Michigan automobile insurance coverage enhance 2024 is poised to influence drivers throughout the state. Rising accident charges, inflation, and evolving state laws are all contributing components to this vital enhance. Specialists predict a considerable leap in premiums in comparison with earlier years, and drivers are urged to grasp the potential ramifications.

This complete evaluation explores the multifaceted components driving this enhance, examines affected protection varieties, supplies methods for customers, and provides insights into potential future developments. The report consists of knowledge visualizations, comparable to charts and graphs, to raised illustrate the complexities of this situation.

Components Driving Michigan Automobile Insurance coverage Enhance in 2024

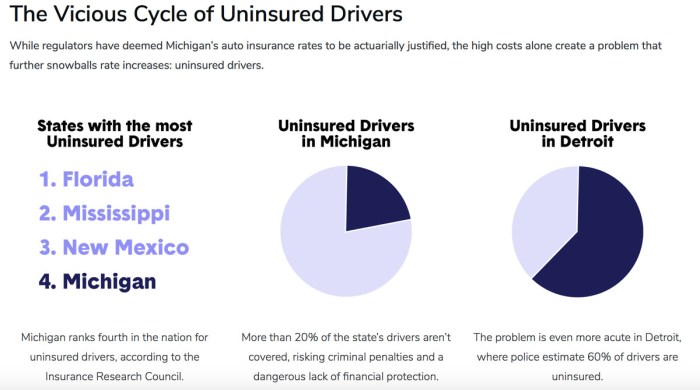

The escalating price of automobile insurance coverage in Michigan in 2024 displays a fancy interaction of financial, societal, and regulatory components. The rising premiums will not be a singular phenomenon however moderately a confluence of points impacting the whole insurance coverage market. This evaluation will dissect the contributing components, from accident statistics to financial developments and legislative adjustments, offering a complete understanding of the present market dynamics.

Accident Statistics and Claims Tendencies

Current accident statistics in Michigan, and nationwide, reveal a regarding development of elevated frequency and severity of collisions. This surge in claims instantly correlates with greater insurance coverage premiums. Elevated distracted driving, notably by means of the pervasive use of cellular units, and difficult street circumstances attributable to climate patterns are main contributing components. The rising price of medical take care of accident victims, a significant factor of claims, additionally locations a considerable burden on insurers, necessitating premium changes.

Inflation and Financial Circumstances

Inflationary pressures have considerably impacted the price of almost all items and companies. The growing prices of labor, supplies, and restore companies instantly translate into greater premiums. For instance, the price of components for auto repairs has risen dramatically, resulting in elevated declare payouts and, consequently, greater insurance coverage charges. The general financial local weather, together with fluctuating rates of interest and employment figures, performs a vital position in shaping the insurance coverage market.

State Laws on Automobile Insurance coverage Pricing

Adjustments in state laws concerning automobile insurance coverage pricing can affect charges. Legislative measures specializing in necessary protection necessities, fee caps, or restrictions on insurer practices can influence the affordability of insurance coverage. For example, if a brand new legislation mandates complete protection for all drivers, it could result in a noticeable enhance in general prices.

Comparability of Common Value Will increase to Different States

Whereas particular figures for Michigan’s common price enhance in 2024 will not be but obtainable, a comparability with different states will probably be helpful for contextualizing the scenario. The present development means that Michigan’s price enhance is probably going aligned with the nationwide common, reflecting the complicated interaction of things impacting the insurance coverage market nationwide. For example, in 2023, a number of states skilled vital will increase, doubtlessly mirroring the components affecting Michigan’s charges.

Influence of Accident Frequency and Severity

A direct correlation exists between the frequency and severity of auto accidents and insurance coverage premiums. Areas with greater accident charges typically see considerably greater premiums. For instance, areas with a historical past of high-speed driving or poor street circumstances could face considerably elevated charges. Moreover, the severity of accidents, together with accidents and property injury, instantly impacts the quantity insurers should pay out.

Desk: Premium Will increase Throughout Michigan Cities

Sadly, exact knowledge on premium will increase throughout particular Michigan cities shouldn’t be available at the moment. Nonetheless, future analyses could present such localized knowledge, revealing potential disparities in insurance coverage prices throughout varied areas.

Observe: This desk would ideally embrace knowledge on premium will increase throughout varied Michigan cities, evaluating the price will increase. Nonetheless, this info shouldn’t be available at the moment.

Protection and Coverage Sorts Affected

The 2024 Michigan automobile insurance coverage market anticipates an increase in premiums, and the forms of protection most susceptible to those will increase fluctuate considerably. Understanding these fluctuations is essential for policyholders to make knowledgeable selections and doubtlessly mitigate the influence of rising prices.Coverage choices, comparable to legal responsibility, collision, and complete protection, will probably expertise various levels of premium changes. The components influencing these changes are multifaceted, together with rising declare frequencies and severity, inflationary pressures on restore prices, and the evolving panorama of the insurance coverage trade.

Legal responsibility Protection Susceptibility

Legal responsibility protection, defending policyholders from monetary accountability within the occasion of an accident, is predicted to be a main goal for premium hikes. Elevated accident charges and escalating authorized prices related to claims typically instantly correlate with the worth of legal responsibility protection. Policyholders ought to assess their present legal responsibility limits and contemplate adjusting them if essential to match their monetary capability.

In some circumstances, a rise within the quantity of legal responsibility protection might not be instantly proportional to the premium enhance. For instance, growing the restrict from $25,000 to $50,000 may need a smaller premium enhance than growing the restrict from $50,000 to $100,000.

Collision and Complete Protection Volatility

Collision and complete protection, safeguarding in opposition to injury to the insured automobile from incidents like accidents or vandalism, are additionally anticipated to face worth fluctuations. Restore prices, influenced by materials worth will increase and labor bills, typically contribute to premium hikes. An increase in accidents involving vital automobile injury, comparable to these attributable to excessive climate or uninsured drivers, can push these premiums upwards.

The influence of complete claims, comparable to these stemming from hail or hearth injury, can even have a notable impact on premium changes.

Deductible Influence on Premium Prices

Deductibles play a crucial position in influencing the price of automobile insurance coverage. Greater deductibles sometimes lead to decrease premiums, whereas decrease deductibles usually result in greater premiums. This inverse relationship stems from the insurer’s danger evaluation; greater deductibles signify a policyholder’s willingness to soak up a larger share of potential monetary losses. For example, a policyholder choosing a $1,000 deductible may see a decrease premium in comparison with one with a $500 deductible.

Influence of Rising Claims for Particular Damages

The rise in claims for particular forms of damages, like hail injury, contributes considerably to the rising prices of automobile insurance coverage. That is because of the frequency and severity of such incidents. Climate patterns, particularly in areas vulnerable to hailstorms or extreme climate occasions, instantly affect the variety of claims filed for hail injury. Equally, a rise in claims for vandalism or theft can instantly correlate with a premium enhance in complete protection.

Comparability of Coverage Sorts and Protection Ranges

A comparability of coverage varieties and protection ranges reveals vital variations in premium prices. The kind of automobile, its age, and its make and mannequin are main components in figuring out the premium. For example, insuring a luxurious sports activities automobile may lead to a better premium in comparison with a compact automobile. Moreover, a better degree of complete protection, comparable to together with glass protection, could lead to a larger premium than a primary complete coverage.

Influence of Add-ons on Closing Premium

Add-ons, comparable to roadside help, can have an effect on the ultimate premium. The addition of roadside help, a supplementary protection, typically leads to a noticeable enhance within the general premium. This extra protection enhances the worth of the coverage however could enhance the price. Different add-ons, like rental reimbursement, can also contribute to the general premium price.

| Protection Stage | Potential Premium Change (Instance) |

|---|---|

| Fundamental Legal responsibility | +10-15% |

| Full Protection (Legal responsibility, Collision, Complete) | +12-20% |

| Enhanced Protection with Add-ons | +15-25% |

Client Methods and Actions

Navigating the rising tide of Michigan automobile insurance coverage prices calls for proactive methods. Customers should take a multifaceted strategy to mitigate bills and keep accountable protection. This entails greater than merely accepting elevated premiums; it necessitates knowledgeable comparisons, diligent record-keeping, and a dedication to protected driving practices.

Evaluating Insurance coverage Quotes, Michigan automobile insurance coverage enhance 2024

Thorough comparability of quotes from a number of suppliers is paramount. Customers ought to make the most of on-line comparability instruments and instantly contact insurers to acquire exact quotes. These instruments combination knowledge from varied corporations, enabling a speedy overview of obtainable choices. Immediately contacting insurers supplies a possibility to tailor protection and doubtlessly safe reductions. Crucially, evaluating quotes ought to embody not solely the bottom premium but additionally related charges, deductibles, and protection limits.

This complete analysis permits for knowledgeable selections.

Sustaining a Good Driving Document

A pristine driving file is a cornerstone of accountable insurance coverage administration. Sustaining a clear driving file by means of adherence to visitors legal guidelines and avoidance of accidents is important. Accidents, even minor ones, can considerably influence future premiums. Common automobile upkeep, together with tire strain checks and brake inspections, additional reduces the danger of accidents. This proactive strategy demonstrably impacts insurance coverage prices, as evidenced by historic developments in accident-related premium changes.

Secure Driving Practices

Implementing protected driving practices instantly correlates with decrease insurance coverage premiums. Defensive driving methods, comparable to sustaining protected following distances, avoiding distractions, and adhering to hurry limits, are essential. This proactive strategy is exemplified by the constant lower in insurance coverage claims noticed amongst drivers practising defensive maneuvers. Furthermore, being conscious of climate circumstances, notably throughout antagonistic climate, minimizes the danger of accidents.

Accountable driving habits, bolstered by a acutely aware consciousness of environmental components, instantly translate into decreased premiums.

Recurrently Reviewing and Adjusting Insurance coverage Insurance policies

Common evaluate and adjustment of insurance coverage insurance policies are important. This course of ought to contain evaluating protection wants, evaluating market charges, and adjusting insurance policies accordingly. Coverage adjustments could embrace including or eradicating protection choices, adjusting deductibles, or switching insurers based mostly on essentially the most advantageous phrases. For instance, if a driver’s household scenario adjustments, their insurance coverage wants may evolve, requiring a coverage adjustment.

Reasonably priced Automobile Insurance coverage Assets in Michigan

A large number of assets aids to find reasonably priced automobile insurance coverage in Michigan. On-line comparability instruments, client advocacy teams, and native insurance coverage companies can present invaluable help. These assets assist customers navigate the often-complex insurance coverage market, making certain knowledgeable selections. Using these assets empowers customers to entry quite a lot of quotes and determine cost-effective options.

Michigan Automobile Insurance coverage Reductions

| Low cost Kind | Description |

|---|---|

| Good Scholar Low cost | Provided to drivers with a very good tutorial file. |

| Defensive Driving Programs | Finishing a defensive driving course can scale back premiums. |

| Multi-Coverage Low cost | Combining a number of insurance coverage insurance policies with the identical supplier can yield reductions. |

| Secure Driver Rewards | Sustaining a clear driving file can result in substantial financial savings. |

| Mileage-Based mostly Reductions | Drivers with low mileage typically obtain discounted premiums. |

Reductions are ceaselessly provided by insurers and may considerably scale back premiums. These reductions acknowledge accountable driving conduct and promote proactive measures to scale back accidents. Understanding the supply and specifics of every low cost is essential for cost-effective insurance coverage.

Visible Illustration of Knowledge: Michigan Automobile Insurance coverage Enhance 2024

The escalating prices of automobile insurance coverage in Michigan necessitate a transparent, visible understanding of the contributing components and regional disparities. Efficient visualizations present essential insights into the intricate relationships between varied components influencing premiums, enabling knowledgeable client selections and facilitating a extra complete evaluation of the scenario.Knowledge visualization methods, comparable to bar graphs, pie charts, and line graphs, are essential for comprehending complicated insurance coverage market dynamics.

These visible instruments remodel uncooked knowledge into simply digestible representations, revealing patterns, developments, and correlations which may in any other case stay hidden. This strategy provides a extra accessible and compelling narrative in comparison with purely textual descriptions, making the knowledge extra impactful and memorable for the viewers.

Common Enhance in Automobile Insurance coverage Premiums Throughout Michigan Areas

A bar graph, with areas on the horizontal axis and common premium will increase on the vertical axis, successfully illustrates the regional variations in automobile insurance coverage premium will increase. Every bar’s peak represents the typical enhance in premiums for a selected area in 2024. This visible illustration facilitates comparisons between areas, highlighting the place premium will increase are most pronounced and the place they’re comparatively average.

For example, a noticeably taller bar for the Higher Peninsula might point out a better enhance in premiums in comparison with the Southeast Michigan area.

Proportion Breakdown of Components Influencing Automobile Insurance coverage Prices

A pie chart supplies a transparent breakdown of the contributing components to the rise in automobile insurance coverage prices. Every slice of the pie represents a particular issue, comparable to accident charges, claims frequency, or financial indicators. The scale of every slice instantly correlates to the proportion contribution of that issue to the general enhance. For instance, a big slice representing “accident charges” signifies that this issue is a big driver of the price enhance.

This visible illustration provides a fast overview of the relative significance of every contributing issue.

Development of Automobile Insurance coverage Premium Will increase in Michigan over the Previous 5 Years

A line graph shows the development of automobile insurance coverage premium will increase in Michigan over the previous 5 years. The x-axis represents the years, and the y-axis represents the premium enhance proportion. A steadily upward sloping line signifies a constant rise in premiums, whereas fluctuations or dips within the line present intervals of comparatively steady or lowering premiums. This visualization helps determine long-term developments and potential cyclical patterns.

For instance, a noticeable spike within the line throughout 2022 might correlate with a particular occasion like a serious pure catastrophe.

Correlation between Accident Charges and Insurance coverage Premium Will increase

A scatter plot can visually display the correlation between accident charges and insurance coverage premium will increase. The x-axis represents accident charges (e.g., accidents per 100,000 autos), and the y-axis represents the proportion enhance in premiums. A optimistic correlation can be depicted by a basic upward development within the knowledge factors, the place greater accident charges correspond to greater premium will increase.

This visible illustration would affirm the connection between accident frequency and the necessity to enhance premiums.

Influence of Varied Driving Behaviors on Automobile Insurance coverage Prices

An infographic evaluating driving behaviors and their influence on automobile insurance coverage prices is useful. The infographic might function varied driving behaviors (e.g., rushing, distracted driving, aggressive driving) and the corresponding premium will increase. This infographic would visually talk the potential prices related to dangerous driving habits, encouraging safer driving practices. Examples of such behaviors may very well be aggressive driving resulting in greater accident danger, or a statistically vital correlation between rushing and better insurance coverage premiums.

Impact of Totally different Driver Profiles on Insurance coverage Premiums

A desk illustrating the influence of various driver profiles on insurance coverage premiums is efficient. The desk ought to checklist driver profiles (e.g., younger drivers, senior drivers, drivers with a clear driving file, drivers with prior accidents), and the related premium quantities. This visible comparability helps customers perceive how their particular driver profile impacts their insurance coverage prices. For example, the desk might showcase how younger drivers typically have greater premiums attributable to their greater accident charges.

Comparability of Automobile Insurance coverage Prices for Totally different Car Sorts

An infographic evaluating the price of automobile insurance coverage for various automobile varieties in Michigan is informative. The infographic might show completely different automobile varieties (e.g., sports activities vehicles, SUVs, sedans) and their corresponding common insurance coverage premiums. The visible comparability would help customers in understanding the affect of car kind on insurance coverage prices. For example, a sports activities automobile with its greater accident danger potential, and consequently, greater insurance coverage prices, may very well be highlighted.

Potential Future Tendencies

The panorama of Michigan automobile insurance coverage is poised for transformation, pushed by a confluence of things. Rising applied sciences, evolving laws, and shifting client behaviors are all poised to reshape the trade, influencing pricing fashions and the very nature of protection. Analyzing these developments is essential for each insurance coverage suppliers and customers to navigate the evolving market.Predicting the exact trajectory of future developments is inherently complicated, however cautious consideration of present developments and potential catalysts permits for knowledgeable hypothesis.

The interaction of technological developments, regulatory shifts, and declare patterns will considerably influence the price and availability of insurance coverage in Michigan.

Influence of Rising Applied sciences on Insurance coverage Pricing

The combination of superior applied sciences, comparable to telematics and AI, is altering the connection between drivers and insurers. Telematics techniques, which monitor driving habits and behaviors, provide the potential for customized pricing. Drivers who exhibit protected driving patterns can doubtlessly safe decrease premiums. Conversely, drivers with greater accident danger or unsafe driving behaviors may face elevated premiums.

This strategy, whereas theoretically enhancing danger evaluation, requires sturdy knowledge assortment and moral concerns to keep away from bias and guarantee equity. Examples exist the place comparable applied sciences are utilized in different industries. For instance, using knowledge analytics within the banking sector helps in danger administration and fraud detection.

Impact of Future Laws on the Value of Automobile Insurance coverage in Michigan

Future laws in Michigan might have a big influence on automobile insurance coverage prices. Adjustments in no-fault legal guidelines, revisions to necessary protection necessities, and potential laws on autonomous autos will all contribute to shifting charges. Notably, legislative responses to rising applied sciences will considerably have an effect on the trade. For example, laws governing using autonomous autos in Michigan will have to be thought-about to find out their influence on insurance coverage insurance policies.

Attainable Responses from Insurance coverage Suppliers to Rising Prices

Insurance coverage suppliers could react to rising prices by means of quite a lot of methods. These might embrace implementing extra subtle danger evaluation fashions, growing premiums for high-risk drivers, exploring new income streams by means of partnerships with different industries, or adjusting protection choices to accommodate altering wants. Additional, insurance coverage corporations could search different strategies of decreasing prices, comparable to enhancing claims administration effectivity.

The intention of those changes can be to take care of profitability whereas providing aggressive charges.

Affect of Autonomous Automobiles on Insurance coverage Charges

The rise of autonomous autos presents a novel problem and alternative for the insurance coverage trade. As autonomous autos develop into extra prevalent, their influence on accident charges and legal responsibility points will develop into crucial to assessing danger. The query of who’s liable in accidents involving autonomous autos will have to be addressed by means of laws. This can considerably have an effect on how insurance coverage corporations worth insurance policies.

For instance, the event of autonomous autos raises complicated questions on legal responsibility and insurance coverage protection, requiring insurance coverage corporations to develop new fashions for assessing danger and figuring out pricing constructions.

Potential Adjustments within the Frequency of Claims

The frequency of automobile insurance coverage claims might fluctuate relying on a number of components. Elevated visitors density, adjustments in driving habits, and the affect of rising applied sciences might all have an effect on the chance of accidents and, subsequently, the variety of claims. Moreover, the adoption of autonomous autos could doubtlessly decrease the frequency of sure forms of accidents. The frequency of claims is a vital consider insurance coverage pricing, because it instantly impacts the general price of premiums.

Using superior driver-assistance techniques and autonomous options might doubtlessly scale back the chance of accidents, resulting in a lower within the variety of claims.

Finish of Dialogue

In conclusion, the 2024 Michigan automobile insurance coverage enhance presents a fancy problem for drivers. Understanding the contributing components, assessing your particular protection wants, and implementing good methods will help mitigate the influence in your pockets. The way forward for insurance coverage in Michigan, nevertheless, stays unsure, and drivers ought to put together for potential additional changes.

Frequent Queries

What are the first components driving the rise in 2024?

A number of components contribute to the rise in Michigan automobile insurance coverage premiums, together with elevated accident charges, elevated claims frequency and severity, inflationary pressures, and changes in state laws.

How will completely different coverage varieties be affected?

Legal responsibility, collision, and complete coverages are all more likely to see premium will increase, with the extent various relying on particular person coverage specifics and driving historical past.

Are there reductions obtainable to assist offset the price?

Sure, varied reductions can be found to Michigan drivers, together with these for protected driving information, good scholar standing, and particular automobile varieties. Drivers ought to contact their insurance coverage supplier to discover obtainable reductions.

What actions can I take to mitigate the price enhance?

Customers can examine quotes from a number of insurers, keep a protected driving file, and frequently evaluate their insurance policies to doubtlessly scale back their premiums.