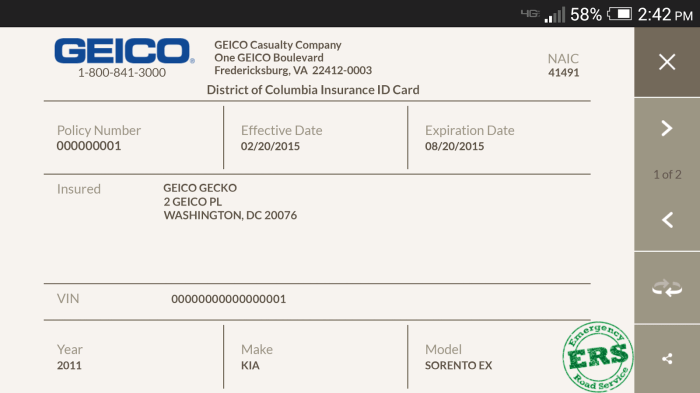

Instance of automotive insurance coverage card – Contoh kartu asuransi mobil, penting banget buat dipake kalau ada masalah di jalan. Jangan sampe ketinggalan, bisa bikin repot. Isi di dalemnya juga lengkap, ada nomor polis, nama yang diasuransikan, dan kontak penting. Pokoknya, kayak surat jalan yang penting banget buat dipake kalau ada masalah sama mobil. Kalau udah ada kartu ini, nggak usah takut kalau ada kejadian di jalan.

Kartu ini kayak identitas mobil kamu di dunia asuransi. Penting banget buat dibawa kalau mau klaim atau ada kejadian di jalan. Ada yang fisik, ada juga yang digital. Mana yang lebih gampang dibawa, itu tergantung selera. Yang penting, kamu punya dan selalu siap pakai.

Overview of Automobile Insurance coverage Playing cards: Instance Of Automobile Insurance coverage Card

A automotive insurance coverage card serves as a vital doc, a testomony to your automobile’s safety below a particular coverage. It acts as a fast reference for important particulars, enabling swift identification and verification of your insurance coverage protection. That is very important in varied conditions, from routine checks to unexpected accidents.The aim of a automotive insurance coverage card is to rapidly present key details about your insurance coverage coverage to authorities or different events concerned in an incident.

This info consists of essential particulars like coverage quantity, insured’s title, contact particulars, and protection specifics. Its perform is basically to make sure clean and environment friendly dealing with of insurance-related issues.

Objective and Operate of a Automobile Insurance coverage Card, Instance of automotive insurance coverage card

A automotive insurance coverage card’s main perform is to readily present verification of your automobile’s insurance coverage protection. That is significantly necessary in case of accidents, claims, or routine checks by authorities. It ensures a swift and correct identification of the policyholder and the small print of the insurance coverage coverage in place.

Typical Data Discovered on a Customary Automobile Insurance coverage Card

The data contained on a regular automotive insurance coverage card is essential for verifying protection. A typical card will show the policyholder’s title, tackle, and make contact with info. It additionally consists of the coverage quantity, the automobile identification quantity (VIN), the efficient dates of the coverage, and particulars of the protection. Moreover, the cardboard often consists of the title and make contact with particulars of the insurance coverage firm.

Completely different Codecs of Automobile Insurance coverage Playing cards

Automobile insurance coverage playing cards will be present in varied codecs. The normal bodily card stays a standard format, available for fast reference. Nevertheless, with the arrival of digital expertise, digital playing cards have turn into more and more prevalent. These digital playing cards will be accessed by way of cell apps or on-line portals, offering simple and prompt entry to coverage particulars.

Significance of Carrying a Legitimate Automobile Insurance coverage Card

Carrying a sound automotive insurance coverage card is of utmost significance. It serves as proof of your automobile’s insurance coverage protection, enabling swift identification and verification of your coverage in case of an accident or different incidents. With out this card, coping with insurance coverage claims or authorities might turn into sophisticated and probably delay the method. It’s, subsequently, essential to all the time carry a sound card or have speedy entry to its digital equal.

Instance of Automobile Insurance coverage Card Data

| Data | Instance |

|---|---|

| Coverage Quantity | 2023-12345678 |

| Insured’s Identify | John Smith |

| Automobile Identification Quantity (VIN) | 1A2B3C4D5E6F7G8H |

| Coverage Efficient Date | October 26, 2023 |

| Coverage Expiration Date | October 26, 2024 |

| Insured’s Handle | 123 Major Avenue, Anytown, CA 91234 |

| Insured’s Cellphone Quantity | 555-1212 |

| Insured’s E mail Handle | john.smith@e mail.com |

| Insurance coverage Firm Identify | Dependable Insurance coverage Firm |

Data on a Automobile Insurance coverage Card

A automotive insurance coverage card serves as a vital doc, appearing as a testomony to the protection supplied. It’s a readily accessible report of your insurance coverage coverage, essential within the occasion of an accident or declare. Understanding its contents is important for navigating the complexities of car insurance coverage.The data contained inside a automotive insurance coverage card just isn’t merely knowledge; it’s a contract, a promise of safety.

It particulars the specifics of your coverage, guaranteeing transparency and accountability. This readability is important for each the insured and the insurance coverage supplier.

Important Particulars on a Automobile Insurance coverage Card

The core parts of a automotive insurance coverage card present vital details about the coverage and its holder. These particulars are important for verification and declare processing. The next info is often current:

- Coverage Quantity: This distinctive identifier instantly hyperlinks the coverage to the insurance coverage firm’s data. It acts as a key to your particular insurance coverage settlement. With out this quantity, the insurance coverage supplier can’t readily entry your coverage particulars.

- Identify of Insured: Correct identification of the policyholder is paramount. This ensures that claims are processed accurately and that the proper particular person receives the advantages of the coverage.

- Contact Particulars: These particulars are essential for communication between the policyholder and the insurance coverage supplier. Immediate communication is important for resolving points and dealing with claims.

Significance of the Coverage Quantity

The coverage quantity is a singular alphanumeric string that identifies your particular automotive insurance coverage coverage. It is vital for a number of causes:

- Coverage Identification: The coverage quantity permits the insurance coverage firm to rapidly and simply find your particular coverage particulars inside their system. That is vital for processing claims and responding to inquiries.

- Verification: When making a declare or contacting the insurance coverage firm, offering the coverage quantity ensures the declare is routed to the proper coverage.

- Monitoring: The coverage quantity permits monitoring of coverage adjustments and updates, guaranteeing that the policyholder is knowledgeable about any modifications.

Significance of Insured’s Identify and Handle

The insured’s title and tackle are basic for correct identification. These particulars affirm the id of the policyholder, which is essential for declare processing and coverage administration.

- Declare Processing: Guaranteeing the proper social gathering receives the advantages of the coverage is essential. Appropriate identification safeguards towards fraud and ensures acceptable declare dealing with.

- Communication: The insured’s tackle and make contact with particulars facilitate environment friendly communication between the policyholder and the insurance coverage firm. That is vital for updates and communication in regards to the coverage.

- Verification: Insurance coverage firms use the tackle to confirm the policyholder’s id and residence, which is necessary for varied causes, together with danger evaluation and coverage administration.

Examples of Contact Data

The contact particulars on a automotive insurance coverage card usually embody:

- Cellphone Quantity: A available telephone quantity permits for fast communication, essential for emergencies and resolving points.

- E mail Handle: An e mail tackle offers a handy and infrequently quicker methodology for communication, significantly for non-urgent issues and coverage updates.

Important Parts of a Automobile Insurance coverage Card

The next desk summarizes important parts discovered on a automotive insurance coverage card:

| Aspect | Description | Instance | Significance |

|---|---|---|---|

| Coverage Quantity | Distinctive identifier for the coverage | 1234567890 | Identifies the particular coverage |

| Identify of Insured | Identify of the policyholder | John Doe | Identifies the policyholder |

| Handle of Insured | Full tackle of the policyholder | 123 Major Avenue, Anytown, CA 12345 | Used for communication and verification |

| Cellphone Quantity | Contact telephone quantity | 555-1212 | Facilitates fast communication |

Digital vs. Bodily Automobile Insurance coverage Playing cards

Brothers and sisters, allow us to delve into the contrasting landscapes of bodily and digital automotive insurance coverage playing cards. Every method presents distinctive benefits and challenges, and understanding these will equip us to make knowledgeable decisions about our automobile’s safety.The selection between a bodily and a digital automotive insurance coverage card hinges on private preferences and priorities. Comfort and safety are paramount concerns.

The digital realm affords unprecedented ease of entry, whereas the tangible nature of the bodily card offers a reassuring sense of tangibility.

Benefits and Disadvantages of Bodily Playing cards

The bodily automotive insurance coverage card, a tangible illustration of our protection, has been a cornerstone of the insurance coverage system for many years. Its tangible nature affords a way of safety for a lot of.

- Tangibility: The bodily card’s tangible presence affords a reassuring feeling of getting the required documentation available. This tangible facet generally is a consolation to some drivers.

- Offline Accessibility: A bodily card permits entry to insurance coverage particulars with out counting on digital units or web connectivity. That is particularly useful in conditions the place web entry is proscribed or unavailable.

- Potential for Enhanced Safety: Some imagine that bodily playing cards, not being simply replicated like digital copies, provide enhanced safety. The bodily nature itself serves as a deterrent to unauthorized entry.

- Disadvantages: Bodily playing cards are inclined to wreck or loss. They are often simply misplaced, requiring substitute and the related administrative hassles. Furthermore, carrying a bodily card will be cumbersome, significantly in conditions the place a number of paperwork should be carried.

Benefits and Disadvantages of Digital Playing cards

In at this time’s digital age, digital automotive insurance coverage playing cards are quickly gaining recognition. They provide vital benefits when it comes to accessibility and comfort.

- Comfort: Digital playing cards will be accessed immediately on smartphones, eliminating the necessity to carry a separate bodily card. This streamlined method saves house and reduces the danger of shedding the cardboard.

- Accessibility: Digital playing cards will be readily accessed through cell apps or on-line portals, making it simple to share the small print with others, akin to roadside help suppliers. This function enhances accessibility.

- Safety Enhancements: Fashionable digital platforms usually incorporate strong safety measures, together with encryption and authentication protocols, to guard towards unauthorized entry. Moreover, digital platforms will be designed to be safe and resilient towards widespread safety threats.

- Disadvantages: Digital playing cards depend on expertise and web connectivity. In areas with poor or restricted connectivity, accessing the cardboard’s info could also be difficult. Additionally, points with the telephone or system itself might render the digital card inaccessible.

Safety Concerns

The safety of each bodily and digital automotive insurance coverage playing cards is a vital concern. Defending private info is paramount.

- Bodily Playing cards: Bodily playing cards ought to be saved securely to forestall loss or theft. One ought to keep away from putting the cardboard in simply accessible areas. Moreover, the cardboard ought to be stored in a safe location to forestall unauthorized entry.

- Digital Playing cards: Defending the system containing the digital card is paramount. Robust passwords and multi-factor authentication are essential safety measures to guard the cardboard’s info. Common software program updates for the system are additionally important to make sure the cardboard’s safety is up-to-date.

Comparability Desk

| Function | Bodily Card | Digital Card |

|---|---|---|

| Accessibility | Requires bodily card; accessible solely when current | Accessible by way of smartphone or on-line portal; all the time accessible |

| Comfort | Much less handy to hold; requires bodily dealing with | Extremely handy; available |

| Safety | Probably much less inclined to digital theft however susceptible to bodily loss | Could be secured with robust passwords and authentication protocols |

| Price | Probably decrease preliminary price however might contain substitute prices | Probably decrease long-term price, however system safety is essential |

| Accessibility in Distant Areas | Accessible in areas with no web connectivity | Depending on web connectivity |

Accessing and Using a Digital Card

Using a digital automotive insurance coverage card entails accessing the designated app or on-line portal.

- Accessing: Comply with the directions supplied by your insurance coverage firm to entry the digital card by way of the cell utility or on-line portal.

- Using: The digital card will present particulars about your insurance coverage protection. Customers can usually share the small print with others.

Utilizing Automobile Insurance coverage Playing cards in Completely different Conditions

A automotive insurance coverage card serves as an important doc, a testomony to the protections you’ve got secured. Understanding its correct use is paramount, particularly in vital conditions. This data empowers you to navigate surprising circumstances with confidence, guaranteeing a clean course of and minimizing potential problems.

Utilizing the Card in Visitors Accidents

Within the occasion of a site visitors accident, your automotive insurance coverage card turns into a vital device. It offers important info to the authorities and the insurance coverage firm concerned, enabling them to correctly assess the scenario and provoke the declare course of. Presenting the cardboard promptly and precisely is vital. This aids within the swift and environment friendly decision of the accident.

Presenting the Card to Authorities

Presenting your insurance coverage card to the police or insurance coverage firm representatives is simple. Guarantee the cardboard is well seen, clearly displaying all crucial particulars. Be ready to reply questions on your coverage and protection. Offering correct info facilitates a clean declare course of. This proactive method streamlines the dealing with of the accident and declare.

Presenting the Card to Insurance coverage Representatives

Equally, presenting the cardboard to insurance coverage representatives entails clear and concise communication. Have the cardboard available and be ready to debate the small print of the accident and your coverage. Thoroughness and readability are key, minimizing potential delays or misunderstandings. This ensures a streamlined claims course of and expedites the decision of the incident.

Essential Conditions Requiring the Card

Having your automotive insurance coverage card available in your automobile is important in quite a few situations. It’s greater than only a doc; it’s a lifeline in instances of want.

A available automotive insurance coverage card minimizes potential problems throughout claims and facilitates swift decision.

- Visitors Accidents: The cardboard is important for rapidly offering info to the police and the concerned insurance coverage firms. With out it, the method could also be delayed or hindered, resulting in elevated stress and issue.

- Property Harm Claims: Whether or not your automotive or one other’s automobile has sustained injury, the insurance coverage card is important to confirm your protection and provoke the declare process.

- Legal responsibility Claims: Should you’re discovered liable for an accident, your insurance coverage card offers the insurance coverage firm with the small print required to course of the legal responsibility declare effectively.

- Roadside Help: In conditions requiring roadside help, the insurance coverage card affords vital info for the towing firm or help service, guaranteeing a clean and immediate decision.

- Automobile Inspections: In some jurisdictions, insurance coverage playing cards is perhaps required throughout automobile inspections or registration processes.

Illustrative Examples of Automobile Insurance coverage Playing cards

A automotive insurance coverage card serves as a tangible illustration of your automobile’s protection, offering essential info in varied conditions. Understanding its format and content material is important for navigating insurance-related issues. This part explores varied examples, from bodily playing cards to digital interfaces, highlighting their key parts.

Pattern Automobile Insurance coverage Card

A normal bodily automotive insurance coverage card usually includes a clear structure, facilitating fast entry to important particulars. Key parts embody the policyholder’s title, coverage quantity, automobile identification particulars (VIN, make, mannequin, 12 months), and the insurance coverage firm’s emblem and make contact with info. It additionally lists the protection varieties and limits, together with legal responsibility, collision, and complete. The cardboard usually features a house for the insured’s signature.

The design is often easy and straightforward to learn, with daring textual content for necessary info.

Digital Automobile Insurance coverage Card Consumer Interface

Digital automotive insurance coverage playing cards provide a user-friendly interface, enhancing accessibility and comfort. The interface generally presents a streamlined show of coverage info. Key info, akin to coverage quantity, automobile particulars, protection particulars, and make contact with info, is commonly organized into sections, with clear headings and labels. The cardboard may embody interactive parts, enabling fast entry to claims procedures, coverage paperwork, or contact help.

Visible cues, akin to color-coding or icons, can spotlight necessary knowledge factors, bettering navigation.

Visible Look of Completely different Varieties of Automobile Insurance coverage Playing cards

Completely different insurance coverage suppliers may make use of distinct visible kinds for his or her playing cards. Some playing cards use an expert, fashionable design with a clear coloration scheme and daring typography. Others may go for a extra conventional design, incorporating parts like firm logos and logos. The colour scheme and design parts ought to be in keeping with the insurance coverage firm’s branding and general id.

The general visible look ought to be visually interesting and straightforward to learn.

Structure and Codecs for Varied Insurance coverage Firms

Insurance coverage firms make use of various layouts and codecs for his or her automotive insurance coverage playing cards. Some playing cards use a table-like format, presenting knowledge in rows and columns. Others might use a extra narrative format, with detailed descriptions of every protection kind. The cardboard’s structure ought to be well-structured and simply navigable. This format permits simple identification of key info.

Structure concerns ought to embody the particular particulars and options of every coverage.

Pattern Automobile Insurance coverage Card Desk

| Part | Data |

|---|---|

| Policyholder Identify | John Smith |

| Coverage Quantity | 1234567890 |

| Automobile Particulars |

|

| Insurance coverage Firm | Dependable Insurance coverage Firm |

| Contact Data | (555) 123-4567 |

| Protection Varieties | Legal responsibility, Collision, Complete |

| Protection Limits | $100,000 Legal responsibility; $100,000 Collision; $50,000 Complete |

Worldwide Automobile Insurance coverage Playing cards

Navigating overseas roads requires cautious consideration of authorized obligations and monetary safeguards. Worldwide automotive insurance coverage playing cards present vital safety for drivers venturing past their dwelling nation. They guarantee compliance with worldwide laws and provide peace of thoughts in unexpected circumstances.Worldwide automotive insurance coverage playing cards are an important device for drivers venturing into unfamiliar territories. They supply the required protection to navigate authorized necessities and mitigate monetary dangers.

They show adherence to worldwide agreements and facilitate clean journey.

Want for Worldwide Automobile Insurance coverage Playing cards

Worldwide automotive insurance coverage playing cards are important for vacationers who drive in overseas international locations. These playing cards guarantee protection aligns with the authorized necessities of the vacation spot nation. With out such protection, drivers danger going through penalties or vital monetary liabilities in case of accidents or injury.

Conditions Requiring an Worldwide Card

A number of situations necessitate the usage of a global automotive insurance coverage card. These embody driving in international locations with stringent authorized necessities for automobile insurance coverage. Moreover, they’re essential for touring to areas the place complete native insurance coverage will not be available or reasonably priced.

Options and Advantages of Worldwide Playing cards

Worldwide automotive insurance coverage playing cards provide varied benefits. They usually present legal responsibility protection for accidents involving different events. Moreover, many insurance policies provide help companies, together with roadside help and emergency medical help. Some playing cards additionally embody protection for damages to the insured automobile. These options make them indispensable for drivers in overseas international locations.

Variations Between Home and Worldwide Playing cards

Home and worldwide automotive insurance coverage playing cards differ in a number of points. Home playing cards usually provide protection throughout the insured’s dwelling nation, whereas worldwide playing cards prolong protection to a number of international locations. This distinction displays the various insurance coverage laws and authorized necessities in numerous jurisdictions. Moreover, the extent of protection and the phrases and situations might differ.

Comparability Desk: Home vs. Worldwide Automobile Insurance coverage Playing cards

| Function | Home Automobile Insurance coverage Card | Worldwide Automobile Insurance coverage Card |

|---|---|---|

| Protection Space | Restricted to the insured’s dwelling nation. | Covers a number of international locations, as specified within the coverage. |

| Authorized Necessities | Often compliant with home laws. | Designed to adjust to worldwide driving and insurance coverage laws in numerous international locations. |

| Phrases and Circumstances | Particular to the home coverage. | Usually consists of provisions to make sure protection complies with worldwide laws and requirements in numerous international locations. |

| Declare Course of | Simplified declare course of throughout the insured’s dwelling nation. | Could contain particular procedures and intermediaries relying on the vacation spot nation. |

| Price | Sometimes extra reasonably priced than worldwide playing cards. | Usually dearer, reflecting the broader scope of protection. |

Epilogue

Jadi, contoh kartu asuransi mobil itu penting banget. Baik yang fisik atau digital, semua penting buat dibawa kalau ada kejadian di jalan. Nanti bisa jadi penyelamat kalau ada masalah. Jangan lupa, simpan dengan baik dan selalu siap pakai. Sekarang udah jelas kan pentingnya contoh kartu asuransi mobil ini?

Semoga informasi ini bermanfaat!

Useful Solutions

Apa yang harus dilakukan jika kartu asuransi mobil hilang?

Segera hubungi perusahaan asuransi untuk membuat penggantian atau melaporkan kehilangan. Jangan sampai kamu kelabakan kalau ada kejadian.

Apakah kartu asuransi mobil bisa digunakan di luar negeri?

Tentu saja, ada kartu asuransi mobil khusus buat luar negeri. Ini penting kalau kamu mau bawa mobil ke luar negeri. Cek dulu ya sama perusahaan asuransi kamu.

Bagaimana cara menyimpan kartu asuransi mobil agar mudah ditemukan?

Simpan di tempat yang mudah dijangkau di dalam mobil. Misalnya di dashboard atau di glove compartment. Jangan sampai tertimbun sama barang lain.

Apakah kartu asuransi mobil perlu dicetak ulang jika ada perubahan knowledge?

Biasanya kartu asuransi mobil akan diperbarui jika ada perubahan knowledge. Hubungi perusahaan asuransi untuk memastikan prosesnya.