Letter of cancellation of automobile insurance coverage is essential for ending your protection easily. This complete information walks you thru the method, masking authorized points, procedures, and important data to incorporate in your cancellation letter.

Navigating insurance coverage cancellation could be advanced. This useful resource gives a transparent roadmap, from understanding your rights to avoiding frequent pitfalls. We’ll discover totally different eventualities and supply sensible examples that can assist you confidently finish your automobile insurance coverage coverage.

Understanding the Letter of Cancellation

A letter of cancellation for automobile insurance coverage formally notifies the insurance coverage firm of your intent to discontinue your coverage. This doc is essential for sustaining a transparent document of your actions and ensures a easy transition. Correctly documenting cancellation is important to keep away from any future disputes or misunderstandings.A cancellation letter serves as official communication, confirming your resolution to terminate your automobile insurance coverage protection.

Its significance lies in its skill to obviously Artikel the phrases of the cancellation, stopping ambiguity and potential conflicts. It additionally gives a documented document for each events concerned, the policyholder and the insurance coverage firm.

Definition of a Letter of Cancellation

A letter of cancellation for automobile insurance coverage is a proper written notification despatched to the insurance coverage firm by the policyholder, explicitly stating their want to terminate the prevailing automobile insurance coverage coverage. This letter acts as a legally binding settlement to finish the protection.

Function and Significance of the Letter

This letter is vital for each events concerned. For the policyholder, it confirms the cancellation, prevents future disputes, and ensures a easy transition to a brand new coverage or no coverage in any respect. For the insurance coverage firm, it gives official discover, permitting them to course of the cancellation appropriately, together with any refunds or excellent claims. This readability is crucial for correct record-keeping and monetary administration.

Typical Parts of a Cancellation Letter

A complete cancellation letter contains a number of key components:

- Coverage Data: The letter should clearly determine the insurance coverage coverage being cancelled, together with the coverage quantity, the insured’s title, and the car particulars (e.g., VIN). This ensures the proper coverage is recognized.

- Cancellation Date: The letter ought to explicitly state the date on which the cancellation is efficient. That is vital for establishing the exact termination level.

- Motive for Cancellation (Optionally available): Whereas not all the time required, together with a quick clarification for cancellation can present context. That is elective, however may also help in future reference if wanted.

- Cancellation Request: The letter ought to clearly state the policyholder’s intent to cancel the coverage. It ought to be unequivocal and go away no room for ambiguity.

- Contact Data: The policyholder’s contact data (title, tackle, telephone quantity, and e-mail) have to be included for communication.

- Affirmation of Receipt: A cancellation affirmation from the insurance coverage firm is very advisable, to make sure the cancellation is acquired and processed.

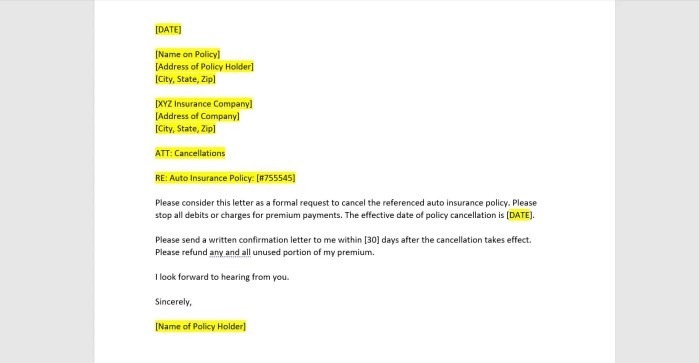

Pattern Format for a Letter of Cancellation, Letter of cancellation of automobile insurance coverage

(Insert pattern letter format right here utilizing a desk)

| Part | Content material Instance |

|---|---|

| Date | October 26, 2023 |

| Policyholder Identify | Jane Doe |

| Coverage Quantity | 123456789 |

| Car Data | 2020 Toyota Camry, VIN: ABC1234567890 |

| Cancellation Date | November 30, 2023 |

| Cancellation Request | I hereby request the cancellation of the above-mentioned coverage, efficient November 30, 2023. |

| Contact Data | Jane Doe, 123 Essential Road, Anytown, CA 91234, 555-1212, janedoe@e-mail.com |

Steps Concerned in Making a Cancellation Letter

Making a cancellation letter entails a number of clear steps:

- Collect crucial data: Accumulate all related coverage particulars, together with the coverage quantity, car data, and cancellation date.

- Draft the letter: Compose a transparent and concise letter outlining the cancellation request, together with all crucial parts.

- Evaluation and proofread: Rigorously overview the letter for any errors in grammar, spelling, or factual data. Guarantee all particulars are correct.

- Ship the letter: Ship the letter through licensed mail to the insurance coverage firm. This gives proof of sending the letter.

- Comply with up (elective): Following up with the insurance coverage firm to substantiate receipt and the processing of the cancellation request is advisable.

Authorized Facets of Cancellation

Cancelling a automobile insurance coverage coverage, whereas seemingly easy, entails particular authorized necessities and implications for each the policyholder and the insurer. Understanding these points is essential for making certain a easy and legally sound cancellation course of. Failure to stick to the prescribed procedures can result in unexpected penalties, starting from penalties to protracted disputes.The authorized framework governing automobile insurance coverage cancellation varies throughout jurisdictions.

Totally different international locations and areas could have distinct rules, impacting the discover intervals, causes for cancellation, and the processes for dispute decision. These variations necessitate cautious consideration of the relevant legal guidelines within the particular jurisdiction.

Authorized Necessities for Cancellation

Understanding the authorized stipulations for cancelling a automobile insurance coverage coverage is important. These necessities typically embody offering written notification, adhering to stipulated discover intervals, and complying with particular circumstances Artikeld within the coverage doc. Failure to fulfill these circumstances may doubtlessly invalidate the cancellation request. Examples embody insufficient discover intervals or non-compliance with particular clauses within the coverage phrases and circumstances.

Implications of Non-Compliance

Non-compliance with the authorized necessities for cancellation can have vital implications. Penalties can vary from the insurer refusing to just accept the cancellation to potential authorized motion, resulting in monetary penalties or the reinstatement of the coverage. These penalties could be particularly extreme if the cancellation is deemed untimely or if the cancellation course of shouldn’t be correctly adopted. For example, failing to offer ample discover can result in the policyholder being held chargeable for excellent premiums.

Comparability of Authorized Frameworks

Totally different jurisdictions have various approaches to automobile insurance coverage cancellation. Some jurisdictions would possibly emphasize shorter discover intervals, whereas others would possibly permit for extra flexibility in sure circumstances. Stricter frameworks typically require extra detailed justifications for cancellation, resulting in a extra rigorous course of. This distinction in authorized frameworks necessitates cautious analysis and consideration of the precise legal guidelines relevant within the jurisdiction the place the coverage was bought.

For instance, a state requiring a 30-day discover interval for cancellation contrasts with a state that enables for rapid cancellation in circumstances of fraud.

Obligations of Policyholder and Insurer

The obligations of each the policyholder and the insurer are outlined by the authorized framework governing automobile insurance coverage cancellation. The policyholder is obligated to comply with the procedures Artikeld within the coverage doc and relevant legal guidelines. The insurer, in flip, is chargeable for acknowledging the cancellation request, addressing any excellent claims, and making certain a easy transition. This entails clear communication and adherence to the established protocols.

For example, the insurer has an obligation to confirm the policyholder’s id and make sure the cancellation is processed accurately.

Potential Disputes and Decision

Disputes associated to automobile insurance coverage cancellation can come up if both occasion fails to adjust to the established procedures. These disputes can contain problems with inadequate discover, non-payment of excellent premiums, or disagreements concerning the validity of the cancellation. Resolving such disputes typically entails negotiation, mediation, or authorized recourse. Examples embody mediation providers offered by business our bodies or, in excessive circumstances, litigation to implement the phrases of the insurance coverage contract.

A pre-dispute decision mechanism typically included in insurance coverage insurance policies may also help expedite the method.

Cancellation Procedures and Timelines

Cancelling your automobile insurance coverage requires adherence to particular procedures and timelines. Understanding these steps is essential for a easy and environment friendly cancellation course of, making certain you keep away from any potential issues or monetary penalties. This part particulars the usual procedures, timelines, and refund processes related to terminating your protection.Cancelling automobile insurance coverage entails a structured method to make sure each events perceive the termination of the settlement.

Correct notification, adherence to deadlines, and correct calculation of excellent premiums are vital points of this course of. The next sections Artikel these key components.

Commonplace Cancellation Procedures

The usual process for cancelling automobile insurance coverage usually entails written notification. Insurers normally require a proper cancellation request in writing, which could be submitted through mail, e-mail, or on-line portals, relying on the insurer’s particular insurance policies. This written communication serves as official affirmation of your intent to terminate the coverage. All the time retain a replica of the cancellation discover on your data.

Cancellation Timelines

Cancellation timelines differ relying on the insurance coverage supplier and the precise coverage phrases. Some insurers could require a discover interval of 30 days, whereas others would possibly permit for rapid cancellation, topic to particular circumstances. A standard follow is a 30-day discover interval, permitting the insurer to course of the cancellation and any excellent claims. Examples of cancellation timelines embody:

- 30-day discover interval for most traditional insurance policies, permitting the insurer ample time to course of the cancellation and any remaining claims.

- Some insurance policies could permit for rapid cancellation, however with potential stipulations relating to any excellent premiums.

- Insurance policies with particular add-ons or riders could have totally different cancellation timelines, typically Artikeld within the coverage paperwork.

Refund Request Course of

Requesting a refund after cancelling automobile insurance coverage entails understanding the phrases of your coverage. In case your coverage permits for a refund, you need to comply with the insurer’s particular directions. Typically, this entails submitting a proper refund request, outlining the explanation for cancellation and any excellent premiums or changes. Guarantee all related paperwork are included, like your coverage particulars and cancellation discover.

Calculating Remaining Premiums

Calculating any remaining insurance coverage premiums entails understanding the coverage’s phrases and any excellent prices. Insurers usually calculate premiums primarily based on the coverage’s period and any relevant add-ons or riders. A standard components for calculating remaining premiums is:

Remaining Premium = (Coverage Length – Days Elapsed)

Day by day Premium Price

For instance, if a coverage was for 12 months and also you cancel after 9 months, the remaining premium calculation would take into account the three months left and the relevant each day fee. Contact your insurance coverage supplier to find out the exact calculation on your coverage.

Notification of Related Events

Notifying related events, such because the Division of Motor Automobiles (DMV), is crucial to make sure compliance with state rules. Failure to inform the DMV of your insurance coverage cancellation may result in issues. Comply with the DMV’s directions for updating your car’s insurance coverage standing. Often, the insurer will deal with this course of, or you may instantly notify the DMV.

That is usually dealt with by the insurer in the course of the cancellation course of, so you need to verify your insurer’s procedures.

Content material for the Cancellation Letter

A transparent and concise cancellation letter is essential for formally ending your automobile insurance coverage coverage. This letter should precisely replicate the policyholder’s intent to terminate the contract and supply all crucial particulars for a easy transition. The letter ought to be well-structured, unambiguous, and simply comprehensible to keep away from any potential disputes.

Important Data within the Cancellation Letter

This part particulars the vital parts wanted in a cancellation letter. Correct inclusion of those components ensures the method is environment friendly and avoids any misunderstandings.

- Coverage Quantity: That is the distinctive identifier on your coverage, important for the insurance coverage firm to find your account. With out this quantity, the corporate could not be capable of course of the cancellation request.

- Policyholder Identify: The total authorized title of the policyholder have to be explicitly said for correct identification.

- Date of Cancellation: A exact date indicating when the policyholder needs the cancellation to take impact is critical. This date is important to determine the efficient termination of the insurance coverage protection.

- Motive for Cancellation: Clearly articulating the explanation for cancellation gives transparency and context to the request. This can be elective however is usually useful in resolving any potential points or for future reference.

- Efficient Date of Cancellation: This clarifies when the policyholder now not needs to be lined beneath the coverage. This date ought to be aligned with the supposed cessation of insurance coverage protection.

- Affirmation Request: Embody an announcement requesting affirmation of cancellation, together with a most well-liked methodology for receiving such affirmation.

Required Data Desk

The desk under Artikels the important data fields to be included within the cancellation letter.

| Discipline | Description |

|---|---|

| Coverage Quantity | Distinctive coverage identification (e.g., 1234567890) |

| Policyholder Identify | Full title of the policyholder (e.g., John Doe) |

| Date of Cancellation | Particular date of cancellation (e.g., October 26, 2024) |

| Motive for Cancellation | Rationalization for cancellation (e.g., Transferring out of state, Discovering a greater fee) |

| Efficient Date of Cancellation | Date on which the insurance coverage protection ceases (e.g., November 1, 2024) |

Stating the Motive for Cancellation

Clearly stating the explanation for cancellation is necessary for record-keeping and future reference. Keep away from imprecise or ambiguous language. Use exact and easy language to obviously articulate the explanation. For instance, as an alternative of “not glad,” use “looking for a greater fee.”

Specifying the Efficient Date of Cancellation

The efficient date of cancellation ought to be clearly specified. That is the date when the insurance coverage protection terminates. The efficient date ought to be at the least a couple of days after the date of the letter, permitting ample time for the corporate to course of the cancellation. For example, if the letter is dated October 26, 2024, the efficient date is likely to be November 1, 2024.

Requesting Cancellation Affirmation

Embody a transparent assertion requesting affirmation of the cancellation. Specify the popular methodology of receiving the affirmation, corresponding to e-mail or mail. This step ensures the policyholder is conscious of the standing of the cancellation request. For instance, “Please affirm the cancellation in writing to [email address] or by mail to [address].”

Insurance coverage Firm Insurance policies: Letter Of Cancellation Of Automotive Insurance coverage

Insurance coverage corporations keep particular insurance policies relating to the cancellation of automobile insurance coverage. These insurance policies dictate the procedures, timelines, and necessities for terminating protection. Understanding these insurance policies is essential for making certain a easy and legally sound cancellation course of. Understanding the precise stipulations of a given insurer can considerably influence the convenience and velocity of the cancellation.Totally different insurers undertake numerous approaches to cancellation, starting from easy on-line portals to extra concerned paperwork processes.

These variations can have an effect on the time required to finalize the cancellation and the related prices.

Comparability of Cancellation Insurance policies

Totally different insurance coverage corporations have various cancellation insurance policies. Some could supply on-line portals for straightforward cancellation, whereas others would possibly require bodily kinds and mail-in procedures. This variance impacts the effectivity of the cancellation course of.

- Some corporations permit cancellations by means of their web sites or cell apps, offering a fast and handy methodology.

- Different corporations would possibly necessitate written notification through mail or licensed mail, adopted by a particular return course of for the cancellation kind.

- Cancellation deadlines, grace intervals, and penalties for early termination differ vastly. Some corporations supply versatile cancellation home windows, whereas others have stricter deadlines, which have to be rigorously reviewed.

Particular Necessities from a Given Insurance coverage Firm

Every insurance coverage firm has distinctive necessities for cancellation. These necessities are Artikeld of their coverage paperwork, which ought to be consulted for particular particulars. These particulars typically embody required notification intervals, causes for cancellation, and related charges or penalties.

- Sure corporations could require a particular kind to be accomplished and returned, together with supporting documentation.

- Coverage phrases and circumstances, normally obtainable on the corporate’s web site, element cancellation insurance policies and procedures, in addition to any related penalties or charges.

- The coverage doc ought to be rigorously reviewed for particular cancellation deadlines and necessities.

Variations in Cancellation Procedures

Cancellation procedures can differ considerably amongst insurance coverage corporations. This variation is usually because of inner operational strategies and on-line platforms. Totally different procedures necessitate totally different timeframes for processing the cancellation.

- Some corporations present an internet portal for initiating cancellation, whereas others could require a telephone name, a mailed letter, or a mix of each.

- The timeframes for processing the cancellation differ and rely upon the chosen methodology and the insurance coverage firm’s inner processes.

- Totally different strategies for cancellation would possibly contain submitting supporting documentation, corresponding to a signed cancellation kind, which have to be reviewed and processed.

Examples of Typical Insurance coverage Firm Cancellation Types

Typical cancellation kinds typically embody fields for the policyholder’s title, coverage quantity, tackle, contact data, and cause for cancellation. The shape will typically specify the required date of cancellation.

“Please notice that the precise format and content material of cancellation kinds could differ amongst insurance coverage corporations.”

Widespread Errors to Keep away from

Cancelling your automobile insurance coverage could be a easy course of, however sure errors can result in issues and sudden penalties. Understanding potential pitfalls and avoiding them will guarantee a easy and hassle-free cancellation.Cautious consideration to element all through the cancellation course of is essential. Errors in communication, missed deadlines, or incomplete paperwork can considerably delay and even forestall the cancellation from taking impact.

Incomplete or Incorrect Types

Errors in filling out the cancellation kinds are a typical supply of issues. Incorrect data or lacking sections can result in delays or rejection of the cancellation request. Double-checking all particulars earlier than submitting the shape is important. For instance, if the policyholder gives an incorrect date of delivery or coverage quantity, the insurance coverage firm would possibly reject the cancellation request.

Guarantee all data, together with dates, coverage numbers, and account particulars, is correct and full.

Failing to Meet Deadlines

Cancellation procedures typically have particular deadlines. Lacking these deadlines may end up in the continuation of the coverage or penalties. Understanding the timeline for cancellation and adhering to the desired deadlines is crucial. Some corporations would possibly require cancellation requests to be acquired by a sure date. Evaluation the precise coverage particulars and cancellation procedures offered by the insurance coverage firm.

Ignoring Essential Communication

The insurance coverage firm would possibly ship notifications or reminders concerning the cancellation course of. Ignoring these communications can result in confusion and missed deadlines. Evaluation all emails and letters acquired from the insurance coverage firm to make sure well timed responses and keep away from any missed steps within the cancellation process. Common communication with the insurance coverage firm, particularly in the course of the cancellation course of, is advisable to keep away from any misunderstandings.

Fee Points

In some circumstances, the cancellation course of would possibly contain excellent funds. Failing to deal with these excellent funds can hinder the cancellation course of. If there are any excellent funds, guarantee these are settled earlier than submitting the cancellation request. This may keep away from any issues and guarantee a easy cancellation. For example, if a policyholder owes excellent premiums, the cancellation won’t be processed till the steadiness is cleared.

Not Acquiring Affirmation

After submitting the cancellation request, it is necessary to acquire affirmation from the insurance coverage firm. Lack of affirmation can result in uncertainty concerning the standing of the cancellation. Request a affirmation letter or e-mail from the insurance coverage firm acknowledging the cancellation request. This affirmation serves as proof that the cancellation has been initiated and is being processed. With out this affirmation, the policyholder is likely to be unsure if the cancellation has been accepted by the insurance coverage firm.

Illustrative Examples

Illustrative examples are essential for understanding the sensible software of automobile insurance coverage cancellation procedures. These examples showcase numerous eventualities, highlighting the required steps and supporting documentation. They supply a tangible reference level for policyholders navigating the cancellation course of.Particular examples display the essential steps concerned in canceling a automobile insurance coverage coverage. These examples are designed to simplify the advanced course of and guarantee policyholders are conscious of their rights and obligations.

Pattern Cancellation Letter

This letter gives a template for a proper automobile insurance coverage cancellation discover. Modify the small print to suit your particular circumstances.“`[Your Name][Your Address][Your Phone Number][Your Email Address][Date][Insurance Company Name][Insurance Company Address]Topic: Cancellation of Automotive Insurance coverage Coverage – [Policy Number]Pricey [Insurance Company Contact Person, if known, otherwise use a general title like “Claims Department”],This letter formally requests the cancellation of my automobile insurance coverage coverage, coverage quantity [Policy Number].

My coverage covers the car [Vehicle Make, Model, Year]. The efficient date of cancellation is [Desired Cancellation Date].Please affirm receipt of this request and advise on the required documentation for processing this cancellation.Sincerely,[Your Signature][Your Typed Name]“`

Cancellation Situations

Understanding the totally different eventualities for canceling automobile insurance coverage insurance policies is important. This desk Artikels frequent conditions and the mandatory actions.

| State of affairs | Motion |

|---|---|

| Coverage Renewal | Cancel coverage earlier than renewal if you happen to now not require protection. |

| Transferring to a New State | Notify the insurer of your tackle change and supposed cancellation of the coverage within the present state. Present proof of residency within the new state. |

| Car Sale | Present the insurance coverage firm with proof of sale, corresponding to a invoice of sale, to terminate protection. |

| Change of Possession | Notify the insurer of the change in possession and supply the mandatory documentation. |

| Policyholder Loss of life | Notify the insurer of the policyholder’s dying and supply required documentation for the coverage to be canceled. |

Detailed Cancellation State of affairs: Car Sale

This state of affairs illustrates the steps concerned in canceling automobile insurance coverage after promoting a car. Correct documentation is crucial for a easy cancellation course of.

1. Receive Proof of Sale

Safe a invoice of sale or different official documentation confirming the car sale. This verifies the change of possession.

2. Notify the Insurance coverage Firm

Contact the insurance coverage firm and inform them of the car sale. Clarify that you simply want to cancel the coverage efficient on a particular date.

3. Present Vital Documentation

Present the insurance coverage firm with a replica of the invoice of sale. Make sure the doc contains important data such because the car’s identification quantity (VIN), date of sale, and the title of the client.

4. Verify Cancellation

Confirm with the insurance coverage firm that your cancellation request has been acquired and processed. Request a affirmation letter outlining the cancellation date and any remaining excellent funds.

5. Return Insurance coverage Paperwork

Return any insurance-related paperwork to the insurance coverage firm.

Various Dispute Decision

Resolving disputes associated to automobile insurance coverage cancellations amicably is usually preferable to prolonged authorized battles. Various Dispute Decision (ADR) strategies supply events an opportunity to barter, mediate, or arbitrate disagreements, doubtlessly saving money and time. These processes could be tailor-made to particular conditions, enabling a extra custom-made decision in comparison with conventional courtroom proceedings.Efficient communication and a willingness to compromise are key to profitable ADR.

Understanding the totally different choices obtainable may also help each the policyholder and the insurance coverage firm discover a mutually agreeable resolution.

Doable Dispute Decision Strategies

A number of strategies exist for resolving disputes relating to insurance coverage cancellation. Negotiation is usually step one, the place each events talk about their positions and attempt to attain a typical floor. Mediation entails a impartial third occasion (mediator) facilitating communication and guiding the events towards a settlement. Arbitration, a extra formal course of, entails a impartial third occasion (arbitrator) making a binding resolution primarily based on the introduced proof.

Arbitration Choices

Arbitration is a proper course of during which an unbiased arbitrator, chosen by the events, hears proof and arguments from each side. This resolution is usually legally binding, just like a courtroom judgment. Several types of arbitration, corresponding to binding and non-binding arbitration, exist. Binding arbitration means the choice is remaining and enforceable, whereas non-binding arbitration permits the events to reject the choice and pursue different choices.

Enchantment Course of

The attraction course of for arbitration choices varies relying on the precise arbitration settlement. If the arbitration settlement features a provision for attraction, the grounds for attraction have to be clearly Artikeld. The attraction course of typically entails a overview of the arbitrator’s resolution by the next authority, usually an appeals panel or courtroom. This overview will typically deal with whether or not the arbitrator acted inside their authority, whether or not there was a major procedural error, or if there was a misunderstanding of the info.

The attraction course of is ruled by the precise guidelines of the arbitration settlement and the related jurisdiction’s legal guidelines.

Final Recap

In conclusion, cancelling your automobile insurance coverage requires cautious planning and adherence to particular procedures. By understanding the authorized necessities, firm insurance policies, and potential disputes, you may guarantee a easy and environment friendly cancellation course of. Keep in mind to meticulously doc all communications and steps to guard your self.

FAQ Defined

What if I do not obtain affirmation of cancellation?

Comply with up with the insurance coverage firm to make sure they acquired your letter. Request a written affirmation to solidify the cancellation.

How lengthy does it take for a cancellation to be efficient?

Cancellation timelines differ by insurance coverage firm. Verify your coverage paperwork or contact your insurer for the precise timeframe.

Can I cancel my automobile insurance coverage if I am transferring out of state?

Sure, you may cancel. Notify the insurance coverage firm of your transfer and the date you intend to depart the state, together with any particulars required by the corporate.

What are the implications of not following correct cancellation procedures?

Failure to comply with procedures may result in continued billing, potential penalties, or difficulties in acquiring a refund. All the time adhere to the Artikeld steps in your coverage and any directions offered by the insurer.