Mutual of omaha long run care insurance coverage – Mutual of Omaha long-term care insurance coverage provides essential safety in opposition to the rising prices of long-term care. Understanding the specifics of those insurance policies, their protection choices, and related prices is important for knowledgeable decision-making. This information explores the important thing options, advantages, and potential drawbacks of Mutual of Omaha’s long-term care insurance coverage, offering a complete overview that can assist you decide if it is the proper match in your wants.

This detailed evaluation delves into the nuances of Mutual of Omaha’s long-term care insurance policy, evaluating them to different main suppliers and highlighting the components influencing premium prices. We’ll study coverage particulars, protection specifics, and the declare course of, equipping you with the data essential to make an knowledgeable selection.

Introduction to Lengthy-Time period Care Insurance coverage

The whisper of previous age, a chilling breeze rustling by the leaves of tomorrow, carries with it the quiet specter of dependence. A time when the acquainted routines of each day life grow to be a frightening problem. Lengthy-term care insurance coverage is a safeguard in opposition to this unsure future, a protect in opposition to the rising tide of caregiving wants. It is a proactive measure, providing monetary help when conventional sources falter.This insurance coverage offers essential monetary help for the prices of long-term care companies, reminiscent of nursing house stays, assisted residing amenities, or in-home care.

It could possibly supply a lifeline, permitting people to take care of their dignity and independence whereas dealing with the calls for of prolonged care.

Frequent Kinds of Lengthy-Time period Care Insurance coverage Protection

Understanding the spectrum of protection choices is crucial for choosing a coverage that aligns with particular person wants and monetary circumstances. Numerous varieties of insurance policies cater to completely different preferences and threat tolerances.

- Particular person Insurance policies: These insurance policies are tailor-made to particular wants and budgets, providing versatile protection choices.

- Group Insurance policies: Typically supplied by employers, these plans present a structured method to long-term care insurance coverage, with predetermined advantages and premiums.

- Hybrid Insurance policies: These mix components of particular person and group insurance policies, offering a mix of customization and pre-determined options.

Significance of Contemplating Lengthy-Time period Care Insurance coverage Choices

The monetary implications of long-term care are substantial. Failure to plan can result in vital monetary pressure on households and people. Contemplating long-term care insurance coverage permits people to mitigate these dangers and keep monetary safety throughout a weak time. Proactive planning is vital to preserving sources and guaranteeing a extra comfy and predictable future.

Comparability of Lengthy-Time period Care Insurance coverage Insurance policies

The desk under highlights key options of various long-term care insurance coverage insurance policies, permitting for a comparative evaluation.

Mutual of Omaha Lengthy-Time period Care Insurance coverage

A whisper of a narrative, a story of shadowed corridors and flickering candlelight, echoes by the annals of insurance coverage. Mutual of Omaha, a reputation steeped in historical past, has navigated the treacherous currents of the trade, weathering storms and rising, phoenix-like, with a repute solid within the fires of reliability. Their long-term care insurance coverage choices, shrouded within the cloak of practicality, are designed to offer a security web in opposition to the unpredictable tides of growing old.Mutual of Omaha, an organization recognized for its longevity and dedication to its policyholders, has a historical past rooted in group and stability.

Their long-term care insurance coverage insurance policies, designed to offer monetary safety in periods of prolonged sickness or incapacity, are a testomony to their dedication to offering complete protection. They’ve confronted challenges, like several establishment navigating the ever-shifting sands of the insurance coverage market, however their deal with offering dependable protection has helped them keep a robust repute.

Historical past and Repute

Mutual of Omaha, a venerable identify within the insurance coverage world, boasts a historical past courting again many years. Their repute for stability and monetary power has been constructed on a basis of sound actuarial practices and a deep understanding of the evolving wants of their policyholders. This repute is just not merely a declare, however a testomony borne out by their sustained presence available in the market and constant constructive buyer suggestions.

Options and Advantages of Mutual of Omaha’s Lengthy-Time period Care Insurance coverage Insurance policies

Mutual of Omaha’s long-term care insurance coverage insurance policies supply a spread of options and advantages designed to deal with the distinctive wants of people as they navigate the complexities of growing old. These plans usually embody provisions for protection of varied varieties of care, from expert nursing amenities to assisted residing, and regularly embody choices for customizing protection to match particular person circumstances. The plans are structured to offer monetary safety in periods of prolonged sickness or incapacity, permitting policyholders to deal with their well being and well-being.

Protection Choices In comparison with Different Main Suppliers

Evaluating Mutual of Omaha’s long-term care insurance coverage choices with these of different main suppliers reveals a various panorama of advantages and pricing constructions. Every supplier tailors its choices to fulfill the particular wants and preferences of various demographics, and policyholders should totally analyze these components to pick out essentially the most appropriate protection.

Key Variations Between Mutual of Omaha’s Plans

| Plan Characteristic | Mutual of Omaha Plan A | Mutual of Omaha Plan B |

|---|---|---|

| Every day Profit Quantity | $150 | $200 |

| Profit Interval | 12 months | 24 months |

| Most Profit Quantity | $100,000 | $150,000 |

| Premiums | (Instance: $100/month) | (Instance: $150/month) |

Mutual of Omaha provides distinct plans to accommodate various wants and monetary conditions. The desk above highlights key variations in each day profit quantities, profit durations, and most payouts, all essential concerns in evaluating essentially the most appropriate plan. Premiums, whereas depending on a number of components, are additionally introduced as a information to policyholders’ understanding of the price.

Coverage Particulars and Protection

A whisper of uncertainty hangs within the air, a premonition of the unknown. Lengthy-term care insurance coverage, a labyrinth of potentialities and limitations, awaits exploration. Understanding its intricacies is essential, as navigating this maze can imply the distinction between peace of thoughts and unexpected hardship.The labyrinthine nature of long-term care insurance coverage insurance policies typically leaves people feeling misplaced. Realizing the particular varieties of care lined, the conditions the place these insurance policies shine, and the potential pitfalls is crucial for knowledgeable decision-making.

This exploration will dissect these essential facets, shedding gentle on the intricacies of Mutual of Omaha’s choices.

Kinds of Care Lined

Mutual of Omaha’s long-term care insurance policy usually cowl a spread of companies, from essentially the most fundamental help with each day residing actions to expert nursing care. This encompasses private care, reminiscent of dressing, bathing, and consuming, in addition to expert nursing care, remedy, and rehabilitation companies. The particular companies included in every plan range, so it is important to rigorously evaluation the coverage particulars.

Helpful Conditions

Lengthy-term care insurance coverage is commonly a beacon of hope in difficult occasions. Contemplate conditions the place people require ongoing help past the scope of conventional healthcare protection. For instance, a stroke survivor needing assist with mobility and each day duties, or an aged particular person requiring round the clock care, might discover long-term care insurance coverage to be an important security web. The monetary burden of those prolonged care wants will be immense, and insurance coverage can considerably cut back the monetary pressure on households.

Coverage Exclusions and Limitations

Navigating the nuances of long-term care insurance coverage insurance policies requires cautious consideration of exclusions and limitations. These clauses Artikel conditions the place protection might not apply. Understanding these facets is essential to keep away from unexpected monetary implications.

Frequent Exclusions and Limitations

| Exclusion Class | Description | Instance |

|---|---|---|

| Pre-existing Circumstances | Circumstances identified or handled earlier than the coverage’s efficient date are sometimes excluded. This implies the coverage might not cowl take care of a situation the insured already had. | An individual with a historical past of arthritis who applies for long-term care insurance coverage after the analysis will not be lined for arthritis-related care. |

| Care Offered at House | The extent of care lined at house might differ from institutional care. The coverage might restrict the kind of care offered at house. | Some insurance policies may cowl solely sure varieties of house care help, like assist with dressing and bathing, however not round the clock nursing care at house. |

| Particular Care Suppliers | Insurance policies might have stipulations relating to the particular care suppliers they cowl. | Some insurance policies won’t cowl care from sure healthcare amenities or particular physicians. |

| Length of Protection | Insurance policies typically place limits on the size of time protection is offered. | A coverage may cowl long-term take care of a most of 5 years, after which the protection might stop, relying on the particular plan. |

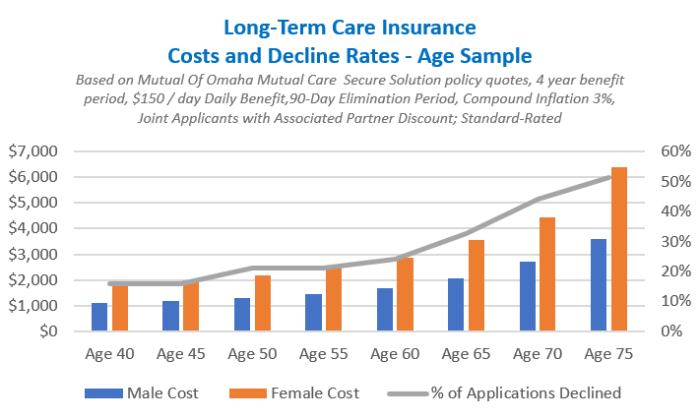

Prices and Premiums

The veil of long-term care insurance coverage premiums hangs heavy, a silent whisper of future monetary burdens. Navigating these prices can really feel like deciphering an historical, cryptic textual content, fraught with hidden variables and unexpected issues. Understanding the components that form these prices is essential, a key to unlocking the potential burdens and advantages of such a coverage.The worth of long-term care insurance coverage is not etched in stone; it is a dynamic equation, influenced by quite a few components.

Your age, naturally, performs a big position. Youthful people usually pay much less, whereas the older you might be, the dearer the coverage turns into. Well being standing is one other pivotal ingredient; pre-existing situations can affect the premium, typically pushing the value upwards. The chosen protection quantity, whether or not you need fundamental help or complete care, straight impacts the price.

The particular advantages included within the coverage, such because the each day allowance or the size of protection, are additional determinants of the general expense.

Elements Influencing Premiums

The intricate dance of long-term care insurance coverage premiums entails a number of key gamers. Age is a major determinant, as the danger of needing long-term care will increase with advancing years. Well being situations, each recognized and unknown, can considerably influence the premium, reflecting the actuarial calculations of potential claims. The specified protection quantity straight correlates with the premium, with larger monetary safety demanding a better price.

The particular advantages bundle, together with each day allowances, the length of protection, and the extent of care included, additionally contributes to the premium’s general construction.

Evaluating Mutual of Omaha Premiums with Rivals

A direct comparability of Mutual of Omaha’s premiums with rivals is not available in a standardized format. Insurance coverage firms typically make use of completely different methodologies for pricing insurance policies, making a easy, apples-to-apples comparability difficult. Elements reminiscent of coverage design, profit constructions, and the particular markets served contribute to the disparities. Direct inquiries with Mutual of Omaha and competitor firms are mandatory for correct comparisons.

Premium Prices for Completely different Age Teams, Mutual of omaha long run care insurance coverage

A glimpse into potential prices for Mutual of Omaha long-term care insurance coverage is obtainable within the following desk. Observe that these are illustrative examples, and precise premiums will range based mostly on particular person circumstances.

| Age Group | Protection Quantity | Annual Premium (Illustrative) |

|---|---|---|

| 50-59 | $5,000/day | $2,500 – $5,000 |

| 60-69 | $5,000/day | $3,000 – $6,000 |

Declare Course of and Administration

A whisper of uncertainty drifts by the halls of growing old, a chilling wind that carries the specter of monetary pressure. Lengthy-term care insurance coverage, a beacon within the twilight of life, guarantees a security web. However how does one navigate the labyrinthine declare course of when the shadows lengthen and the necessity arises? This exploration delves into the intricate mechanisms of claims, revealing the steps and eventualities concerned.The declare course of is a rigorously orchestrated dance, requiring precision and understanding.

A well-defined process, designed to alleviate anxiousness and streamline the method, is paramount. Realizing the steps and examples of conditions the place a declare is perhaps filed can ease the burden and supply peace of thoughts.

Declare Submitting Conditions

Understanding the circumstances that necessitate a declare is essential. These eventualities embody a spread of potential wants. A sudden, debilitating stroke, leaving a liked one depending on fixed care, can set off a declare. A progressive neurological situation, slowly eroding independence, may necessitate long-term care companies and subsequent declare submitting. Even a extreme accident, leading to extended rehabilitation and caregiving necessities, can result in a declare.

Steps in Submitting a Declare

Navigating the declare course of is a collection of rigorously choreographed steps. Every step is a vital ingredient in guaranteeing a clean and environment friendly decision.

- Preliminary Contact and Evaluation:

- Documentation Submission:

- Declare Evaluate and Analysis:

- Profit Dedication:

- Profit Disbursement:

The journey begins with a name to Mutual of Omaha. A preliminary evaluation determines the character of the necessity and the eligibility of the policyholder for advantages. Gathering the required documentation and coverage data is essential at this stage. This preliminary contact ensures the declare is filed accurately and effectively.

A complete packet of paperwork is essential. Medical data, doctor statements, and care plan particulars type the inspiration of the declare. The completeness and accuracy of those paperwork are important for a swift and efficient evaluation. Lacking or incomplete documentation might delay or deny the declare.

Mutual of Omaha meticulously opinions the submitted paperwork. This step entails assessing the policyholder’s eligibility and the need of the requested care. Medical professionals and claims adjusters consider the state of affairs. This stage ensures that the declare meets the coverage’s Artikeld necessities.

Primarily based on the evaluation, Mutual of Omaha will decide the quantity of advantages payable. This willpower relies on the coverage particulars, the kind of care wanted, and the length of care. The policyholder will obtain notification of the authorized profit quantity and the plan for disbursement.

As soon as authorized, the advantages are disbursed in keeping with the coverage phrases. The method of cost is clear and streamlined to make sure well timed receipt by the care supplier.

Declare Course of Desk

| Step | Description |

|---|---|

| Step 1 | Preliminary contact with Mutual of Omaha and preliminary evaluation of the state of affairs. |

| Step 2 | Submission of full and correct documentation, together with medical data and care plans. |

| Step 3 | Evaluate and analysis of the declare by Mutual of Omaha’s medical professionals and claims adjusters. |

| Step 4 | Dedication of advantages payable based mostly on coverage particulars, care wants, and length of care. |

| Step 5 | Disbursement of advantages in keeping with coverage phrases to the designated care supplier. |

Buyer Evaluations and Testimonials

Whispers of satisfaction and unease, just like the chilling wind by a forgotten crypt, echo by the digital halls of buyer opinions. These murmurs, these rigorously chosen phrases, supply a glimpse into the intricate tapestry of experiences with Mutual of Omaha’s long-term care insurance coverage.

Unraveling these threads reveals a posh narrative, a mixture of consolation and apprehension.

Buyer Suggestions Evaluation

A shadowy determine lurks inside the realm of buyer suggestions. Some voices resonate with reward, others with concern. Understanding these contrasting views is essential for comprehending the nuances of the insurance coverage program. This evaluation dissects the frequent threads woven into the opinions, each constructive and detrimental, to offer a complete view.

Optimistic Buyer Suggestions

A refrain of contentment rises from the digital ether. Clients who discovered worth in this system typically spotlight the peace of thoughts it offers. The safety of figuring out their future wants are doubtlessly lined is a strong motivator.

- “I am eternally grateful for the peace of thoughts this coverage offers. Realizing my care is roofed, it doesn’t matter what, is priceless.”

- “The declare course of was surprisingly simple. The employees was responsive and useful all through your entire course of. I felt assured of their experience.”

- “The premiums had been cheap in comparison with different quotes I acquired. The protection choices had been versatile sufficient to fulfill my particular wants.”

Detrimental Buyer Suggestions

A counterpoint emerges, a whisper of discontent. Issues regularly revolve across the complexity of the coverage particulars, the perceived limitations of protection, and the monetary burden of premiums. These points underscore the significance of thorough coverage evaluation and comparability.

| Class | Evaluate Excerpt |

|---|---|

| Detrimental | “The coverage wording was dense and complicated. It took me a number of hours to totally perceive the small print.” |

| Detrimental | “The premium prices had been considerably increased than I anticipated, particularly given the extent of protection.” |

| Detrimental | “The declare course of appeared overly bureaucratic. I skilled a number of delays and issues.” |

Selecting the Proper Coverage: Mutual Of Omaha Lengthy Time period Care Insurance coverage

The labyrinth of long-term care insurance coverage insurance policies can really feel like a haunted home, full of whispers of hidden prices and unsure futures. Navigating this maze requires a eager eye and a gentle hand, and maybe, a bit little bit of braveness. However worry not, for with cautious consideration and the proper steerage, yow will discover the coverage that most accurately fits your wants.

A well-chosen coverage is not nearly defending your monetary future; it is about safeguarding your peace of thoughts within the face of the unknown.Deciding on the right long-term care insurance coverage coverage is a vital resolution. It is not nearly numbers and premiums; it is about anticipating the potential for future care wants and securing monetary safety. An acceptable coverage can present important help when confronted with sudden long-term well being challenges, stopping monetary destroy and guaranteeing a snug high quality of life.

Selecting the flawed coverage, nevertheless, can go away you weak and uncovered, like a ship and not using a rudder in a storm.

Consulting a Monetary Advisor

A monetary advisor acts as a educated information within the complicated panorama of long-term care insurance coverage. They possess the experience to investigate your particular monetary state of affairs, contemplating your belongings, liabilities, and projected future wants. This personalised method helps tailor a coverage to your particular person circumstances, optimizing protection and minimizing prices. By understanding your distinctive state of affairs, an advisor can determine potential pitfalls and spotlight optimum methods.

Elements to Contemplate

A number of components affect the choice of an acceptable long-term care insurance coverage coverage. These components vary from the projected price of care in your space to your particular person well being historical past. A complete analysis of those components ensures the chosen coverage aligns along with your anticipated wants and price range. Contemplate your present well being, anticipated future well being wants, and the monetary implications of potential long-term care bills.

Take into consideration your way of life and residing preparations, and the way these components may have an effect on your care necessities.

Coverage Analysis Questions

An intensive analysis of a long-term care insurance coverage coverage entails asking particular questions to make sure it aligns along with your wants and monetary state of affairs. These questions assist to uncover the potential advantages and disadvantages of various insurance policies. Do not be afraid to delve deep into the small print; your future well-being will depend on it. Inquiries to ask embody:

- What are the particular varieties of care lined by the coverage? (e.g., nursing house care, assisted residing, house well being care)

- What’s the each day or month-to-month profit quantity offered below the coverage?

- What’s the most profit interval supplied by the coverage?

- What are the coverage’s exclusions and limitations?

- What’s the coverage’s premium construction and the way does it range over time?

- What are the coverage’s administrative prices and declare processing procedures?

- What’s the coverage’s assured renewable clause?

Coverage Professionals and Cons

Understanding the strengths and weaknesses of various coverage sorts is essential. The next desk illustrates the potential benefits and drawbacks of varied long-term care insurance coverage insurance policies, categorized by key options. This can support in making an knowledgeable resolution.

| Coverage Characteristic | Professional | Con |

|---|---|---|

| Protection Quantity | Greater protection quantities present larger monetary safety in case of considerable care wants. | Greater protection quantities typically translate to increased premiums. |

| Profit Interval | Longer profit durations supply prolonged monetary safety in opposition to long-term care bills. | Longer profit durations might enhance premiums considerably. |

| Premium Construction | Premiums based mostly on age and well being standing can mirror a extra correct evaluation of threat. | Premiums might enhance over time, particularly with age. |

| Coverage Exclusions | Clear exclusions restrict protection to particular care wants, doubtlessly decreasing premium prices. | Exclusions may go away gaps in protection if care wants fall exterior the coverage’s scope. |

Concluding Remarks

In conclusion, Mutual of Omaha long-term care insurance coverage presents a big possibility for these in search of safety in opposition to the substantial bills of long-term care. Cautious consideration of coverage specifics, premium prices, and protection choices is paramount. Consulting with a monetary advisor can additional help in navigating the complexities of selecting the best coverage. This complete information goals to empower you with the data to make an knowledgeable resolution about your long-term care insurance coverage wants.

Query Financial institution

What are the everyday each day profit quantities supplied by Mutual of Omaha?

Mutual of Omaha provides a spread of each day profit quantities, various based mostly on the particular plan. Info on exact each day profit quantities is not obtainable with out particular plan particulars.

How does Mutual of Omaha’s declare course of work?

The declare course of usually entails submitting mandatory documentation, which varies relying on the particular circumstances. Mutual of Omaha probably has an in depth course of Artikeld of their coverage paperwork.

What are some frequent exclusions in long-term care insurance coverage insurance policies?

Frequent exclusions typically embody pre-existing situations, care offered exterior the scope of the coverage, and sure varieties of care not deemed medically mandatory. Seek the advice of the coverage doc for exact particulars.

Are there any age limitations or restrictions on Mutual of Omaha’s long-term care insurance coverage?

Mutual of Omaha probably has age restrictions on when people should purchase insurance policies, much like different insurance coverage suppliers. Particular age limits will be discovered within the coverage particulars.