Life insurance coverage peak weight chart is a vital side of figuring out insurance coverage premiums. It supplies a historic overview of how insurers have used bodily attributes to evaluate threat. Nonetheless, these charts have limitations and biases, and fashionable threat evaluation strategies are evolving.

This text delves into the small print of life insurance coverage peak weight charts, exploring the info behind them, their impression on premiums, various evaluation strategies, and the potential position of know-how in shaping the way forward for threat analysis. Understanding these nuances is vital to creating knowledgeable choices about life insurance coverage insurance policies.

Introduction to Life Insurance coverage Peak Weight Charts

Life insurance coverage, an important side of economic planning, usually entails assessing threat to find out premiums. Traditionally, insurers relied on varied components to gauge threat, and peak and weight charts had been a distinguished device. Whereas their use has developed, understanding their position up to now and current is vital to greedy the intricacies of life insurance coverage.Peak and weight charts had been initially used to foretell mortality threat.

The logic behind this was easy: sure bodily attributes would possibly correlate with well being circumstances that might result in untimely demise. These correlations had been usually based mostly on statistical evaluation of huge populations, trying to determine developments between bodily traits and longevity.

Historic Context and Function

Youth insurance coverage corporations used peak and weight charts to categorize people into threat teams. This facilitated the creation of premium constructions, with these deemed greater threat paying greater premiums. The aim was simple: to evaluate threat and worth insurance policies accordingly. These charts had been supposed to streamline the underwriting course of, enabling faster and extra environment friendly analysis of candidates.

Limitations and Potential Biases

Peak and weight charts, whereas as soon as helpful, are usually not an ideal predictor of well being. Vital limitations embody the truth that they do not account for particular person life-style components, corresponding to weight loss program, train, and smoking habits. An individual with a better BMI could be extremely lively and wholesome, whereas somebody with a decrease BMI might need underlying well being points. This lack of individualization can result in vital inaccuracies.Moreover, these charts usually exhibit inherent biases.

As an illustration, they may not precisely replicate the well being standing of people from various backgrounds or ethnicities. The historic knowledge used to create these charts might be influenced by societal components that disproportionately have an effect on sure populations.

Whereas life insurance coverage peak weight charts appear simplistic, their inherent biases usually overshadow their purported accuracy. They continuously fail to account for particular person well being components, making them a questionable metric for assessing threat. That is strikingly just like the inherent assumptions baked into many recipes, like a recipe for apple pie utilizing canned apple pie filling recipe for apple pie using canned apple pie filling , which may drastically alter the ultimate end result relying on the standard of the elements.

In the end, each require a extra nuanced method to actually perceive the complexities concerned.

Utilization in Underwriting

Insurance coverage underwriters use peak and weight data as one element of a broader analysis. Whereas not the only real determinant, it is a issue that is nonetheless thought-about alongside different standards like medical historical past, household historical past, and life-style selections. This complete method goals to supply a extra nuanced evaluation of threat.

Forms of Life Insurance coverage and Premium Affect

Various kinds of life insurance coverage insurance policies react in another way to peak and weight concerns. Time period life insurance coverage, designed for a particular interval, might need barely totally different premium constructions based mostly on threat components. Everlasting life insurance coverage, corresponding to entire life or common life, additionally components in peak and weight, although doubtlessly much less instantly, as they’re designed for long-term protection.

- Time period Life Insurance coverage: Premiums for time period life insurance coverage are sometimes instantly correlated to perceived threat, influenced by components like age, peak, weight, and well being. Larger threat candidates will usually pay greater premiums.

- Everlasting Life Insurance coverage: For everlasting life insurance coverage, peak and weight might play a smaller position in comparison with time period life insurance coverage. Underwriting is extra complete, contemplating a spread of things past bodily attributes. Nonetheless, the preliminary premium quantity would possibly nonetheless be impacted by perceived threat.

Fashionable Traits and Concerns, Life insurance coverage peak weight chart

Fashionable insurance coverage corporations more and more depend on refined actuarial fashions that transcend easy peak and weight charts. These fashions combine a broader vary of well being components, together with genetic predispositions and blood markers, to supply a extra correct and personalised threat evaluation. The aim is to supply a extra correct analysis of an applicant’s long-term well being dangers, moderately than counting on simplified metrics.

Understanding the Knowledge Behind the Charts

Life insurance coverage peak and weight charts are extra than simply arbitrary numbers. They symbolize years of painstaking analysis and knowledge evaluation, aiming to foretell mortality threat. Understanding the components that go into these charts is vital to appreciating their limitations and potential biases, in addition to recognizing their position in pricing insurance policies.These charts are constructed on a basis of statistical fashions, correlating bodily attributes like peak and weight with the chance of demise at varied ages.

This isn’t an ideal science, and it is vital to concentrate on the methodologies and the components that have an effect on the accuracy of those estimations.

Knowledge Assortment and Compilation Strategies

Life insurance coverage corporations depend on huge datasets to create these charts. These datasets are sometimes compiled from a number of sources, together with present insurance coverage data, epidemiological research, and authorities well being surveys. This complete method goals to seize a consultant pattern of the inhabitants. The sheer quantity of information is essential in smoothing out particular person anomalies and figuring out patterns that aren’t instantly obvious in smaller datasets.

Components Thought of in Figuring out Mortality Charges

Mortality charges aren’t merely decided by peak and weight. A mess of things affect the danger of demise. Age is probably the most essential issue. Underlying well being circumstances, smoking habits, household historical past of ailments, and life-style selections additionally play a big position. These are sometimes integrated into extra refined fashions past easy peak and weight correlations.

Affect of Medical Developments and Altering Demographics

Medical developments considerably impression mortality charges. Enhancements in therapies and preventive measures have altered the connection between bodily attributes and lifespan. Altering demographics, corresponding to rising life expectancy and shifts in inhabitants distribution, additionally affect the info used to create these charts. This necessitates steady updates to the charts, to replicate the evolving nature of well being and society.

For instance, the elevated prevalence of sure ailments or the rising charges of weight problems would must be mirrored within the up to date charts.

Correlating Peak, Weight, and Mortality Threat

The correlation between peak, weight, and mortality threat is complicated. Completely different fashions are employed, some easier than others, to determine relationships between these components. Probably the most simple technique would possibly use a statistical mannequin that establishes a relationship between physique mass index (BMI) and mortality threat. Nonetheless, extra superior strategies might account for varied components and supply extra nuanced predictions.

Potential Inaccuracies and Biases in Knowledge Assortment and Evaluation

Knowledge assortment and evaluation are by no means excellent. There’s all the time a possible for inaccuracies and biases. One potential supply of error is the accuracy of the info submitted by people. There might also be choice bias, as people who select to buy life insurance coverage might have totally different traits in comparison with those that do not. Moreover, there could be biases embedded throughout the fashions used to research the info, resulting in skewed outcomes.

It’s essential to concentrate on these limitations and to interpret the outcomes cautiously.

Affect of Peak and Weight on Premiums

Life insurance coverage premiums aren’t a one-size-fits-all determine. Components like your peak and weight play a big position in figuring out the price. Insurance coverage corporations assess these components to calculate the danger related to insuring your life. Understanding how these components affect premiums can assist you make knowledgeable choices about your coverage.Insurance coverage corporations use actuarial knowledge to estimate the chance of demise at totally different ages.

This knowledge, which considers varied components together with peak, weight, and medical historical past, permits them to calculate the suitable premium for every particular person. Peak and weight are simply two parts in a fancy calculation, however they’re vital ones, influencing the danger profile.

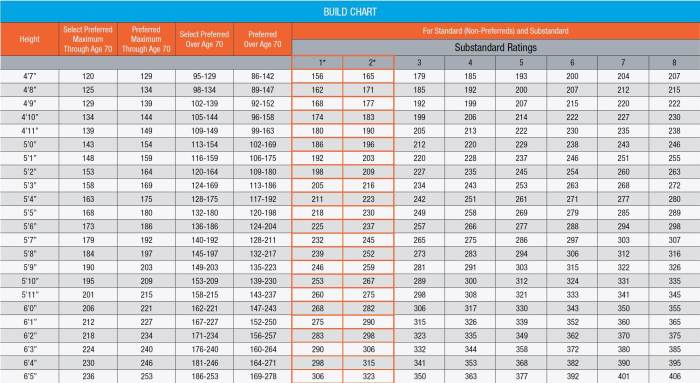

Premium Variations Based mostly on Peak and Weight

Insurance coverage corporations usually categorize people into totally different peak and weight brackets to find out premiums. These classes are normally based mostly on Physique Mass Index (BMI) which is calculated by dividing weight in kilograms by the sq. of peak in meters. This method supplies a standardized method to assess threat throughout a various inhabitants.

| Peak (inches) | Weight (lbs) | BMI Class | Estimated Premium (pattern coverage – $100,000 protection) |

|---|---|---|---|

| 60-64 | 120-150 | Underweight/Wholesome Weight | $150/yr |

| 65-69 | 150-180 | Wholesome Weight | $175/yr |

| 70-74 | 180-210 | Wholesome Weight/Chubby | $200/yr |

| 75-79 | 210-240 | Chubby | $225/yr |

| 80+ | 240+ | Overweight | $250+/yr |

These figures are illustrative and shouldn’t be taken as exact estimates. Precise premiums will range considerably relying on the insurance coverage firm, coverage kind, and different components like age and well being. This desk demonstrates how a better BMI, usually related to elevated well being dangers, correlates with greater premiums.

Changes in Premium Calculation

Insurance coverage corporations alter premiums based mostly on varied components, together with peak and weight. Components corresponding to age, gender, and life-style selections additionally play a big position in calculating premiums. These calculations take into account mortality tables, medical historical past, and different components to foretell the chance of demise throughout the coverage interval.

The precept behind this method is to steadiness the monetary threat of the insurer with the price of the coverage for the insured.

For instance, a 30-year-old male who’s 6 ft tall and weighs 180 kilos will seemingly have a decrease premium than a 60-year-old feminine who’s 5 ft 4 inches tall and weighs 200 kilos. It’s because the danger of demise is usually decrease for youthful, more healthy people.

Coverage Kind and Premium Affect

Various kinds of life insurance coverage insurance policies react in another way to peak and weight variations.

| Coverage Kind | Peak/Weight Affect |

|---|---|

| Time period Life Insurance coverage | Premiums are usually extra delicate to peak/weight variations, particularly for greater threat classes. |

| Entire Life Insurance coverage | Peak/weight has a smaller impression in comparison with time period life insurance coverage. |

| Common Life Insurance coverage | Premiums can fluctuate relying on the coverage’s particular provisions and the insured’s threat profile. |

These variations in premiums replicate the various ranges of threat related to totally different coverage sorts. Premiums for time period life insurance coverage, as an illustration, are extra conscious of adjustments in well being dangers as a result of restricted period of protection. Premiums for entire life insurance coverage are usually much less delicate to those components as a result of longer period and funding parts.

Different Strategies for Threat Evaluation

Life insurance coverage used to rely closely on easy peak and weight charts, however fashionable threat evaluation is much extra refined. Gone are the times of crude estimations; insurers now make use of a multifaceted method that considers a wealth of knowledge past simply your bodily dimensions. This extra nuanced technique permits for a extra correct analysis of your threat profile, resulting in fairer premiums and extra tailor-made insurance policies.Fashionable life insurance coverage corporations use a mix of things to find out the chance of somebody experiencing a well being occasion.

As a substitute of relying solely on static measurements, they incorporate dynamic knowledge reflecting an individual’s present well being state and life-style selections. This enables for a extra complete and personalised method to threat evaluation.

Medical Historical past

Medical historical past is a cornerstone of contemporary threat evaluation. Insurers meticulously look at previous sicknesses, surgical procedures, and any continual circumstances. This contains diagnoses, remedy plans, and restoration occasions. A historical past of circumstances like diabetes, coronary heart illness, or most cancers considerably impacts the danger evaluation. A radical medical historical past permits insurers to raised perceive a person’s well being trajectory and predict future well being wants.

Life-style Components

Past medical historical past, insurers additionally take into account life-style components. Smoking habits, alcohol consumption, and weight loss program are all evaluated. Train routines and total exercise ranges are additionally thought-about, as these play a pivotal position in sustaining good well being. These components are essential as a result of they supply perception into a person’s dedication to their well-being and the proactive steps they take to mitigate well being dangers.

Well being Metrics and Questionnaires

Insurers make use of varied well being metrics to refine threat evaluation. Blood strain, levels of cholesterol, and blood glucose readings, if out there, provide helpful insights. Moreover, complete well being questionnaires are employed to assemble detailed data on life-style, well being habits, and household medical historical past. These questionnaires are designed to gauge threat components in a scientific method, offering a extra granular view of a person’s total well being.

Whereas life insurance coverage peak weight charts usually appear simplistic, their inherent limitations are readily obvious. These charts, continuously used to determine preliminary threat assessments, are sometimes overly generalized, failing to account for particular person well being circumstances. This will result in inaccurate premium calculations, particularly when contemplating properties like life-style selections and household historical past. As an illustration, somebody residing at 131 Lonsdale st Melbourne vic 3000, with a recognized predisposition to sure well being dangers, would possibly face considerably totally different premiums in comparison with a person with comparable metrics however a more healthy profile.

In the end, a nuanced method to assessing threat, incorporating a wider vary of things, is essential for truthful and correct life insurance coverage pricing.

Examples of Well being Questionnaires

Well being questionnaires are essential instruments in underwriting. These detailed varieties delve into varied features of an applicant’s well being. They usually inquire about previous sicknesses, surgical procedures, drugs, and household historical past of sure ailments. Examples of questions would possibly embody: “Have you ever ever been recognized with a continual sickness?” or “Do you often interact in strenuous bodily exercise?”. Such questions allow a extra holistic view of the applicant’s threat profile, going past primary measurements to embody a wider spectrum of things.

Comparability with Conventional Peak/Weight Charts

Conventional peak/weight charts are comparatively easy and cheap. Nonetheless, they provide a restricted view of a person’s total well being. Fashionable strategies, encompassing medical historical past, life-style components, and well being metrics, present a considerably extra complete and correct evaluation of threat. This superior method acknowledges that an individual’s well being is much extra complicated than merely their peak and weight.

Significance of Full Medical Analysis

A whole medical analysis is important for correct insurability dedication. This entails a radical evaluation of medical data, session with medical professionals, and probably bodily examinations. This multifaceted method ensures that the insurance coverage firm has a whole image of the applicant’s well being standing. With no complete analysis, the insurer would possibly miss essential data, doubtlessly resulting in inaccurate threat evaluation and inappropriate premium pricing.

Illustrative Examples of Peak Weight Charts

Life insurance coverage corporations use peak and weight knowledge to evaluate threat and decide premiums. This data is a part of a fancy mannequin, contemplating varied components. The charts are simplified representations of a much wider threat evaluation course of.

Pattern Life Insurance coverage Peak Weight Chart (Age 30-35)

Insurance coverage corporations categorize people based mostly on peak and weight to group comparable threat profiles. This simplification helps in pricing insurance policies. The chart beneath reveals a hypothetical instance for people aged 30-35. Be aware that precise charts utilized by insurers are considerably extra detailed and embody a variety of things past peak and weight.

| Peak (inches) | Weight (lbs) | Premium Class |

|---|---|---|

| 5’4″ – 5’6″ | 120-150 | Commonplace |

| 5’4″ – 5’6″ | 151-170 | Most popular |

| 5’4″ – 5’6″ | 171-190 | Most popular |

| 5’7″ – 5’9″ | 120-150 | Commonplace |

| 5’7″ – 5’9″ | 151-175 | Most popular |

| 5’7″ – 5’9″ | 176-195 | Most popular |

| 5’10” – 6’0″ | 130-160 | Commonplace |

Mortality Charges for Completely different Peak and Weight Classes

This desk illustrates hypothetical mortality charges for a similar age group. Precise charges are much more complicated and embody quite a few different components like life-style selections, medical historical past, and household historical past. The aim is to exhibit how these components are thought-about in calculating premiums.

| Peak/Weight Class | Mortality Charge (per 10,000) |

|---|---|

| Commonplace | 10 |

| Most popular | 7 |

| Wonderful | 4 |

Premium Dedication Utilizing the Chart

The premium class assigned within the first desk is a vital think about figuring out the insurance coverage premium. Insurance coverage corporations use complicated fashions to reach at premiums. These fashions incorporate the mortality charges and different threat components. A ‘Commonplace’ class would possibly lead to a better premium in comparison with a ‘Most popular’ or ‘Wonderful’ class.

Hypothetical Case Research

A 32-year-old particular person, 5’8″ and weighing 165 kilos, falls into the ‘Most popular’ class. This implies their threat of demise is decrease than somebody within the ‘Commonplace’ class, resulting in a doubtlessly decrease premium. Conversely, a 32-year-old, 5’8″ particular person weighing 210 kilos would seemingly be positioned in a better threat class and pay a better premium.

Limitations and Biases of the Chart Examples

Peak and weight charts, as simplified representations, don’t account for particular person well being circumstances, life-style selections, and household historical past. An individual with a excessive BMI however wonderful well being and a household historical past of longevity might need a decrease threat than somebody with a decrease BMI however a household historical past of untimely demise. This simplification inevitably introduces biases. Moreover, these charts do not take into account components like smoking, alcohol consumption, and train habits.

The charts are usually not a definitive measure of threat however a device to group people into broad classes for pricing functions.

Potential Affect of Know-how on Charts

Life insurance coverage premiums are influenced by components like age, well being, and life-style. Historically, peak and weight charts performed a task in threat evaluation. Nonetheless, technological developments are quickly reshaping this panorama, doubtlessly resulting in extra exact and environment friendly strategies for evaluating threat.The evolving world of know-how presents thrilling prospects for refining how life insurance coverage corporations assess threat, shifting past static peak and weight charts.

New knowledge sources and complex algorithms provide the potential to construct a extra correct image of a person’s well being and longevity, leading to extra personalised premiums.

Rising Applied sciences Enhancing Threat Evaluation

Technological developments are introducing modern strategies for threat evaluation. Wearable know-how, like health trackers and smartwatches, gathers complete knowledge on every day exercise, sleep patterns, and coronary heart price variability. These knowledge factors might be built-in into threat fashions to supply a extra holistic view of a person’s well being standing. Moreover, genetic testing and superior medical imaging applied sciences provide insights into a person’s predisposition to sure ailments, permitting for a extra tailor-made threat evaluation.

Incorporating New Knowledge Sources

The incorporation of latest knowledge sources into life insurance coverage threat evaluation is a key development. Think about a situation the place a person’s constant use of well being apps, meticulously monitoring their dietary consumption, sleep patterns, and train habits, is built-in into the danger evaluation course of. This wealth of private well being knowledge, mixed with conventional components like peak and weight, may doubtlessly present a extra correct image of their well being profile and longevity.

The potential exists for personalised threat evaluation fashions to emerge, enabling a extra correct reflection of particular person well being dangers.

Bettering Effectivity and Accuracy

Know-how guarantees to considerably improve the effectivity and accuracy of the life insurance coverage course of. AI-powered programs can analyze huge quantities of information, figuring out patterns and correlations that could be missed by human analysts. This automated course of can speed up the underwriting course of, lowering turnaround occasions for coverage functions. The accuracy of threat evaluation might be improved by integrating these superior instruments, doubtlessly resulting in extra exact premium calculations and a fairer evaluation of threat.

Future Functions of AI in Predicting Mortality Threat

Synthetic intelligence (AI) is poised to play an important position in predicting mortality threat. AI algorithms might be skilled on huge datasets of well being data, figuring out complicated relationships between varied components and mortality charges. As an illustration, an AI mannequin may analyze a person’s genetic make-up, life-style selections, and medical historical past to estimate their future mortality threat with larger precision.

Such predictive fashions may result in extra correct premium calculations, benefitting each the insurer and the policyholder.

Illustrative Instance

Think about a situation the place a person persistently logs their well being knowledge through a wearable gadget. The information, encompassing exercise ranges, sleep high quality, and coronary heart price, is built-in into an AI-powered threat evaluation mannequin. This knowledge, mixed with conventional components like peak, weight, and age, permits the system to generate a extra nuanced threat profile for the person. This might result in extra correct premium calculations, reflecting the person’s precise well being standing extra exactly.

Ultimate Evaluation: Life Insurance coverage Peak Weight Chart

In conclusion, whereas life insurance coverage peak weight charts have been a conventional technique of threat evaluation, fashionable approaches emphasize a holistic analysis of things past simply peak and weight. A whole medical analysis, life-style components, and different well being metrics play a big position in modern threat evaluation. The way forward for these charts seemingly entails a extra nuanced and complete method, incorporating technological developments to create extra correct and environment friendly threat evaluations.

Fashionable Questions

What are the restrictions of utilizing peak and weight to evaluate mortality threat?

Peak and weight charts might be inaccurate as a result of they do not account for particular person variations in physique composition, muscle mass, or underlying well being circumstances. Additionally they doubtlessly perpetuate biases based mostly on components like race or ethnicity.

How do insurance coverage corporations alter premiums based mostly on peak and weight?

Insurance coverage corporations use peak and weight as one issue amongst many of their actuarial fashions. Completely different classes are sometimes created for peak and weight ranges, with premiums rising for these in higher-risk classes. The precise premium adjustment relies on the insurance coverage firm’s methodology.

Are there various strategies for threat evaluation in fashionable life insurance coverage?

Sure, fashionable life insurance coverage more and more makes use of complete medical evaluations, together with life-style components, medical historical past, and well being metrics like blood strain and levels of cholesterol, to evaluate threat extra precisely.

How does know-how affect life insurance coverage peak weight charts?

Know-how is remodeling threat evaluation by permitting for the evaluation of huge quantities of information, together with genetic data and wearable gadget knowledge, to supply extra personalised and correct threat assessments. This may increasingly result in extra exact premium calculations sooner or later.