimates, and another related paperwork. A well-organized record-keeping system will help you within the declare course of and supply proof of your declare.

- Doc every thing: Take photographs or movies of the car’s situation earlier than the theft, if potential. When you have any pre-theft harm data, embody them within the declare documentation. This documentation is essential in establishing the car’s pre-theft worth.

Making ready for Potential Delays or Disputes

Insurance coverage claims, whereas usually easy, can sometimes encounter delays or disputes. Understanding potential roadblocks and making ready for them is essential. For instance, discrepancies within the reported car particulars or a contested valuation might result in a delay. Understanding your rights and being ready to current additional proof will help mitigate these potential points.

- Evaluation your coverage: Completely perceive your coverage’s phrases and circumstances, particularly concerning the declare course of and payout limits. This ensures you are conscious of the potential roadblocks earlier than they happen.

- Search authorized counsel if crucial: If you happen to encounter a dispute or have considerations concerning the declare’s dealing with, take into account consulting with a authorized skilled. This will help you perceive your rights and navigate the method successfully.

Following Up on Declare Standing

Commonly checking on the declare standing ensures you are knowledgeable about its progress. This proactive method helps you perceive the declare’s standing and facilitates communication with the insurer.

- Schedule common check-ins: Contact your insurance coverage supplier periodically to inquire concerning the declare’s standing. This proactive method retains you up to date and ensures you are on prime of the declare course of.

- Preserve detailed communication data: Doc all communication with the insurance coverage firm, together with dates, occasions, and the particular data mentioned. This record-keeping is essential if you’ll want to reference earlier conversations.

Avoiding Widespread Errors

Submitting a stolen automobile insurance coverage declare can really feel like navigating a maze. Understanding the widespread pitfalls can prevent a headache and guarantee a smoother, extra environment friendly course of. Understanding these potential errors is essential for getting the utmost payout you deserve.

Accuracy and Completeness in Documentation

Correct and full documentation is paramount for a profitable declare. Errors, omissions, or inconsistencies can delay and even deny your declare. Consider it like a puzzle; every bit (doc) wants to suit completely to finish the image. If one piece is lacking or incorrect, your entire image is affected.

- Incorrectly Reporting the Theft: Offering inaccurate particulars concerning the theft, just like the date or time, can severely impression the declare’s validity. This might result in your insurance coverage firm questioning the legitimacy of the incident.

- Lacking or Incomplete Documentation: Do not underestimate the facility of paperwork! Be sure you have all crucial paperwork, together with police reviews, witness statements, and car registration. Any lacking piece of the puzzle can hinder the declare course of.

- Incorrectly Describing the Car: A exact description of the stolen car, together with its make, mannequin, 12 months, colour, and any distinctive options, is important. A minor discrepancy can result in the declare being rejected.

Penalties of Declare Errors

The results of constructing errors throughout the declare course of could be important. It might imply a delay in receiving your payout, a denial of the declare altogether, or perhaps a lower within the payout quantity. It is like attempting to construct a home on shaky floor; the muse must be strong to make sure a profitable consequence.

- Delayed Payouts: Errors can result in delays in processing your declare. This may trigger monetary pressure if you happen to want the funds instantly.

- Declare Denial: Insurance coverage firms are legally obligated to uphold their coverage phrases and circumstances. If the declare is incomplete or inaccurate, the insurance coverage firm may deny it, leaving you with out the compensation you deserve.

- Decreased Payouts: In some circumstances, inaccuracies may result in a discount within the payout quantity. That is notably true if the inaccuracies relate to the worth of the car or the protection particulars.

Methods to Keep away from Declare Errors

Proactive measures will help you keep away from these pitfalls. Preparation is essential to a clean declare course of. Deal with every step like a puzzle piece; guarantee each piece is right.

- Thorough Documentation: Instantly after the theft, collect all related paperwork, together with police reviews, witness statements, and car registration. Maintain copies of every thing. This will probably be invaluable throughout the declare course of.

- Correct Reporting: Present correct and detailed details about the theft to the insurance coverage firm and the police. If doubtful, search clarification from the insurance coverage firm.

- Evaluation Coverage Phrases and Situations: Rigorously evaluation your insurance coverage coverage to grasp the particular necessities for a stolen car declare. Understanding the phrases is like understanding the foundations of the sport.

Instance of a Widespread Mistake and its Affect

Think about a driver reporting their car stolen on Monday however offering the date as Saturday. The insurance coverage firm may query the veracity of the declare, resulting in a delay or denial. This easy error might have a big impression on the declare’s consequence.

Illustrative Examples of Payouts

Unveiling the intricacies of stolen automobile insurance coverage payouts could be daunting. These examples will illuminate how varied elements converge to find out the ultimate quantity, making the method much less mysterious and extra comprehensible.Understanding the particular circumstances of every case is essential for comprehending the payout calculation. Every state of affairs illustrates how coverage particulars, car situation, and harm affect the settlement.

Situation 1: Complete Loss with Complete Protection

A policyholder’s prized classic sports activities automobile, valued at $50,000, was stolen and declared a complete loss. The coverage included complete protection. The insurer’s appraisal decided the automobile’s precise money worth (ACV) on the time of theft was $45,000. This state of affairs displays the insurer’s duty to pay the ACV, reasonably than the market worth.

Calculation: The insurer can pay the ACV of $45,000 to the policyholder, much less any relevant deductibles.

| Issue | Affect on Payout |

|---|---|

| Car Worth | The next car worth leads to a better payout (as much as the ACV). |

| Complete Protection | Covers losses past collision, together with theft. |

| Deductible | Reduces the payout by the deductible quantity. |

Situation 2: Partial Injury with Collision Protection

A policyholder’s fashionable SUV, price $35,000, was concerned in an accident the place it was stolen. The car sustained important harm, together with dents and scratches. The insurer’s restore estimate was $12,000. The coverage included collision protection.

Calculation: The insurer can pay the restore value of $12,000, much less the deductible. This payout assumes the car could be repaired. If deemed a complete loss, the ACV will probably be paid as an alternative.

| Issue | Affect on Payout |

|---|---|

| Restore Prices | Restore prices instantly affect the payout quantity. |

| Collision Protection | Covers harm from collisions, even when the automobile is stolen. |

| Deductible | Reduces the payout by the deductible quantity. |

Situation 3: Stolen Elements with Legal responsibility Protection

A policyholder’s truck, insured beneath legal responsibility protection, had essential components stolen. The components, important for the car’s operation, had been price $5,000. The coverage solely covers damages or losses incurred by the insured car whether it is broken or concerned in an accident. The theft of the components does not fall beneath legal responsibility protection.

Calculation: On this case, there isn’t a payout as a result of legal responsibility protection doesn’t cowl the theft of components. The policyholder may want to hunt further insurance coverage or discover different avenues to get well the price of the stolen components.

| Issue | Affect on Payout |

|---|---|

| Protection Sort | Legal responsibility protection solely covers damages to others; it doesn’t cowl the insured car. |

| Stolen Elements | The lack of components, if in a roundabout way attributable to a collision or accident, may not be lined. |

Sources for Additional Info

Want greater than only a calculator? Understanding the place to seek out reliable details about stolen automobile insurance coverage payouts is essential. This part factors you in the direction of respected sources that will help you perceive your rights and choices higher.Looking for skilled recommendation is usually one of the best plan of action when coping with complicated insurance coverage claims. Insurance coverage professionals can present tailor-made steering primarily based in your particular state of affairs and coverage.

Respected Insurance coverage Organizations

Insurance coverage firms are a key useful resource for understanding their very own insurance policies. Their web sites often have detailed details about protection, declare procedures, and regularly requested questions (FAQs). Many supply devoted customer support channels for coverage clarification and declare help. Understanding the language utilized in insurance coverage insurance policies is important.

- Main insurance coverage suppliers usually have devoted sections on their web sites that designate their stolen car protection insurance policies intimately.

- Their FAQs can present fast solutions to widespread questions and considerations.

- Accessing these assets empowers you to grasp your particular coverage particulars and the way the claims course of operates.

Governmental Companies and Shopper Safety

Authorities businesses usually present beneficial assets and steering for shoppers coping with insurance coverage points. These businesses could be notably useful in circumstances of disputes or suspected unfair practices. Their data is usually primarily based on broader authorized and shopper safety frameworks.

- Shopper safety businesses supply useful data on navigating insurance coverage claims, rights, and procedures.

- State insurance coverage departments is usually a beneficial useful resource for particular state laws and steering.

- These businesses can help you in understanding your rights as a shopper when coping with insurance coverage firms.

Authorized Professionals and Insurance coverage Advisors

If you happen to’re dealing with a posh declare or dispute, looking for authorized recommendation is usually advisable. A lawyer specializing in insurance coverage regulation can present customized steering in your state of affairs, assess the deserves of your declare, and advocate to your pursuits. Insurance coverage advisors will help analyze insurance policies and information you thru the claims course of, providing a distinct perspective from an insurance coverage firm’s viewpoint.

- Consultations with authorized professionals specializing in insurance coverage regulation are essential for navigating complicated claims or disputes successfully.

- Impartial insurance coverage advisors can present an goal evaluation of your coverage and assist in navigating the declare course of.

- Authorized professionals will help you perceive your rights and guarantee your declare is dealt with pretty, defending your pursuits.

On-line Boards and Communities

On-line boards and communities devoted to automobile insurance coverage is usually a beneficial supply of knowledge and help. These communities can help you join with different policyholders who’ve confronted comparable conditions and study from their experiences. Nonetheless, it is vital to confirm the accuracy and reliability of knowledge present in these boards.

- On-line boards supply a platform for sharing experiences and gaining insights from others who’ve navigated comparable insurance coverage conditions.

- Be cautious of anecdotal proof and at all times cross-reference data with official assets.

- Assist teams is usually a beneficial useful resource for understanding the challenges and options concerned in coping with insurance coverage claims.

Ending Remarks

In conclusion, acquiring a good payout for a stolen car requires cautious consideration of things like car worth, protection sort, and declare procedures. This information affords a complete overview of the method, from preliminary declare submitting to potential disputes. By understanding your coverage phrases, evaluating insurance coverage suppliers, and avoiding widespread errors, you possibly can maximize your possibilities of a swift and passable payout.

Keep in mind, looking for skilled recommendation when crucial can considerably enhance your consequence.

FAQ Information

What occurs if the police do not discover my stolen automobile?

If the police are unable to find your stolen car, your insurance coverage declare course of should still proceed, relying in your coverage and the proof you present. You will must doc all efforts to get well the car, equivalent to submitting a police report, contacting authorities, and another actions taken to assist within the restoration course of.

How lengthy does it usually take to obtain a payout?

The timeframe for receiving a payout can differ considerably relying in your insurance coverage supplier, the complexity of the declare, and any crucial investigations. Some suppliers have faster processing occasions, whereas others could take longer. Your insurance coverage coverage ought to specify the everyday timeframe.

Can I get a payout if the stolen automobile was not absolutely paid off?

If the stolen car was not absolutely paid off, the payout will usually be primarily based on the quantity you owe on the mortgage, plus any further bills, equivalent to mortgage curiosity or penalties. You could want to supply documentation from the lender to show your possession curiosity.

What if I haven’t got all of the required paperwork?

Contact your insurance coverage supplier instantly to debate the lacking paperwork and work in the direction of an answer. They can help in buying the lacking data or could supply different strategies for offering the required documentation.