How a lot is hole insurance coverage for a automotive? This Bali-style information dives deep into the world of hole insurance coverage, serving to you perceive its prices and the way it works. We’ll cowl every thing from the fundamentals to the nuances, making certain you are totally geared up to make an knowledgeable determination.

Getting the fitting automotive insurance coverage is vital to clean rides, particularly relating to defending your funding. Hole insurance coverage is a vital component, and this information is your go-to for all issues associated to the prices and specifics of this essential protection.

Defining Hole Insurance coverage

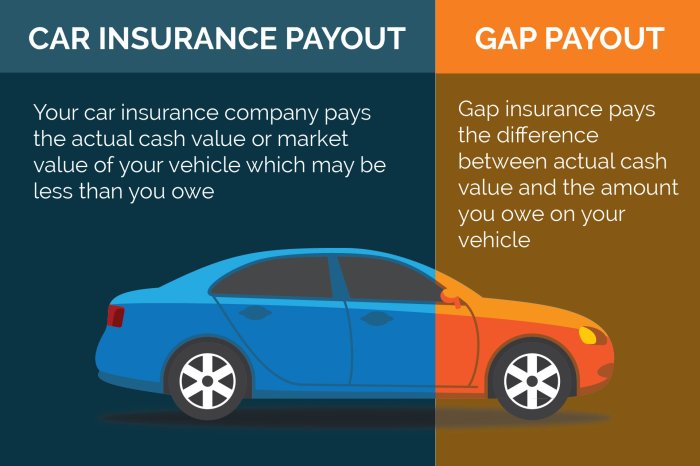

Hole insurance coverage is a specialised kind of auto insurance coverage that protects policyholders from monetary losses if their automobile’s worth falls under the excellent mortgage quantity after an accident or theft. This protection is essential in at the moment’s market the place automobile depreciation can considerably influence the quantity recovered in a declare.This safety fills the “hole” between the precise money worth of the automobile and the quantity nonetheless owed on the mortgage.

Hole insurance coverage is commonly missed however is usually a important monetary safeguard. It is notably essential for people who’ve financed their autos, as commonplace insurance coverage insurance policies could not cowl the total mortgage quantity within the occasion of a complete loss.

Circumstances Requiring Hole Insurance coverage

Hole insurance coverage is most frequently wanted when a automobile’s worth depreciates to some extent the place it’s lower than the quantity owed on a mortgage. This will happen as a result of components like accident injury, theft, and even put on and tear over time. It’s essential to think about {that a} automotive’s market worth can diminish considerably over its lifetime. This depreciation can exceed the quantity of protection supplied by conventional insurance coverage insurance policies, creating a spot that hole insurance coverage is designed to shut.

Hole Insurance coverage vs. Different Automobile Insurance coverage

Hole insurance coverage differs considerably from different types of auto insurance coverage. Whereas complete and collision protection defend in opposition to damages attributable to accidents or different occasions, they usually solely cowl the automobile’s present market worth. Hole insurance coverage, nonetheless, focuses particularly on the distinction between the automobile’s worth and the excellent mortgage quantity, safeguarding in opposition to the potential monetary lack of the mortgage.

A vital distinction is that complete or collision insurance coverage covers the injury to the automotive, whereas hole insurance coverage covers the monetary distinction.

Examples of Hole Insurance coverage Protection

Contemplate a state of affairs the place a automotive, financed for $25,000, is totaled in an accident. The automobile’s present market worth is just $18,000. Conventional insurance coverage would pay out the $18,000. Hole insurance coverage would then cowl the remaining $7,000, the distinction between the mortgage quantity and the payout, making certain the lender is repaid. One other instance is a theft the place a automobile with an excellent mortgage of $20,000 is stolen, and its market worth is $10,000.

The insurance coverage firm would pay out the $10,000, however the hole insurance coverage would pay the remaining $10,000, successfully masking the total mortgage quantity.

Comparability of Hole Insurance coverage and Complete Automobile Insurance coverage

| Function | Hole Insurance coverage | Complete Automobile Insurance coverage |

|---|---|---|

| Protection | Covers the distinction between the automobile’s worth and the excellent mortgage quantity. | Covers injury to the automobile attributable to occasions not associated to collision, similar to vandalism, theft, fireplace, or hail. |

| Focus | Monetary safety for the lender. | Safety for the automobile itself. |

| Triggering Occasion | Whole loss or important injury leading to a worth lower than the mortgage quantity. | Varied occasions inflicting injury not associated to collision. |

| Monetary Accountability | Protects the borrower from the mortgage shortfall. | Covers the price of repairs or substitute of the broken automobile. |

Elements Affecting Hole Insurance coverage Prices

Hole insurance coverage, designed to guard policyholders from monetary loss if their automobile’s worth depreciates under the excellent mortgage quantity, performs a important function in fashionable automotive financing. Understanding the components influencing its value is important for knowledgeable decision-making. The premiums usually are not static; they’re calculated based mostly on a number of variables, making a one-size-fits-all method inaccurate.The price of hole insurance coverage is not solely decided by the automobile’s age or worth; a number of interconnected parts contribute to the ultimate worth.

These components vary from the automobile’s make and mannequin to the mortgage quantity and the insurance coverage firm’s pricing technique. Consequently, comparability buying throughout suppliers is important for locating essentially the most appropriate coverage.

Automobile Traits and Depreciation

Automobile make, mannequin, and 12 months considerably influence hole insurance coverage premiums. Luxurious autos, sports activities vehicles, and high-demand fashions usually expertise larger depreciation charges in comparison with extra widespread fashions. It’s because their resale worth can decline extra quickly. Consequently, the hole between the automobile’s worth and the excellent mortgage quantity is bigger, requiring a better premium to cowl potential losses.

For instance, a high-performance sports activities automotive mannequin, particularly one which has skilled fast market depreciation, would doubtless command a extra substantial hole insurance coverage premium in comparison with a extra commonplace mannequin of the identical 12 months.

Excellent Mortgage Quantity

The excellent mortgage quantity immediately influences the hole insurance coverage value. A bigger mortgage quantity interprets to a larger potential loss if the automobile’s worth depreciates under the excellent mortgage quantity. It’s because the distinction between the mortgage quantity and the automotive’s value is the quantity that the insurance coverage should cowl. This direct relationship implies that a better mortgage quantity typically corresponds to a better hole insurance coverage premium.

Insurance coverage Firm Pricing Fashions

Insurance coverage firms make use of completely different pricing fashions for hole insurance coverage. Some firms would possibly use a standardized share of the mortgage quantity, whereas others would possibly contemplate components just like the automobile’s age, mileage, and restore historical past. This variation can result in important variations in premiums from completely different suppliers. For example, one firm would possibly issue within the automobile’s mileage, recognizing that larger mileage typically correlates with elevated put on and tear, doubtlessly impacting resale worth.

One other firm could use a extra generalized, percentage-based mannequin that doesn’t consider particular traits. Understanding the particular mannequin employed by every insurer is essential for correct value comparisons.

Comparability of Prices from Totally different Suppliers

Hole insurance coverage premiums fluctuate significantly throughout completely different insurance coverage suppliers. Policyholders ought to examine quotes from a number of firms to establish essentially the most aggressive pricing. Elements similar to the corporate’s underwriting standards, market place, and total pricing technique affect the ultimate premium. For instance, a smaller, regional insurer would possibly supply a decrease premium than a big nationwide firm, however this is dependent upon the specifics of the automobile and mortgage.

Mortgage Quantity and Hole Insurance coverage Price Relationship

| Mortgage Quantity (USD) | Estimated Hole Insurance coverage Premium (USD) |

|---|---|

| 15,000 | 150-200 |

| 20,000 | 200-250 |

| 25,000 | 250-300 |

| 30,000 | 300-350 |

| 35,000 | 350-400 |

Word: The above desk supplies a normal estimate. Precise premiums could fluctuate based mostly on different components just like the automobile’s make, mannequin, 12 months, and the particular pricing mannequin of the insurance coverage firm.

Calculating Hole Insurance coverage Protection

Figuring out the exact quantity of hole insurance coverage wanted is essential for shielding in opposition to monetary loss within the occasion of a complete loss or theft of a automobile. This entails a cautious evaluation of the automobile’s worth and the excellent mortgage stability. Understanding this course of permits customers to make knowledgeable choices relating to the suitable protection degree.Calculating hole insurance coverage protection is a simple course of that entails evaluating the automobile’s precise money worth (ACV) to the excellent mortgage stability.

The distinction represents the quantity of protection wanted to make sure the mortgage is totally paid in case of a complete loss. This course of is essential for mitigating potential monetary hardship if the automobile is totaled or stolen, making certain the lender is repaid even when the automobile’s worth is lower than the excellent mortgage.

Figuring out Precise Money Worth

The precise money worth (ACV) of a automobile is its truthful market worth on the time of a complete loss or theft. This worth is influenced by numerous components, together with the automobile’s make, mannequin, 12 months, mileage, situation, and market demand. Figuring out ACV entails assessing the automobile’s present situation and evaluating it to comparable autos available in the market. Skilled value determinations, or on-line valuation instruments utilized by insurance coverage firms, can present a extra correct estimate.

Calculating the Distinction

The core of hole insurance coverage calculation is figuring out the distinction between the automobile’s ACV and the excellent mortgage quantity. This distinction represents the hole that hole insurance coverage will cowl.

Step-by-Step Calculation

- Decide the automobile’s precise money worth (ACV). This worth may be obtained from on-line valuation instruments, skilled value determinations, or from the insurance coverage firm.

- Receive the excellent mortgage quantity. This data is often accessible from the lender.

- Subtract the ACV from the excellent mortgage quantity. The consequence represents the quantity of hole protection wanted.

Instance: If a automobile’s ACV is $15,000 and the excellent mortgage stability is $20,000, the hole protection wanted is $5,000 ($20,000 – $15,000).

Depreciation’s Position, How a lot is hole insurance coverage for a automotive

Depreciation is a key issue influencing the hole insurance coverage calculation. As a automobile ages and mileage will increase, its worth decreases. This depreciation immediately impacts the ACV and, consequently, the hole quantity. A automobile with larger mileage or older mannequin 12 months will doubtless have a decrease ACV in comparison with a more recent mannequin.

Illustrative Desk

| State of affairs | Automobile ACV | Excellent Mortgage Quantity | Hole Protection Wanted |

|---|---|---|---|

| State of affairs 1 | $18,000 | $22,000 | $4,000 |

| State of affairs 2 | $12,500 | $15,000 | $2,500 |

| State of affairs 3 | $25,000 | $30,000 | $5,000 |

Word: These examples are illustrative and will not replicate all potential situations. The precise quantities will fluctuate based mostly on the person automobile and mortgage particulars.

Kinds of Hole Insurance coverage Insurance policies: How A lot Is Hole Insurance coverage For A Automobile

Hole insurance coverage insurance policies, designed to bridge the distinction between the automobile’s precise money worth (ACV) and the excellent mortgage quantity, are available numerous types. Understanding these variations is essential for customers to pick the coverage that most closely fits their monetary wants and automobile circumstances. Totally different insurance policies supply completely different ranges of safety, impacting the premiums and protection scope.{The marketplace} presents a spectrum of hole insurance coverage insurance policies, every tailor-made to handle particular conditions.

These insurance policies usually fluctuate when it comes to their protection scope, exclusions, and the extent to which they defend in opposition to unexpected occasions. Selecting the best coverage is important to make sure complete safety with out pointless prices.

Commonplace Hole Insurance coverage Insurance policies

Commonplace hole insurance coverage insurance policies usually cowl the distinction between the automobile’s ACV and the excellent mortgage stability. This protection is commonly essentially the most fundamental kind, offering a simple resolution for mortgage safety. The coverage usually pays out the distinction in worth if the automobile’s value falls under the mortgage quantity as a result of injury or theft. A serious good thing about this kind is its simplicity and relative affordability.

Nonetheless, the protection is restricted to the said phrases of the coverage, usually excluding conditions past the fundamental loss state of affairs.

Enhanced Hole Insurance coverage Insurance policies

Enhanced hole insurance coverage insurance policies prolong past the usual protection. They steadily embody protection for sure incidents not explicitly coated by commonplace insurance policies, similar to accidents or complete loss. These insurance policies can also supply further protection for an extended interval than the usual insurance policies. Enhanced insurance policies usually include larger premiums, reflecting the expanded safety they supply. Examples of added protection would possibly embody prolonged mechanical failures, or accidents attributable to extreme climate occasions.

This expanded protection may be engaging to these looking for a better degree of safety.

Custom-made Hole Insurance coverage Insurance policies

Custom-made hole insurance coverage insurance policies supply a tailor-made method, permitting for particular inclusions and exclusions. These insurance policies present most flexibility, enabling people to decide on the precise degree of safety wanted. For instance, somebody driving a high-value automobile would possibly select a custom-made coverage with further protection for particular potential dangers. The customization course of permits for premiums to be adjusted based mostly on the particular protection chosen, which may be useful for these on the lookout for a extremely focused resolution.

Nonetheless, custom-made insurance policies may be advanced to grasp, and premiums could also be larger than these of normal or enhanced insurance policies.

Desk of Hole Insurance coverage Coverage Varieties

| Coverage Kind | Protection | Options | Advantages | Drawbacks |

|---|---|---|---|---|

| Commonplace | Distinction between ACV and mortgage stability | Primary, simple | Inexpensive, straightforward to grasp | Restricted protection, could not cowl all loss situations |

| Enhanced | Distinction between ACV and mortgage stability, plus further incidents | Broader protection | Better safety in opposition to numerous losses | Increased premiums, could have exclusions |

| Custom-made | Tailor-made to particular wants | Particular inclusions/exclusions | Most flexibility | Potential complexity, larger premiums |

Evaluating Hole Insurance coverage Suppliers

Navigating the panorama of hole insurance coverage suppliers can really feel like a minefield. Understanding the varied protection choices, pricing methods, and customer support ranges is essential for customers looking for satisfactory safety. This comparability goals to light up the important thing components that distinguish respected suppliers.

Respected Hole Insurance coverage Suppliers

A number of well-established insurance coverage firms and specialised hole insurance coverage suppliers supply complete protection. These suppliers have a monitor report of offering dependable safety to customers. Key gamers available in the market embody main insurance coverage suppliers, and devoted hole insurance coverage specialists. Evaluating their reputations and choices is important.

Protection Choices Provided by Suppliers

Totally different suppliers supply various protection choices. Some could focus on explicit automobile sorts or fashions, whereas others supply broader protection, together with complete safety in opposition to monetary losses. A major issue to think about is the pliability of protection, and the way it may be tailor-made to particular person wants.

Pricing Methods of Varied Suppliers

Hole insurance coverage pricing is influenced by a number of components, together with the automobile’s make, mannequin, and age, and the quantity of protection. Suppliers make use of completely different pricing methods, some providing aggressive charges, whereas others could have extra advanced or tiered pricing constructions. Customers ought to examine not solely the bottom worth but in addition any potential add-ons or supplementary protection choices.

Buyer Service Rankings of Suppliers

Customer support performs a important function within the total satisfaction of a spot insurance coverage coverage. Critiques and rankings from earlier prospects supply worthwhile insights into the standard of help supplied by completely different suppliers. Immediate responses, clear communication, and environment friendly decision of claims are key indicators of a supplier’s dedication to customer support.

Comparative Evaluation of Suppliers

| Supplier | Options | Pricing | Buyer Rankings |

|---|---|---|---|

| Firm A | Provides complete protection for numerous automobile sorts, together with high-value autos. Gives custom-made protection choices. | Aggressive charges, with choices for premium protection and add-ons. | Excessive buyer satisfaction rankings, based mostly on opinions and testimonials. Identified for responsive customer support. |

| Firm B | Makes a speciality of particular automobile sorts and fashions, with detailed protection choices for sure makes and fashions. | Aggressive charges, with concentrate on worth for cash. | Constructive buyer rankings, however barely fewer opinions in comparison with different suppliers. |

| Firm C | Gives commonplace hole insurance coverage protection with versatile choices for numerous automobile sorts. | Decrease charges in comparison with opponents, however fewer add-on choices. | Common buyer satisfaction rankings, with blended opinions. |

This desk summarizes a comparative evaluation of three consultant hole insurance coverage suppliers. Elements like options, pricing, and buyer rankings needs to be rigorously evaluated to decide on the best choice for particular person wants. Extra analysis into every supplier’s particular insurance policies and phrases is inspired. Transparency and readability are essential when making a choice a few monetary product as essential as hole insurance coverage.

Understanding Exclusions and Limitations

Hole insurance coverage, whereas designed to guard in opposition to monetary loss when a automotive’s worth drops under its mortgage quantity, is not a blanket assure. Insurance policies include exclusions and limitations that outline the conditions the place protection will not apply. Understanding these specifics is essential for customers to keep away from disagreeable surprises when making a declare.Hole insurance coverage insurance policies usually exclude sure forms of injury or loss, limiting protection to particular situations.

This will fluctuate considerably between insurers, highlighting the necessity for thorough coverage overview. Realizing what’s excluded is equally essential as figuring out what’s coated.

Frequent Exclusions and Limitations

Hole insurance coverage insurance policies usually don’t cowl losses ensuing from sure occasions. These exclusions usually contain components like the reason for injury and the character of the declare.

- Theft or Vandalism past a sure worth: Some insurance policies may not cowl the total hole if the theft or vandalism ends in a loss exceeding a pre-defined threshold. This threshold varies throughout suppliers. For instance, if a coverage has a $5000 threshold for theft and the loss exceeds that quantity, the coverage may not cowl the remaining stability.

- Accidents involving the insured’s actions: Insurance policies usually exclude protection for losses stemming from the insured’s negligence or reckless driving. This implies if a automotive accident is attributable to the driving force’s actions, hole insurance coverage may not cowl the distinction between the automotive’s worth and the mortgage quantity.

- Harm from pure disasters or acts of God: Some insurance policies explicitly exclude protection for losses ensuing from occasions like floods, earthquakes, or hurricanes. That is because of the excessive variability and potential for widespread claims associated to such occasions.

- Modifications and Alterations: If the automotive’s worth is considerably altered by aftermarket modifications or customizations, the hole protection may not replicate these modifications. For example, if a automobile’s worth is elevated as a result of a high-performance engine, hole insurance coverage could not cowl the total quantity of the elevated mortgage stability.

Circumstances The place Hole Insurance coverage May Not Apply

Hole insurance coverage is just not universally relevant. Sure circumstances can set off coverage exclusions, resulting in a scarcity of protection.

- Unpaid Premiums: If the policyholder fails to keep up constant premium funds, the protection could be suspended or canceled, doubtlessly rendering the insurance coverage ineffective.

- Coverage Lapses: Much like unpaid premiums, if the coverage lapses as a result of non-payment or different causes, protection for future losses is often void.

- Automobile Misuse: If the automobile is used for functions outdoors the coverage’s phrases, protection could also be denied. This will embody utilizing the automobile for industrial functions or exceeding the permitted mileage restrict.

Significance of Reviewing the Coverage Doc Fastidiously

A complete understanding of hole insurance coverage coverage exclusions and limitations is essential. Coverage paperwork usually include particular particulars relating to these parts. Failure to overview these provisions can result in unexpected points throughout a declare.

Potential for Protection Disputes and Decision

Disagreements about protection underneath hole insurance coverage insurance policies can come up. Addressing these points promptly and effectively is vital. Consulting with an insurance coverage skilled or a authorized advisor can present worthwhile steering in resolving disputes. An intensive overview of the coverage doc can stop potential conflicts by clearly outlining protection phrases and limitations.

Potential Exclusions and Limitations Desk

| Exclusion/Limitation Class | Description | Instance |

|---|---|---|

| Reason for Loss | Occasions that set off the hole declare are excluded. | Harm from a automotive accident attributable to the insured’s recklessness. |

| Automobile Situation | Modifications or alterations can have an effect on protection. | A automobile’s worth is inflated by aftermarket modifications. |

| Policyholder Actions | Unpaid premiums or coverage lapses can void protection. | Failure to pay premiums results in protection suspension. |

| Exterior Elements | Losses as a result of pure disasters or acts of God could be excluded. | A flood damages the automobile, however the coverage excludes flood injury. |

Shopping for Hole Insurance coverage

Securing hole insurance coverage entails a simple course of, however understanding the accessible choices and evaluating insurance policies is essential for customers. This significant step ensures that policyholders are adequately protected within the occasion of a complete loss or injury to their automobile.The method of buying hole insurance coverage varies relying on the automobile’s financing methodology and the chosen method. A complete understanding of those nuances is important to creating an knowledgeable determination.

Customers can both buy the protection on the time of financing or as an add-on later. Selecting the best coverage is dependent upon a number of components, together with the automobile’s worth, the excellent mortgage stability, and the coverage supplier’s phrases.

Buying Choices

The supply of hole insurance coverage is influenced by the financing methodology employed. Patrons financing their autos usually have the choice to buy hole insurance coverage as a part of the financing settlement. This bundled method is a typical methodology of buying the protection.

Including Hole Insurance coverage Later

An alternative choice to buying hole insurance coverage throughout the financing course of is so as to add it later as a stand-alone coverage. Many insurance coverage suppliers supply this add-on protection, usually at a barely larger premium in comparison with protection included in a financing bundle. This method permits customers to buy protection after the preliminary buy of the automobile.

Evaluating Insurance policies

Fastidiously evaluating numerous hole insurance coverage insurance policies is important for securing essentially the most appropriate protection. A number of key components affect the price of hole insurance coverage. The automobile’s make, mannequin, and 12 months, in addition to the excellent mortgage stability, immediately have an effect on the premium. It is strongly recommended to acquire quotes from a number of suppliers and examine their phrases and circumstances earlier than making a choice.

Selecting the Proper Coverage

Customers ought to rigorously overview the coverage particulars, together with the protection quantity, exclusions, and limitations. An intensive understanding of the coverage’s specifics is important. Elements like deductibles and ready durations also needs to be thought of.

Step-by-Step Information

- Assess the automobile’s worth and the excellent mortgage stability. This preliminary step permits for a extra correct evaluation of the hole protection wanted.

- Receive quotes from a number of insurance coverage suppliers. Evaluating quotes helps establish the perfect worth for the protection.

- Evaluate the coverage particulars, specializing in protection quantities, exclusions, and limitations. A transparent understanding of the coverage’s nuances is essential.

- Examine the varied coverage choices, similar to buying on the time of financing or including it later. The best choice will rely upon the person’s circumstances and funds.

- Choose the coverage that aligns together with your wants and funds. This significant step ensures the chosen protection adequately protects the buyer.

- Full the mandatory paperwork and make the fee. Following these steps ensures the coverage is formally activated.

How Hole Insurance coverage Works in Totally different Situations

Hole insurance coverage, designed to guard in opposition to monetary losses exceeding the automotive’s depreciated worth, operates otherwise relying on the character of the declare. Its operate turns into essential in numerous situations, from minor accidents to complete losses, making certain policyholders usually are not left with substantial out-of-pocket bills. Understanding these nuances is important for making knowledgeable choices relating to automotive insurance coverage protection.

Accident Situations

Hole insurance coverage steps in when the automotive’s worth drops under the excellent mortgage quantity. That is usually triggered by accidents leading to important injury. If the injury is repairable, the insurance coverage firm will usually cowl the restore prices, however the hole insurance coverage is not going to be triggered. Nonetheless, if the injury exceeds the automotive’s worth, triggering a complete loss, hole insurance coverage turns into considerably extra essential.

Whole Loss Situations

A complete loss happens when the automobile’s injury surpasses its market worth. In such circumstances, the insurance coverage firm will usually pay the policyholder the market worth of the automobile, usually considerably decrease than the quantity owed on the mortgage. Hole insurance coverage steps in to cowl the distinction between the market worth and the excellent mortgage stability, making certain the lender receives the total quantity owed.

Important Harm Situations

When a automobile sustains substantial injury, however is just not deemed a complete loss, the protection differs. The insurance coverage firm would possibly solely cowl the repairs, leaving the policyholder liable for the distinction between the restore prices and the pre-accident worth. On this occasion, hole insurance coverage could not totally cowl the hole between the mortgage stability and the automotive’s depreciated worth. Nonetheless, the hole insurance coverage coverage might help by decreasing the out-of-pocket expense the policyholder incurs.

Examples of Hole Insurance coverage Payouts

Contemplate a state of affairs the place a automotive is concerned in an accident, leading to $20,000 value of harm. The automotive’s pre-accident worth is $25,000, and the excellent mortgage stability is $30,000. If the automotive is deemed a complete loss, the insurance coverage firm pays out the $25,000 market worth. Hole insurance coverage then covers the $5,000 distinction between the $30,000 mortgage stability and the $25,000 payout.

This instance highlights how hole insurance coverage acts as a security internet for the policyholder and the lender in complete loss situations.

Limitations of Hole Insurance coverage

Hole insurance coverage would not cowl each state of affairs. For instance, if a automobile is broken as a result of a pure catastrophe or theft, the extent of protection is dependent upon the particular coverage’s phrases and circumstances. Moreover, some injury situations could not set off a spot declare. For instance, if the automotive is broken in a fender bender and the restore prices are decrease than the automotive’s worth, the hole insurance coverage might not be triggered.

Understanding the constraints of hole insurance coverage is essential for efficient monetary planning.

Conclusive Ideas

So, how a lot is hole insurance coverage to your automotive? All of it is dependent upon numerous components like your automotive’s worth, excellent mortgage quantity, and the insurance coverage supplier. This information has armed you with the data to make your best option to your journey. Now go forth and safe your journey!

Normal Inquiries

What if my automotive is broken however not totaled? Does hole insurance coverage nonetheless apply?

Sure, hole insurance coverage can nonetheless apply in case your automotive is broken, however not totaled. It is dependent upon the specifics of your coverage and the extent of the injury.

Can I purchase hole insurance coverage after I’ve already purchased my automotive?

Sure, you possibly can usually add hole insurance coverage as an add-on protection. Verify together with your insurance coverage supplier for particulars.

What is the distinction between hole insurance coverage and complete automotive insurance coverage?

Hole insurance coverage particularly covers the distinction between your automotive’s worth and your excellent mortgage quantity in case of a complete loss or important injury. Complete insurance coverage covers broader injury sorts.

How do I select the fitting hole insurance coverage supplier?

Examine suppliers based mostly on protection choices, pricing, and buyer opinions. Search for respected firms with monitor report.