Does medical health insurance cowl automotive accident accidents? This important query typically leaves people bewildered, navigating a posh internet of insurance policies and procedures. Understanding the nuances of protection, exclusions, and the claims course of is important for these concerned in a automotive accident. This complete information will dissect the intricacies of medical health insurance and automotive accident accidents, empowering you with the information wanted to confidently navigate the often-confusing panorama of insurance coverage claims.

We are going to discover the varied sorts of medical health insurance plans, analyzing their particular protection for automotive accident-related accidents. We may even delve into potential exclusions and limitations, outlining the elements that may affect protection selections. Finally, this information will present a transparent roadmap for understanding the insurance coverage claims course of and in the end acquiring the medical care you deserve.

Protection Scope

Understanding your medical health insurance protection for automotive accident accidents is essential for monetary preparedness. This data empowers you to navigate the medical course of with readability and confidence, making certain you obtain the required care with out undue monetary stress. Insurance coverage insurance policies are designed to offer a security internet, however the specifics of protection can fluctuate considerably.Complete understanding of your coverage’s phrases and circumstances is paramount.

This data is your defend towards potential monetary burdens and means that you can make knowledgeable selections relating to your healthcare. This part delves into the nuances of assorted medical health insurance plans and their implications for accident-related medical bills.

Varieties of Well being Insurance coverage Plans and Their Protection

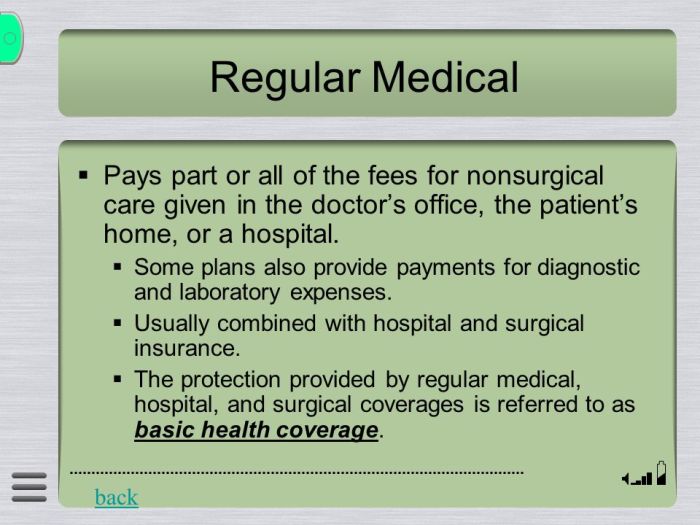

Medical insurance plans fluctuate of their advantages and limitations. The most typical sorts embody fundamental, complete, and high-deductible plans. Every plan presents totally different ranges of protection for accident-related accidents.

Typical Protection for Completely different Medical Bills

The extent of protection for various medical bills can differ considerably. Hospital stays, physician visits, surgical procedures, and rehabilitation therapies could have various levels of protection based mostly on the chosen plan. Understanding the specifics of your plan is essential for navigating these bills.

Function of Deductibles, Co-pays, and Co-insurance

Deductibles, co-pays, and co-insurance are essential elements in figuring out out-of-pocket bills. Deductibles symbolize the quantity it’s essential to pay earlier than insurance coverage begins overlaying prices. Co-pays are fastened quantities you pay for particular companies (like physician visits), and co-insurance is a proportion of the medical invoice you pay. Understanding these parts permits for reasonable monetary planning.

Desk of Protection Varieties and Limitations

| Protection Kind | Typical Protection | Limitations | Examples |

|---|---|---|---|

| Primary | Covers important medical companies akin to emergency room visits, hospital stays, and doctor companies. Prescribed drugs are normally coated, however the extent of protection will depend on the coverage. | Restricted protection for preventative care, specialised procedures, and rehabilitation. Potential for prime out-of-pocket bills as a consequence of deductibles, co-pays, and co-insurance. | A affected person with a fundamental plan may need restricted protection for bodily remedy after a automotive accident, requiring vital out-of-pocket funds. |

| Complete | Supplies broader protection than fundamental plans, together with preventative care, specialised procedures, and a wider vary of medical companies. Rehabilitation companies and various therapies could also be included. | Nonetheless topic to deductibles, co-pays, and co-insurance. Protection for sure therapies or procedures could be capped or have particular limitations. | A complete plan would possibly cowl numerous therapies, together with acupuncture and therapeutic massage, for post-accident restoration, however the specifics depend upon the coverage’s particulars. |

| Excessive-Deductible Well being Plan (HDHP) | Requires the next deductible than different plans. Usually paired with a Well being Financial savings Account (HSA) to assist handle out-of-pocket bills. Sometimes gives a broader vary of advantages as soon as the deductible is met. | Excessive out-of-pocket bills throughout the preliminary levels of remedy. The plan’s advantages could be restricted if the deductible hasn’t been met. Understanding the plan’s most out-of-pocket prices is essential. | An individual with an HDHP would possibly face vital out-of-pocket prices for the preliminary medical care after a automotive accident. Nevertheless, as soon as the deductible is met, their protection will enhance. |

Exclusions and Limitations

Understanding the superb print of your medical health insurance coverage relating to automotive accident accidents is essential. Whereas insurance coverage goals to assist you throughout difficult instances, figuring out the potential limitations will help you put together and navigate the method extra successfully. This part highlights widespread exclusions and limitations, equipping you with the information to anticipate potential roadblocks.

Frequent Exclusions and Limitations

Medical insurance insurance policies, whereas designed to supply complete protection, typically comprise particular exclusions and limitations. These provisions outline conditions the place protection could be decreased or denied fully, notably regarding automotive accident accidents. Understanding these exclusions and limitations will help you make knowledgeable selections about your healthcare decisions.

Pre-existing Situations

Pre-existing circumstances can considerably affect protection for accident-related accidents. A pre-existing situation is a medical subject that existed earlier than the accident, and its affect on protection varies extensively by insurance coverage coverage. Some insurance policies could not cowl the remedy of pre-existing circumstances, even when aggravated or worsened by the accident. Others could solely cowl the remedy of the accident-related damage itself, not the pre-existing situation.

| Exclusion Class | Description | Examples | Impression |

|---|---|---|---|

| Pre-existing Situations | Situations current earlier than the accident, even when aggravated by it. | Continual again ache, diabetes, hypertension, prior knee surgical procedure. | Protection could also be restricted or excluded, probably solely overlaying the accident-related damage, not the pre-existing situation. |

| Particular Procedures | Sure medical procedures or therapies won’t be coated. | Beauty surgical procedure, experimental therapies, various therapies (with out prior approval). | You would possibly must discover different choices or think about further bills. |

| Limitations on Therapy | Limits on the period or scope of remedy for sure accidents. | Particular variety of bodily remedy periods, most hospital keep. | You would possibly must discover out-of-pocket bills or think about various choices. |

| Exclusions for Non-Important Providers | Providers not thought of medically essential for the remedy of the damage won’t be coated. | Pointless treatment, therapies exceeding beneficial pointers, pointless diagnostic assessments. | You could want to debate the need of the service together with your doctor. |

Conditions The place Protection May Be Denied or Decreased

Protection could be denied or decreased in numerous conditions, akin to when the accident was deemed to be brought on by the insured’s reckless conduct, or when the remedy exceeds the pre-defined limits set by the insurance coverage coverage. Additionally, if the damage wasn’t instantly associated to the accident or if the remedy falls outdoors the scope of essential care.

Examples of Pre-existing Situations Impacting Protection

An individual with a historical past of power again ache who experiences a herniated disc in a automotive accident would possibly discover that solely the remedy instantly associated to the herniated disc (ensuing from the accident) is roofed. The continued remedy for the pre-existing again ache could be excluded. Equally, a diabetic particular person experiencing an accident-related leg fracture would possibly discover that the remedy for the fracture is roofed, however the ongoing administration of their diabetes isn’t.

These are simply examples, and the particular particulars fluctuate tremendously between insurance policies and conditions.

Components Affecting Protection

Understanding how your medical health insurance responds to automotive accident accidents is essential. This part delves into the intricate elements that affect protection selections, empowering you to navigate this complicated course of with higher confidence. Insurance coverage protection is not a easy sure or no; it is a nuanced analysis contemplating numerous parts.

Driver’s Fault and Accident Severity

The extent of accidents and the related medical bills instantly correlate to the severity of the accident. A minor fender bender will seemingly lead to minimal protection in comparison with a high-impact collision inflicting extreme accidents. Insurance coverage corporations meticulously assess the accident’s severity based mostly on elements like affect pressure, car harm, and eyewitness accounts. Moreover, figuring out the motive force’s fault is a important part in figuring out who bears accountability for the accident-related bills.

A driver discovered at fault is extra prone to be chargeable for paying the injured occasion’s medical bills, and their insurance coverage firm will seemingly deal with nearly all of the claims.

Injured Social gathering’s Function within the Accident

The injured occasion’s function within the accident considerably impacts insurance coverage protection. Contributory negligence legal guidelines, current in some jurisdictions, could scale back or get rid of protection if the injured occasion’s actions contributed to the accident. As an example, if a driver ran a pink mild and was injured, the extent of protection could be diminished based mostly on the diploma to which their actions had been an element within the accident.

At-Fault vs. No-Fault Programs

At-fault insurance coverage techniques maintain the motive force chargeable for the accident chargeable for damages. The injured occasion recordsdata a declare with the at-fault driver’s insurance coverage firm. Conversely, no-fault techniques compensate injured events no matter who was at fault. This method typically gives sooner declare processing and decreased litigation. Nevertheless, the quantity of compensation could also be capped in some circumstances.

Understanding the system in place in your space is significant for navigating the claims course of.

Varieties of Insurance coverage Protection

Several types of insurance coverage insurance policies provide various protection ranges. Private Harm Safety (PIP) protection usually covers medical bills no matter fault, whereas medical funds protection focuses solely on the injured occasion’s medical payments. Understanding the particular provisions of your coverage is essential for correct expectations. Evaluating and contrasting these insurance policies is important for figuring out essentially the most appropriate protection to your wants.

Roles of Completely different Events

The insurance coverage firm performs an important function in evaluating claims, figuring out protection, and processing funds. The injured occasion is chargeable for reporting the accident and initiating the declare course of. The at-fault occasion, or their insurance coverage firm, is accountable for overlaying damages if discovered liable. All events concerned have a definite function in making certain a clean and environment friendly declare course of.

Flowchart of Protection Dedication, Does medical health insurance cowl automotive accident accidents

| Step | Motion | Social gathering Concerned |

|---|---|---|

| 1 | Accident Happens | All events concerned |

| 2 | Report the accident | Injured occasion |

| 3 | Assess the severity of the accident and determine the at-fault occasion. | Insurance coverage firm, regulation enforcement |

| 4 | Decide the sort and extent of accidents. | Medical professionals, insurance coverage adjuster |

| 5 | Consider protection based mostly on the coverage provisions. | Insurance coverage firm |

| 6 | Course of claims and make funds. | Insurance coverage firm |

This flowchart illustrates the overall strategy of figuring out protection, however particular steps and necessities could fluctuate relying on the jurisdiction and coverage specifics.

Insurance coverage Claims Course of

Navigating the insurance coverage claims course of after a automotive accident can really feel overwhelming. Nevertheless, understanding the steps concerned empowers you to successfully search compensation to your accidents and related bills. This part will present an in depth roadmap for submitting a declare, highlighting essential steps and potential challenges. Keep in mind, a well-structured and well timed declare considerably will increase your possibilities of a constructive end result.

Submitting the Declare

Submitting an insurance coverage declare is an important first step. This entails contacting your individual insurance coverage firm and the at-fault occasion’s insurance coverage firm, if relevant. It is essential to doc each interplay with each events. It is best to promptly report the accident to your insurer, offering particulars just like the date, time, location, and an outline of the accident. Acquire copies of all police stories, witness statements, and medical data.

This preliminary step establishes a proper file of the incident and your declare.

Documentation Necessities

Complete documentation is significant within the insurance coverage claims course of. This encompasses a spread of supplies that substantiate your declare. Important paperwork typically embody medical payments, receipts for bills, and pictures of the accident scene. Copies of police stories, witness statements, and medical data are additionally essential. Sustaining detailed data of all bills, together with misplaced wages, medical prices, and ache and struggling, strengthens your declare.

Significance of Well timed Reporting and Correct Documentation

Immediate reporting and correct documentation are paramount to a profitable declare. Delays in reporting or inaccuracies in documentation can negatively affect your declare. The earlier you report the accident and supply full documentation, the extra seemingly your declare can be processed effectively. Insurance coverage corporations typically have strict deadlines for submitting claims, so adherence to those timelines is essential.

Frequent Challenges within the Claims Course of

Navigating the claims course of can current numerous challenges. These embody coping with insurance coverage firm representatives who could attempt to reduce the severity of your accidents or disputes over legal responsibility. Understanding your rights and actively speaking your wants all through the method is essential to beat these challenges. Think about in search of authorized counsel should you encounter vital obstacles.

Steps Concerned in Submitting a Declare

- Report the accident: Instantly contact your individual insurance coverage firm and, if relevant, the at-fault occasion’s insurance coverage firm. Present them with the required particulars, together with date, time, location, and an outline of the incident.

- Collect documentation: Accumulate all related documentation, akin to medical payments, receipts, police stories, witness statements, and photographs of the accident scene. This consists of data of misplaced wages, ache and struggling, and every other associated bills.

- Submit the declare: Full and submit the required declare types, offering all requested data and documentation to your insurance coverage firm. Make sure to observe all their directions fastidiously.

- Comply with up: Recurrently observe up together with your insurance coverage firm to inquire concerning the standing of your declare and deal with any questions or issues they could have. Preserve a transparent file of all communication.

- Negotiate if essential: If there are disputes about legal responsibility or the extent of your accidents, be ready to barter with the insurance coverage firm. If essential, search authorized recommendation from an legal professional.

- Search authorized counsel if wanted: Should you encounter vital challenges or disputes, in search of authorized illustration can present steering and assist in navigating the claims course of.

Instance of Documentation Required

| Class | Examples |

|---|---|

| Medical Data | Physician’s notes, hospital payments, X-rays, MRIs, bodily remedy data |

| Monetary Data | Pay stubs, tax returns, receipts for medical bills, misplaced wages documentation |

| Accident-related Proof | Police stories, witness statements, pictures of the accident scene, harm to autos |

Preventive Measures

Embarking on a journey in direction of safer roads requires a proactive strategy. By understanding and implementing preventive measures, you considerably scale back the danger of accidents and the potential for accidents. These steps are usually not nearly avoiding hurt; they’re about cultivating a tradition of security that advantages each driver and highway consumer.Taking proactive steps to forestall automotive accidents is not nearly avoiding bother; it is about fostering a safer driving atmosphere for everybody.

These measures aren’t merely suggestions; they’re important parts of accountable driving. Understanding their significance is essential to mitigating the danger of accidents and defending lives.

Seatbelt Utilization

Correct seatbelt utilization is paramount in mitigating the severity of accidents within the occasion of a collision. Seatbelts act as a important security internet, considerably decreasing the danger of ejection from the car and the chance of significant accidents. Research constantly reveal a powerful correlation between seatbelt use and decreased damage charges.

- All the time fasten your seatbelt earlier than beginning your car.

- Guarantee all passengers, together with kids, are correctly restrained utilizing applicable youngster security seats or seatbelts.

- By no means regulate your seatbelt whereas the car is in movement.

Adherence to Site visitors Legal guidelines

Strict adherence to site visitors legal guidelines is a cornerstone of accident prevention. Legal guidelines are established to information protected and accountable conduct on the highway. Following these guidelines not solely protects your self but in addition these round you. A tradition of law-abiding driving contributes considerably to a safer driving atmosphere.

- Obey all pace limits, particularly in areas with greater site visitors density.

- Yield to pedestrians and different autos as required by site visitors alerts and legal guidelines.

- Keep away from distracted driving, together with utilizing cell phones or different units.

- By no means drive drunk or medicine.

Protected Driving Setting

Sustaining a protected driving atmosphere entails a proactive strategy to car upkeep and consciousness of surrounding circumstances. A well-maintained car is extra prone to carry out reliably, decreasing the potential for mechanical failures that may result in accidents.

- Recurrently examine your car for any mechanical points, akin to tire stress, brake operate, and lights.

- Guarantee your car is correctly geared up with important security options, akin to functioning airbags and anti-lock brakes.

- Drive with consciousness of your environment, together with climate circumstances and site visitors patterns.

- Give your self enough time to react to potential hazards.

Protected Driving Practices

Training protected driving habits goes past merely adhering to the regulation. It entails a proactive strategy to anticipating potential hazards and responding to them successfully.

- Preserve a protected following distance from the car in entrance of you, particularly in difficult climate circumstances.

- Be ready for sudden stops or adjustments in site visitors stream.

- Use your mirrors and test your blind spots usually.

- Hold your eyes targeted on the highway and never in your telephone or different distractions.

Visible Information for Protected Driving Practices

(Visible information not included as requested)A visible information to protected driving practices can be an infographic showcasing numerous eventualities, highlighting the right responses to totally different driving conditions. This might embody illustrations of protected following distances, visible representations of blind spots, and examples of correct lane adjustments.

Abstract

In conclusion, navigating the world of medical health insurance protection for automotive accident accidents requires cautious consideration of particular person plans, potential exclusions, and the nuances of the claims course of. This information has illuminated the complexities concerned, empowering readers with the information to proactively handle their rights and duties. Keep in mind, in search of skilled recommendation is all the time beneficial for personalised steering.

Q&A: Does Well being Insurance coverage Cowl Automobile Accident Accidents

Can a pre-existing situation have an effect on protection for accidents sustained in a automotive accident?

Sure, pre-existing circumstances can typically have an effect on protection. Insurance coverage corporations could deny or scale back protection in the event that they deem the situation instantly contributed to the damage. That is typically a posh subject {and professional} authorized recommendation is beneficial.

What’s the function of the at-fault occasion in figuring out protection?

The at-fault occasion’s insurance coverage usually handles the medical bills of the injured occasion. If the injured occasion is deemed at fault, their very own insurance coverage could cowl a portion of the bills, relying on the particular coverage.

What documentation is usually required for submitting an insurance coverage declare?

Documentation necessities fluctuate however typically embody medical data, police stories, witness statements, and every other related data pertaining to the accident and accidents.

How can I reduce the danger of accidents in a automotive accident?

Adhering to site visitors legal guidelines, carrying seatbelts, and sustaining a protected driving atmosphere are essential preventive measures. Common car upkeep and defensive driving methods can considerably scale back the danger of accidents.