Refinance automotive mortgage with hole insurance coverage – Refining automotive mortgage with hole insurance coverage—a sensible transfer for a smoother trip. It is about understanding your choices, assessing your wants, and navigating the method with confidence. This complete information dives deep into the world of automotive mortgage refinancing, exploring the nuances of hole insurance coverage and serving to you make the most effective choice on your monetary future.

From evaluating totally different refinancing choices to understanding the potential impression in your credit score rating, we’ll equip you with the data to confidently navigate this significant monetary choice. Study in regards to the benefits and downsides of hole insurance coverage and the way it can impression your month-to-month funds.

Understanding Refinancing Choices: Refinance Automotive Mortgage With Hole Insurance coverage

A symphony of economic orchestration unfolds when considering a automotive mortgage refinance. Navigating the labyrinth of choices can appear daunting, but understanding the method and obtainable devices empowers knowledgeable choices. This exploration delves into the intricacies of refinancing, revealing the various pathways and pivotal components that form the end result.The method of refinancing a automotive mortgage entails changing an current mortgage with a brand new one, usually with extra favorable phrases.

This may entail a decrease rate of interest, an extended compensation interval, or a mix of each. The essential aspect is securing a greater monetary association tailor-made to your wants.

Refinancing Choices

A plethora of refinancing choices exists, every with its personal nuances. These embody choices from conventional banks to on-line lenders and credit score unions. The selection hinges in your particular circumstances and desired outcomes. Cautious consideration of the phrases and circumstances of every possibility is paramount.

Components Influencing Automotive Mortgage Curiosity Charges

A number of components intertwine to affect automotive mortgage rates of interest. Credit score rating, mortgage quantity, mortgage time period, and the prevailing market circumstances are all pivotal. A better credit score rating usually interprets to a decrease rate of interest, reflecting a decrease perceived threat to the lender.

Execs and Cons of Refinancing with Hole Insurance coverage

Refinancing with hole insurance coverage presents a fancy calculus. The benefit lies in sustaining or acquiring safety towards potential mortgage shortfalls. Conversely, the price of hole insurance coverage wants cautious consideration, as it might not all the time be financially advantageous. Weighing the potential advantages towards the added expense is crucial.

Kinds of Hole Insurance coverage

Numerous sorts of hole insurance coverage exist, every with distinctive options. Some cowl solely the distinction between the automotive’s worth and the excellent mortgage quantity, whereas others present complete protection encompassing numerous eventualities, together with harm or theft. Understanding these nuances is essential for aligning protection with particular person wants.

Comparability of Refinancing Prices (with and with out Hole Insurance coverage)

| Function | Refinancing with out Hole Insurance coverage | Refinancing with Hole Insurance coverage |

|---|---|---|

| Curiosity Charge | Doubtlessly decrease or larger relying on creditworthiness and market circumstances | Doubtlessly decrease or larger relying on creditworthiness and market circumstances. Could also be barely larger because of the further value of insurance coverage. |

| Month-to-month Cost | Decrease, if rate of interest is decrease. | Doubtlessly larger, if rate of interest is larger to compensate for insurance coverage premiums. |

| Whole Curiosity Paid | Decrease if the rate of interest is decrease. | Doubtlessly larger if the rate of interest is larger to compensate for insurance coverage premiums. |

| Whole Value (Mortgage + Insurance coverage) | Decrease, as no hole insurance coverage premiums are concerned. | Greater, because it consists of hole insurance coverage premiums. |

| Safety Towards Loss | No safety if automotive worth drops under mortgage quantity. | Safety if automotive worth drops under mortgage quantity, offering monetary cushion. |

A complete analysis of the components influencing the whole value is essential. Rigorously weighing the potential advantages of hole insurance coverage towards the added premiums is crucial for a sound monetary choice.

Assessing Hole Insurance coverage Wants

A prudent analysis of hole insurance coverage is paramount when contemplating a automotive mortgage refinance. This essential evaluation, akin to a meticulous appraisal, weighs the potential advantages towards the potential drawbacks, guaranteeing a financially sound choice. Understanding the intricacies of hole insurance coverage, and its relation to your refinancing technique, will empower you to navigate this monetary panorama with confidence.

Conditions The place Hole Insurance coverage is Useful

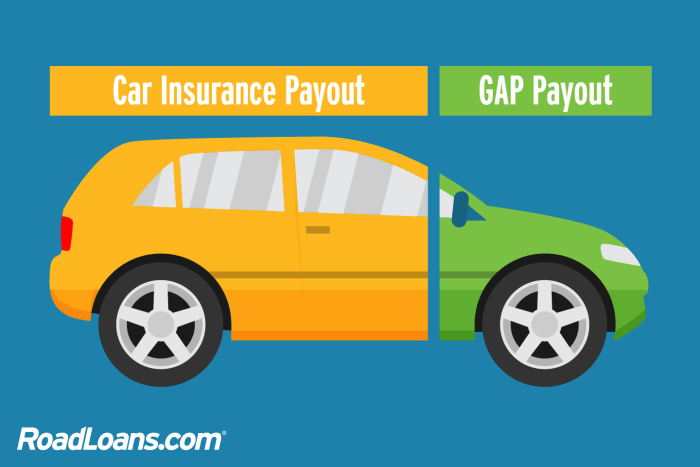

Hole insurance coverage, a safeguard towards unexpected circumstances, proves significantly worthwhile in sure eventualities. When the market worth of your car depreciates considerably, or if it is totaled in an accident, hole insurance coverage steps in to cowl the distinction between the excellent mortgage quantity and the car’s precise money worth. This safety turns into indispensable when going through surprising occasions that diminish the car’s value.

For instance, a sudden, extreme accident may depart your car with little salvage worth, however your mortgage obligation nonetheless exists. This situation clearly demonstrates the essential position hole insurance coverage performs in preserving your monetary well-being.

Potential Dangers of Not Having Hole Insurance coverage

Failing to safe hole insurance coverage throughout a refinance carries inherent dangers. With out this significant safety, you turn out to be personally accountable for any shortfall between the mortgage steadiness and the car’s recovered worth. This monetary publicity can considerably impression your total monetary stability. Think about a catastrophic accident, leaving your car past restore. If not lined by hole insurance coverage, the remaining mortgage steadiness can be your accountability, a considerable monetary burden that would impression your private funds.

Value of Hole Insurance coverage vs. Refinancing Financial savings

A cautious comparability of hole insurance coverage premiums to the potential financial savings from refinancing is crucial. Whereas hole insurance coverage provides to the general value of financing, the potential for important financial savings from refinancing usually outweighs the price of insurance coverage. If the financial savings from a decrease rate of interest or month-to-month fee exceed the insurance coverage premium, it’s usually a financially sound option to safe hole insurance coverage.

For instance, a $500 premium for hole insurance coverage may appear important, but when refinancing yields $1000 in annual financial savings, the funding in hole insurance coverage is justified.

Components to Think about When Evaluating Hole Insurance coverage Wants

A number of components affect the need of hole insurance coverage throughout refinancing. These embody the present market worth of the car, the excellent mortgage steadiness, the car’s age and situation, and the anticipated length of the mortgage. Moreover, the chance of an accident or harm performs a pivotal position. An older car with a excessive excellent mortgage quantity, in a high-risk space, may necessitate hole insurance coverage.

Inquiries to Ask When Selecting Hole Insurance coverage

Understanding the phrases of hole insurance coverage is essential earlier than committing. Key questions embody the protection extent, the exclusions, and the declare course of. What particular eventualities are lined, and what circumstances may void the coverage? Additionally, inquire about any restrictions or limitations on the protection. These particulars will empower you to make an knowledgeable choice, guaranteeing the coverage aligns together with your particular wants.

Protection Quantity Wanted for Totally different Eventualities

| Situation | Mortgage Quantity | Automobile Worth | Hole Insurance coverage Quantity Wanted ||—|—|—|—|| Whole Loss (Accident) | $20,000 | $10,000 | $10,000 || Important Depreciation | $15,000 | $8,000 | $7,000 || Minor Accident/Restore | $12,000 | $11,000 | $0 |

Refinancing with Hole Insurance coverage

A symphony of economic orchestration unfolds when contemplating refinancing a automotive mortgage, particularly when coupled with the prudence of hole insurance coverage. This intricate course of, like a rigorously composed musical piece, requires meticulous consideration to element and a transparent understanding of the devices concerned. Navigating this monetary panorama ensures a smoother trip towards automotive possession.

Refinancing Steps and Procedures

Refinancing a automotive mortgage with hole insurance coverage is a multifaceted course of, akin to assembling a fancy puzzle. Every step, meticulously carried out, contributes to a profitable consequence. Understanding the sequential nature of those actions is essential for a seamless transaction.

- Evaluation and Utility: The journey begins with an intensive evaluation of present mortgage phrases and a comparability of accessible refinancing choices. Consideration of rates of interest, mortgage durations, and potential financial savings is paramount. An software is then submitted, outlining the specified refinancing parameters and highlighting the necessity for hole insurance coverage. This preliminary step acts because the cornerstone of the whole course of.

- Hole Insurance coverage Analysis: A essential analysis of hole insurance coverage protection is crucial. This entails understanding the distinction between the car’s present worth and the excellent mortgage steadiness, to find out the suitable hole insurance coverage protection quantity. This meticulous analysis will in the end outline the optimum safety on your funding.

- Pre-Approval and Mortgage Phrases: A pre-approval course of, akin to a monetary audition, will set up the refinancing parameters and potential mortgage phrases. This step gives a preview of the potential settlement, highlighting essential components reminiscent of rates of interest, compensation schedules, and whole value of financing. This step affords readability and reduces uncertainty.

- Documentation Submission: A complete documentation bundle is required, meticulously ready to help the refinancing software. This bundle usually consists of copies of car registration, proof of insurance coverage, and monetary statements. These paperwork function the pillars of the applying, confirming the applicant’s eligibility and monetary standing.

- Mortgage Approval and Hole Insurance coverage Incorporation: The lender evaluations the applying, together with the hole insurance coverage request. If authorized, the phrases of the brand new mortgage, incorporating hole insurance coverage, are finalized. This signifies the fruits of the meticulous course of, setting the stage for the subsequent part.

- Closing and Funding: The ultimate stage entails the signing of the refinancing settlement and the discharge of funds to repay the unique mortgage. This transition marks the completion of the refinancing course of, permitting the borrower to embrace their new mortgage phrases.

Timeline for Refinancing Steps

A structured timeline, like a meticulously composed rating, gives a roadmap for the refinancing course of. This timeline affords readability and assists in anticipating the varied levels.

| Step | Description | Timeline (Approximate) |

|---|---|---|

| Evaluation & Utility | Consider choices, submit software | 1-3 enterprise days |

| Hole Insurance coverage Analysis | Assess hole insurance coverage wants | 1-2 enterprise days |

| Pre-Approval & Mortgage Phrases | Get hold of pre-approval, assessment phrases | 2-5 enterprise days |

| Documentation Submission | Collect & submit required paperwork | 1-2 enterprise days |

| Mortgage Approval & Hole Insurance coverage Incorporation | Mortgage approval, incorporate hole insurance coverage | 3-7 enterprise days |

| Closing & Funding | Signal settlement, obtain funds | 1-2 enterprise days |

Understanding Phrases and Situations

Rigorously scrutinizing the phrases and circumstances of the refinancing settlement is essential, akin to deciphering a fancy musical rating. This step safeguards towards unexpected penalties and ensures a harmonious monetary association.

Typical Refinancing Eventualities with Hole Insurance coverage

Refiancing eventualities with hole insurance coverage embody quite a lot of conditions, every distinctive in its necessities. A situation the place a car depreciates quickly necessitates a complete hole insurance coverage coverage. One other instance entails refinancing to scale back month-to-month funds whereas sustaining complete protection. These eventualities spotlight the adaptability of hole insurance coverage in numerous monetary conditions.

Refinancing Options and Comparisons

A symphony of economic decisions awaits, the place the melody of your automotive mortgage refinancings takes middle stage. Navigating the intricate panorama of choices can really feel daunting, however understanding every observe permits for a harmonious monetary future. This exploration delves into the varied paths obtainable, providing a comparability of refinancing with hole insurance coverage to various methods.Refinancing choices are pivotal, influencing the monetary trajectory of your automotive possession.

Choosing the proper possibility requires cautious consideration of potential advantages and downsides, guaranteeing a path that aligns together with your monetary objectives. A nuanced understanding of every various is essential for a profitable consequence.

Refinancing with Hole Insurance coverage vs. Extending the Mortgage Time period

Selecting between refinancing with hole insurance coverage and increasing the mortgage time period entails weighing the trade-offs. Refinancing with hole insurance coverage usually gives a decrease month-to-month fee because of a probably decrease rate of interest, however the total value may improve if the hole insurance coverage premium is substantial. Extending the mortgage time period lowers month-to-month funds, however the whole curiosity paid over the mortgage’s life is considerably larger.

- Refinancing with Hole Insurance coverage: This strategy usually ends in a decrease month-to-month fee, particularly if a positive rate of interest is secured. Nonetheless, the added value of hole insurance coverage ought to be factored into the whole value of the mortgage.

- Extending the Mortgage Time period: This technique affords decrease month-to-month funds, however the cumulative curiosity paid over the prolonged mortgage interval is significantly larger, in the end impacting the general value of the mortgage.

Different Choices for Securing Further Automotive Safety

Past refinancing, a number of avenues exist for securing further automotive safety. These choices could supply comparable advantages to hole insurance coverage or complement refinancing methods.

- Supplemental Insurance coverage Insurance policies: Think about buying further complete or collision protection that goes past the minimal necessities, offering complete safety towards harm or theft.

- Automotive Guarantee: A producer’s guarantee or an prolonged guarantee can supply safety towards mechanical points, lowering your out-of-pocket bills.

Execs and Cons of Every Possibility, Refinance automotive mortgage with hole insurance coverage

A complete understanding of the benefits and downsides is essential for knowledgeable decision-making. Every possibility has its personal set of advantages and downsides that ought to be rigorously evaluated in relation to your monetary scenario and driving habits.

- Refinancing with Hole Insurance coverage:

- Execs: Doubtlessly decrease month-to-month funds, safety towards a loss exceeding the mortgage quantity.

- Cons: Further hole insurance coverage premium, probably larger whole value over the mortgage’s life if rate of interest is not favorable.

- Extending the Mortgage Time period:

- Execs: Decrease month-to-month funds.

- Cons: Considerably larger whole curiosity paid over the mortgage’s life, probably resulting in a bigger total value.

Making Knowledgeable Selections

To make the optimum selection, contemplate your monetary circumstances, anticipated driving habits, and threat tolerance. Totally evaluate the rates of interest, mortgage phrases, and related prices of every possibility.

- Calculate Whole Prices: Assess the whole value of every possibility, together with curiosity, premiums, and potential future restore bills. A transparent understanding of those components is important for sound monetary planning.

- Assess Your Danger Tolerance: Consider your willingness to imagine threat associated to automotive harm or theft. This evaluation ought to inform your selection of protection.

- Search Skilled Recommendation: Consulting a monetary advisor can present customized steerage and insights primarily based in your particular monetary profile.

Comparability Desk of Financing Choices

This desk affords a concise overview of the varied financing choices, highlighting key features for a fast comparability.

| Possibility | Month-to-month Cost | Whole Curiosity Paid | General Value |

|---|---|---|---|

| Refinance with Hole Insurance coverage | Doubtlessly decrease | Doubtlessly larger or decrease | Doubtlessly decrease or larger |

| Lengthen Mortgage Time period | Decrease | Greater | Greater |

| Supplemental Insurance coverage | No direct impression | No direct impression | Variable |

Influence of Curiosity Charges on Mortgage Prices

Rates of interest instantly affect the whole value of a automotive mortgage with hole insurance coverage. Greater rates of interest result in the next whole value over the mortgage time period. A transparent understanding of how various rates of interest have an effect on mortgage prices is essential for making an knowledgeable choice.

| Curiosity Charge (%) | Mortgage Quantity ($10,000) | Whole Curiosity Paid (over 5 years) | Whole Value of Mortgage |

|---|---|---|---|

| 5 | $10,000 | $800 | $10,800 |

| 7 | $10,000 | $1,400 | $11,400 |

| 9 | $10,000 | $2,200 | $12,200 |

Influence on Credit score Rating and Funds

A symphony of economic choices, refinancing a automotive mortgage, significantly with hole insurance coverage, orchestrates a fancy interaction of creditworthiness and money circulate. Understanding the potential repercussions in your credit score rating, month-to-month outlays, and long-term monetary stability is paramount. Navigating this monetary panorama requires cautious consideration and a nuanced understanding of the variables at play.

Credit score Rating Implications

Refinancing, in and of itself, usually has a minimal impression in your credit score rating. A brand new mortgage software and arduous inquiry are registered in your credit score report, probably leading to a slight, short-term dip in your rating. Nonetheless, this impression is often minimal and short-term, and if the refinancing choice enhances your monetary place, it could yield constructive long-term results.

Month-to-month Cost Dynamics with Hole Insurance coverage

The inclusion of hole insurance coverage in your refinancing technique introduces a component of elevated month-to-month value. The premium for this safety provides to your current mortgage funds, influencing your month-to-month finances. Cautious comparability of various financing choices is crucial. For example, a $25,000 mortgage with a 5% rate of interest and $500 hole insurance coverage premium may translate right into a month-to-month fee of $600, in comparison with a $550 month-to-month fee with out hole insurance coverage.

This can be a hypothetical instance, and the precise figures will depend upon particular mortgage phrases and circumstances.

Lengthy-Time period Monetary Implications

Refinancing choices, whether or not with or with out hole insurance coverage, maintain important long-term monetary implications. Decreasing your rate of interest can result in substantial financial savings over the lifetime of the mortgage, liberating up funds for different monetary objectives. Conversely, the next month-to-month fee, significantly with hole insurance coverage, could pressure your finances and probably hinder different monetary targets. It’s important to weigh the potential advantages towards the monetary obligations.

Budgetary Influence of Hole Insurance coverage

The price of hole insurance coverage should be factored into your finances. This premium is a direct addition to your current month-to-month automotive mortgage fee. The premium quantity relies on the automotive’s worth and the quantity of protection, which can range amongst totally different suppliers. A better premium will necessitate cautious monetary planning and potential changes to your finances.

Month-to-month Cost Comparability Desk

The next desk illustrates potential month-to-month fee adjustments underneath numerous refinancing eventualities:

| Situation | Curiosity Charge (%) | Mortgage Time period (Years) | Hole Insurance coverage Premium ($) | Estimated Month-to-month Cost ($) |

|---|---|---|---|---|

| Situation 1 (No Hole Insurance coverage) | 4.5 | 5 | 0 | $450 |

| Situation 2 (Hole Insurance coverage) | 4.5 | 5 | 200 | $650 |

| Situation 3 (Decrease Curiosity Charge) | 3.5 | 5 | 0 | $400 |

| Situation 4 (Longer Time period) | 4.5 | 7 | 0 | $350 |

Mortgage Time period and Curiosity Charge Influence

Totally different mortgage phrases and rates of interest considerably have an effect on month-to-month funds. A shorter mortgage time period, whereas usually related to larger month-to-month funds, can lead to a decrease whole curiosity paid over the lifetime of the mortgage. Conversely, an extended mortgage time period, although resulting in decrease month-to-month funds, will increase the whole curiosity paid. The rate of interest instantly correlates to the month-to-month fee; a decrease rate of interest often interprets to a decrease month-to-month fee.

Think about a $25,000 mortgage: a 5% rate of interest over 5 years may end in a month-to-month fee of $500, whereas a 3% rate of interest over 7 years may yield a month-to-month fee of $400. The selection will depend on your monetary priorities and circumstances.

Discovering a Respected Lender

A symphony of economic decisions awaits, every observe a possible path to a smoother, extra inexpensive automotive mortgage. Navigating this intricate panorama calls for discernment and meticulous analysis, guaranteeing a harmonious consequence. Choosing the proper lender is pivotal to a profitable refinancing expertise.

Figuring out Respected Lenders

Respected lenders specializing in automotive refinancing with hole insurance coverage are meticulously vetted and acknowledged for his or her dedication to honest and clear practices. Their experience lies in navigating the complexities of hole insurance coverage, providing aggressive charges, and guaranteeing a seamless refinancing course of. Thorough analysis is crucial to differentiate these respected lenders from those that may supply much less favorable phrases or lack the required experience.

Significance of Researching Lenders Totally

Thorough analysis into lenders’ reputations and observe data is paramount. Scrutinizing their monetary stability, service historical past, and buyer evaluations permits a discerning eye to pick a lender with a confirmed dedication to buyer satisfaction. This proactive strategy ensures a smoother transaction and minimizes potential pitfalls.

Standards for Selecting a Lender

Selecting a lender necessitates cautious consideration of a number of key standards. Components reminiscent of aggressive rates of interest, clear price constructions, and a dedication to glorious customer support are important. A lender’s expertise in dealing with hole insurance coverage claims and their responsiveness to inquiries are additionally very important. Lenders with a robust repute for well timed processing and environment friendly communication are most popular.

Inquiries to Ask Lenders

To make sure an appropriate match, it’s prudent to ask particular questions relating to refinancing choices. Inquire in regards to the lender’s particular insurance policies regarding hole insurance coverage, the method for making use of for a mortgage, and the phrases of the mortgage settlement. Enquire about any related charges, together with origination charges, closing prices, and prepayment penalties. Perceive the lender’s strategy to resolving potential disputes.

These inquiries assist guarantee a mutually useful and clear relationship.

- What are your rates of interest for automotive refinancing with hole insurance coverage?

- What’s your price construction, and are there any hidden costs?

- What’s your course of for dealing with hole insurance coverage claims?

- What’s your customer support coverage, and the way can I attain you with questions?

- What are your prepayment penalties, if any?

Examples of Respected Lenders

A number of establishments excel in offering automotive refinancing companies, together with hole insurance coverage choices. These establishments usually have a confirmed observe file of offering glorious customer support, aggressive charges, and clear processes.

Evaluating Lender Providers and Charges

A comparative evaluation of lender companies and costs is invaluable in choosing the most suitable choice. A well-structured desk, such because the one under, gives a concise overview of assorted lenders and their related companies and costs. This comparability empowers knowledgeable decision-making.

| Lender | Curiosity Charge (Instance) | Hole Insurance coverage Protection | Origination Charge | Processing Charge |

|---|---|---|---|---|

| First Nationwide Financial institution | 4.5% | Customary Protection | $200 | $50 |

| Dependable Credit score Union | 4.2% | Enhanced Protection | $150 | $25 |

| Sensible Finance | 4.8% | Customizable Protection | $250 | $75 |

Addressing Potential Points and Pitfalls

The trail to a smoother automotive mortgage refinance could be fraught with hidden obstacles. Navigating these potential pitfalls requires a eager eye and a resolute spirit, akin to a seasoned explorer charting a treacherous panorama. Cautious consideration and proactive measures are important to keep away from expensive missteps.Refining a automotive mortgage is a big monetary endeavor, and understanding potential issues is essential for a profitable consequence.

By anticipating and mitigating these points, debtors can safeguard their monetary well-being and guarantee a constructive expertise all through the method.

Widespread Refinancing Pitfalls

An intensive understanding of frequent pitfalls can considerably improve the chance of a profitable refinancing course of. These potential points vary from misinterpretations of phrases to ignored particulars within the effective print. By anticipating these difficulties, debtors can strategy the method with larger confidence and keep away from expensive errors.

- Inaccurate Mortgage Utility Data: Offering incorrect or incomplete data on the applying can result in delays, rejection, or perhaps a denial of the mortgage software. The meticulous assortment and correct reporting of all monetary particulars are essential.

- Ignoring Credit score Rating Implications: A damaging impression on the credit score rating because of an unsuccessful refinancing try can have long-term penalties. Rigorously weighing the potential advantages towards the dangers of the credit score rating impression is crucial.

- Failing to Examine Mortgage Phrases: An intensive comparability of mortgage phrases, together with rates of interest, charges, and compensation schedules, from a number of lenders is important. Blindly accepting the primary supply can lead to a much less advantageous settlement.

- Neglecting Hidden Charges: Hidden charges and costs, usually buried within the effective print of mortgage agreements, can considerably improve the general value of the refinance. Rigorously scrutinizing all paperwork to establish any hidden costs is a essential step.

Hole Insurance coverage Protection Points

Hole insurance coverage, whereas providing safety towards potential losses, additionally presents particular challenges. It’s critical to totally assess the protection’s scope and limitations to keep away from surprising outcomes.

- Understanding Protection Limits: Hole insurance coverage protection shouldn’t be limitless. Understanding the coverage’s protection limits and exclusions is crucial to make sure satisfactory safety. Reviewing the coverage’s effective print is a essential step in understanding protection specifics.

- Potential for Pointless Protection: In sure eventualities, hole insurance coverage may not be crucial. Assessing the worth of the car and the excellent mortgage steadiness to find out if protection is actually wanted is crucial. Consideration of the trade-off between protection and price is important.

- Coverage Limitations and Exclusions: Insurance policies usually comprise limitations and exclusions that may considerably prohibit protection. Thorough investigation of the coverage’s particulars, together with the listing of exclusions, is paramount.

Dealing with Refinancing Points and Disputes

Addressing points and disputes promptly and successfully is crucial to resolve conflicts through the refinancing course of. This usually entails direct communication and documentation to resolve the problem.

- Speaking Successfully: Clear and concise communication with the lender is important to resolve any points promptly. Sustaining detailed data of all communications could be instrumental in resolving disagreements.

- Documenting Every thing: Thorough documentation of all interactions and communications with the lender is essential. This documentation could be invaluable if disputes come up through the refinancing course of.

- In search of Mediation or Arbitration: If direct communication proves unsuccessful, contemplate mediation or arbitration to resolve the dispute. These choices usually present a structured strategy to battle decision.

Significance of Thorough Analysis and Due Diligence

Thorough analysis and due diligence are cornerstones of a profitable refinancing endeavor. It is a dedication to understanding the whole course of and mitigating potential dangers.

- Scrutinizing Lender Fame: Thorough analysis into the lender’s repute, monetary stability, and customer support observe file is paramount. Checking evaluations and scores of the lender can present essential insights.

- Analyzing A number of Affords: Analyzing mortgage affords from numerous lenders permits debtors to match rates of interest, charges, and phrases to seek out the absolute best deal. A comparative evaluation is a robust software for acquiring probably the most advantageous settlement.

- Reviewing Mortgage Paperwork Rigorously: Rigorously reviewing all mortgage paperwork, together with the mortgage settlement, the hole insurance coverage coverage, and any related kinds, is essential. Pay shut consideration to the effective print to keep away from surprising surprises.

Widespread Refinancing Errors

Understanding frequent errors will help debtors keep away from expensive missteps. These errors usually stem from an absence of preparedness or inadequate due diligence.

- Speeding the Course of: Speeding the refinancing course of can result in overlooking vital particulars and accepting much less favorable phrases. Cautious planning and a measured strategy can keep away from this pitfall.

- Ignoring Various Choices: Exploring various refinancing choices, reminiscent of searching for a mortgage from a distinct lender or selecting a distinct sort of mortgage, can result in extra favorable phrases. Diligent consideration of alternate options could be useful.

- Overlooking Hole Insurance coverage Options: A complete evaluation of hole insurance coverage alternate options can present worthwhile perception. Exploring various choices for shielding towards loan-value variations is essential.

Potential Issues and Options

A structured strategy to addressing potential issues throughout refinancing could be useful. This desk Artikels potential issues and their corresponding options.

| Potential Drawback | Answer |

|---|---|

| Incorrect software data | Evaluation and proper software particulars earlier than submission. |

| Unfavorable rate of interest | Examine charges from a number of lenders and negotiate. |

| Hidden charges | Scrutinize mortgage paperwork rigorously for hidden charges. |

| Hole insurance coverage misrepresentation | Totally assessment the coverage’s phrases and circumstances. |

| Poor communication with lender | Doc all communications and escalate issues if crucial. |

Final Conclusion

In conclusion, refinancing your automotive mortgage with hole insurance coverage generally is a highly effective software for monetary administration, however cautious consideration is essential. By understanding the method, evaluating your wants, and evaluating totally different choices, you can also make an knowledgeable choice that aligns together with your monetary objectives. Do not rush; do your analysis and select the suitable lender to maximise your financial savings and reduce dangers.

Important Questionnaire

What are the frequent pitfalls to keep away from through the refinancing course of?

Speeding into a call with out thorough analysis, failing to match totally different lenders, and never understanding the phrases and circumstances of the refinancing settlement are frequent pitfalls. Additionally, overlooking potential points with hole insurance coverage protection is a essential mistake.

How does hole insurance coverage have an effect on my month-to-month funds?

The price of hole insurance coverage can be added to your month-to-month fee. The precise quantity will depend on the chosen protection and the phrases of your refinancing.

What questions ought to I ask lenders about refinancing choices?

Inquire about rates of interest, charges, and the precise phrases of hole insurance coverage protection. Ask in regards to the lender’s expertise with refinancing automotive loans and their customer support practices. You should definitely ask in regards to the course of when you have any questions.

How can I evaluate totally different refinancing choices successfully?

Use on-line comparability instruments and create a desk to match rates of interest, charges, and phrases. Examine month-to-month funds for numerous eventualities to evaluate the long-term monetary implications of various decisions.