Low cost South Dakota automobile insurance coverage is a vital consideration for drivers within the state. Navigating the assorted elements impacting premiums and understanding obtainable reductions can considerably decrease your prices. This complete information supplies insights into the South Dakota automobile insurance coverage market, serving to you discover the perfect offers and make sure you’re adequately protected.

We’ll discover the frequent varieties of protection, evaluate insurance coverage suppliers, and focus on methods for negotiating decrease charges. Understanding the state’s laws and your driving report’s impression on premiums is essential to securing inexpensive protection. Discover ways to maximize financial savings and make knowledgeable selections to guard your funds.

Overview of South Dakota Automotive Insurance coverage

South Dakota’s automobile insurance coverage market is a little bit of a blended bag, mate. Premiums can range wildly relying on just a few key elements, however usually, yow will discover some respectable offers if the place to look. The charges are influenced by issues like your driving historical past, the kind of automobile you drive, and even the place you reside throughout the state.

Understanding these elements is essential to getting the very best worth.

Components Influencing Automotive Insurance coverage Premiums in South Dakota

South Dakota’s automobile insurance coverage premiums are affected by a variety of parts. These embrace the driving force’s age and historical past, the automobile’s make and mannequin (together with its security options), the situation of residence, and even the kind of car use (e.g., commuting vs. weekend driving). Claims historical past additionally performs an enormous position, with a historical past of accidents or violations resulting in larger premiums.

Frequent Kinds of Automotive Insurance coverage Protection in South Dakota

South Dakota, like many states, mandates sure minimal protection ranges for legal responsibility insurance coverage. Nonetheless, drivers typically go for extra protection to guard themselves and their belongings. The most typical varieties of protection embrace legal responsibility insurance coverage (protecting injury to others), collision protection (defending your car towards injury from an accident), and complete protection (protecting damages from occasions aside from accidents, equivalent to vandalism or climate).

Including uninsured/underinsured motorist protection can also be essential for additional safety if somebody with out adequate insurance coverage causes an accident.

Common Automotive Insurance coverage Charges in South Dakota

| Protection Kind | Common Fee (Instance – Estimated) |

|---|---|

| Legal responsibility Solely (Minimal Protection) | $800 – $1,200 per 12 months |

| Legal responsibility + Collision + Complete | $1,500 – $2,500 per 12 months |

| Legal responsibility + Collision + Complete + Uninsured/Underinsured Motorist | $1,800 – $3,000 per 12 months |

Observe: These areestimated* common charges. Precise charges will range tremendously primarily based on particular person circumstances. Components like driving report, car kind, and site will all play a task within the closing worth.

Figuring out Low cost Insurance coverage Choices

Sorted by way of the South Dakota insurance coverage scene, we have discovered some strong methods to bag your self a cut price. Dodging these rip-off premiums ain’t rocket science, but it surely does want a little bit of know-how. Understanding the ropes, you may get a superb deal and keep away from being stung by sneaky insurance policies.Discovering the suitable insurance coverage is not simply in regards to the lowest worth; it is about discovering a coverage that matches your wants and driving habits.

Take into account elements like your car kind, driving report, and site throughout the state, as these play an enormous position in shaping your premiums.

Comparability Web sites: Your Insurance coverage-Discovering Tremendous Instrument

Comparability web sites are your secret weapon within the battle for reasonable automobile insurance coverage. They act like a one-stop store, permitting you to check quotes from a number of suppliers without delay. This protects you the effort of looking down every insurer individually. Utilizing comparability web sites allows you to see side-by-side how totally different corporations’ insurance policies stack up, serving to you decide the perfect match.

Insurance coverage Supplier Comparability: Native vs. Nationwide

South Dakota has a mixture of nationwide insurance coverage giants and locally-based gamers. Nationwide corporations typically have economies of scale, probably resulting in decrease charges. On the flip aspect, native suppliers may supply extra personalised service, realizing the particular quirks of the state’s driving panorama. Evaluating each sorts can reveal hidden bargains.

Reductions: Sweetening the Deal

Insurance coverage corporations dish out reductions for varied causes. These can embrace secure driving information, anti-theft units, and even a number of insurance policies with the identical firm. Reductions could be a game-changer when making an attempt to nail down a superb fee.

| Low cost Kind | Description | Instance |

|---|---|---|

| Protected Driving | Based mostly in your driving historical past and report. | Accident-free drivers can typically get a reduction. |

| A number of Insurance policies | Having a couple of coverage with the identical firm. | Insuring your automobile and residential with the identical supplier. |

| Anti-theft Machine | Putting in an anti-theft system in your car. | Alarm methods or monitoring units. |

| Pupil Low cost | In case you are a scholar. | Applies to college students with a superb driving report. |

| Bundling (residence & auto) | Combining auto and residential insurance coverage with the identical firm. | One-stop store for all of your insurance coverage wants. |

Insurance coverage Firm Monetary Energy: A Take a look at the Books

An organization’s monetary energy is essential. Insurers must be secure and in a position to pay claims, and that is necessary on your peace of thoughts. Scores from businesses like A.M. Greatest or Customary & Poor’s supply insights into the monetary stability of insurance coverage corporations. A robust monetary standing suggests the insurer is much less prone to disappear whenever you want them.

Components Affecting South Dakota Automotive Insurance coverage Prices

Proper, so that you’re tryna’ get the perfect deal on automobile insurance coverage within the Black Hills, or wherever you are primarily based in South Dakota. Understanding the elements that form your premiums is essential to baggin’ an honest worth. Consider it like this: the extra your profile aligns with the dangerous driver profile, the upper the associated fee.South Dakota automobile insurance coverage, like another, ain’t nearly your postcode.

An entire heap of different issues, out of your driving historical past to your journey itself, can considerably impression your charges. It is all about assessing your threat profile, so let’s break it down.

Driving Data and Insurance coverage Premiums

Your driving historical past is a large consider figuring out your insurance coverage prices. Accidents, dashing tickets, and at-fault collisions all sign a better threat to insurers. Every incident, particularly these with critical accidents, may imply a hefty hike in your premiums. As an illustration, a driver with a clear slate will usually pay lower than somebody with a historical past of a number of site visitors violations.

Insurers use this information to evaluate your probability of submitting a declare. A clear report, like a pristine report in a recreation, is essential to keepin’ these charges low.

Car Kind and Age Impacting Prices

The kind of car you drive also can have an effect on your insurance coverage prices. Sports activities automobiles and high-performance autos typically have larger premiums in comparison with sedans or hatchbacks. The car’s age is one other issue. Older autos, notably these that aren’t maintained effectively, are typically dearer to restore or exchange. Insurers weigh this threat when setting your charges.

Because of this should you’re rocking a classic journey or a supercar, you could be lookin’ at a better premium than should you have been in a primary household automobile.

Location’s Affect on Insurance coverage Charges, Low cost south dakota automobile insurance coverage

Location inside South Dakota also can affect your insurance coverage premiums. Areas with larger crime charges or accident frequencies typically have larger charges. It is because insurers take into account the chance related to a selected location. Areas with a better focus of drivers, like city facilities, may have larger premiums. This could be a critical issue, as a location with a better threat will price you extra.

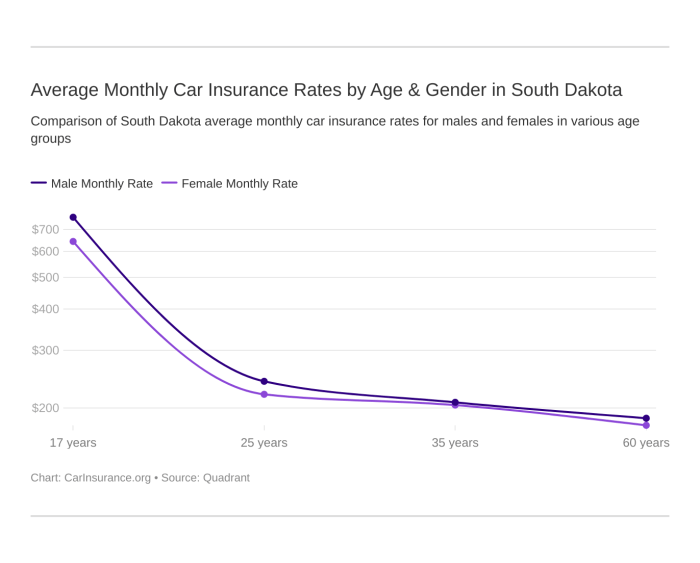

Age and Gender Affecting Premiums

Insurance coverage corporations additionally take into account your age and gender when setting your premiums. Youthful drivers, statistically, are concerned in additional accidents than older drivers. This larger threat leads to larger premiums for youthful drivers. Gender, whereas not a big consider South Dakota, remains to be thought-about by some insurers in sure areas. It isn’t an enormous deal, however insurers typically issue it into their assessments.

Impression of Every Issue on Premium Prices (Illustrative Desk)

| Issue | Impression on Premium Prices |

|---|---|

| Clear Driving File | Decrease premiums |

| Excessive-Efficiency Car | Greater premiums |

| Older Car | Doubtlessly larger premiums |

| Excessive-Crime Space | Greater premiums |

| Youthful Driver | Greater premiums |

Suggestions for Negotiating Decrease Charges

Snagging a killer deal on South Dakota automobile insurance coverage ain’t rocket science, but it surely does take a little bit of know-how. Understanding the ropes and taking part in your playing cards proper can land you a critical low cost, saving you some critical dosh. It is all about understanding the sport and realizing what levers to tug.

Methods for Decrease Premiums

Insurance coverage corporations typically use a wide range of elements to calculate premiums. Understanding these elements provides you a tactical benefit when negotiating. Components like your driving historical past, the kind of car you drive, and your location all play a component. Proactively addressing these elements can result in substantial financial savings. As an illustration, a clear driving report is a serious asset within the recreation of insurance coverage negotiations.

Sustaining a Good Driving File

A spotless driving report is king on the subject of securing decrease insurance coverage charges. This implies avoiding accidents and site visitors violations. Constant secure driving habits reveal accountable behaviour to the insurance coverage firm, which might translate to vital financial savings. Each level in your report can impression your charges, so staying accident-free is essential. Keep away from dangerous driving behaviours, and you will probably see a noticeable drop in your premiums.

Advantages of Bundling Insurance policies

Bundling your insurance coverage insurance policies, equivalent to residence and auto insurance coverage, typically unlocks reductions. Insurance coverage corporations typically reward prospects who consolidate their insurance coverage wants beneath one roof. This streamlined method can result in vital price reductions. The mixed financial savings could make an actual distinction to your backside line. A bundle deal can provide you extra worth and prevent cash.

Inquiries to Ask Insurance coverage Brokers

Do not be shy about asking questions. Proactive engagement along with your insurance coverage agent can reveal hidden financial savings alternatives. Inquire about reductions for secure driving, multi-policy bundles, or another obtainable incentives. Understanding the totally different choices may help you to barter successfully and discover the perfect deal on your wants. Be ready to ask about particular reductions and discover totally different protection choices to see what could be tailor-made on your particular person scenario.

- What reductions can be found for secure drivers?

- Are there any multi-policy reductions obtainable?

- What are the phrases and situations of every low cost?

- How does my driving report have an effect on my charges?

- Are there any reductions for particular car sorts or security options?

Comparability of Bundled vs. Particular person Insurance policies

Bundling insurance policies can typically present vital financial savings in comparison with buying particular person insurance policies. This can be a confirmed technique. The next desk illustrates a possible comparability.

| Coverage Kind | Estimated Annual Premium (USD) |

|---|---|

| Particular person Auto Insurance coverage | 1500 |

| Bundled Auto and Residence Insurance coverage | 1200 |

Understanding Protection Choices

Sorted by way of the jargon, this part breaks down the totally different insurance coverage coverages obtainable on your wheels, highlighting the essential bits to maintain your journey secure and your pockets pleased. Navigating these choices can really feel like navigating a maze, however we’ll map it out for you, so you are not misplaced in a sea of paperwork.

Legal responsibility Protection Choices

Legal responsibility protection protects you should you trigger injury or damage to another person. Totally different ranges of legal responsibility cowl totally different quantities of potential payouts. Customary insurance policies typically supply a minimal stage, however take into account rising protection to make sure you’re ready for greater claims. As an illustration, a high-value declare may exceed your primary coverage restrict, leaving you personally liable.

- Bodily Harm Legal responsibility: Covers medical bills and misplaced wages for the injured social gathering, as much as the coverage limits. That is important should you’re concerned in an accident the place somebody will get harm.

- Property Injury Legal responsibility: Covers injury you trigger to a different individual’s property, equivalent to their automobile or home. This safeguards you from hefty restore payments.

Complete and Collision Protection

These coverages step in when injury occurs to your car, no matter who’s at fault.

- Complete Protection: This protection protects towards non-collision incidents, equivalent to theft, vandalism, hearth, hail, or climate injury. Consider it as your all-encompassing protect towards unexpected occasions.

- Collision Protection: Covers injury to your car should you’re concerned in a collision, no matter who’s at fault. That is important for changing or repairing your car should you’re in a crash.

Uninsured/Underinsured Motorist Safety

What occurs if the opposite driver in an accident has no insurance coverage or inadequate protection? This protection kicks in that will help you get better damages.

- Uninsured/Underinsured Motorist Safety: Protects you and your passengers should you’re concerned in an accident with an uninsured or underinsured driver. This prevents you from shouldering the monetary burden if the opposite social gathering’s protection is inadequate.

Private Harm Safety (PIP)

PIP protection is designed to deal with your personal accidents and medical bills no matter who’s at fault in an accident.

- Private Harm Safety (PIP): Covers medical bills, misplaced wages, and different bills associated to accidents sustained in an accident, even should you’re the at-fault driver. That is essential for quick medical consideration and restoration prices.

Protection Choices Comparability

| Protection | Professionals | Cons |

|---|---|---|

| Legal responsibility | Fundamental safety, typically required by legislation | Restricted safety on your personal car; would not cowl your accidents |

| Complete | Covers a variety of damages past collisions | Could have larger premiums than different coverages |

| Collision | Covers injury to your car in a collision, no matter fault | Could have larger premiums than different coverages |

| Uninsured/Underinsured Motorist | Protects you from accidents with at-fault drivers with out sufficient insurance coverage | Further price, however a vital safeguard |

| Private Harm Safety (PIP) | Covers medical bills and misplaced wages for you and your passengers no matter fault | Could not cowl ache and struggling past medical prices |

Insurance coverage Supplier Comparisons

Navigating the murky waters of South Dakota automobile insurance coverage? Understanding which supplier’s a superb match on your wants is essential. It isn’t simply in regards to the most cost-effective quote; it is about discovering an organization you may belief to deal with claims easily and pretty. Choosing the proper insurance coverage supplier is essential to a stress-free expertise.

Supplier Repute and Buyer Evaluations

Buyer opinions are a goldmine of insights into an organization’s service high quality. Studying opinions on unbiased platforms, and straight on the suppliers’ web sites, can provide you a way of how they deal with their prospects. Optimistic suggestions typically highlights fast declare settlements, useful customer support reps, and clear communication. Conversely, damaging opinions may reveal points with delays, unhelpful employees, or advanced declare processes.

Claims Dealing with Processes

The way in which an organization handles claims is a significant factor in your total expertise. A streamlined course of, with clear communication and well timed settlements, will prevent a headache if the worst occurs. Some corporations supply on-line declare portals, making the method simpler. Researching how suppliers deal with totally different declare sorts, from minor fender benders to complete losses, is important.

This perception permits for a greater understanding of their effectivity and responsiveness.

Monetary Stability

Monetary stability is paramount. An organization’s monetary energy signifies its potential to pay out claims, even throughout powerful occasions. Search for corporations with a powerful monitor report and a strong repute for monetary accountability. A good score company’s evaluation can present goal details about an organization’s monetary stability.

Supplier Comparability Desk

This desk supplies a concise overview of various insurance coverage suppliers in South Dakota, evaluating their rankings, buyer opinions, and common claims dealing with occasions. It is a snapshot that will help you make an knowledgeable determination.

| Insurance coverage Supplier | Score (e.g., A.M. Greatest) | Buyer Evaluations (Common Score/General Sentiment) | Common Declare Dealing with Time (Days) |

|---|---|---|---|

| Instance Ins Co 1 | A+ | 4.5/5 – Largely constructive, highlighting fast declare processing | 7 |

| Instance Ins Co 2 | A | 4.0/5 – Blended opinions, some complaints about customer support | 10 |

| Instance Ins Co 3 | B+ | 3.8/5 – Barely damaging sentiment, some considerations about declare dealing with | 14 |

| Instance Ins Co 4 | A- | 4.7/5 – Extraordinarily constructive, emphasizes glorious customer support and environment friendly claims dealing with | 5 |

Observe: Scores and occasions are examples and should range. At all times examine with the supplier straight for probably the most present info.

Analyzing South Dakota Insurance coverage Legal guidelines

South Dakota’s automobile insurance coverage scene ain’t precisely a jungle, but it surely’s gotta be navigated proper. Understanding the principles is essential to keep away from any nasty surprises, like a hefty tremendous or a refusal of your declare. Understanding the dos and don’ts, plus the hoops you gotta leap by way of, will prevent a ton of stress and potential hassle.

Obligatory Protection Necessities

South Dakota, like most states, calls for a sure stage of safety for drivers and different highway customers. Failure to satisfy these requirements can result in critical penalties. This part lays out the important protection you are legally obliged to have.

- Bodily damage legal responsibility (BI): This covers accidents you trigger to different folks in an accident. It is like a security web for these harmed in a crash you are accountable for.

- Property injury legal responsibility (PD): This protects the opposite driver’s automobile or property should you’re at fault. It covers the price of repairs or alternative.

- Uninsured/Underinsured Motorist (UM/UIM) protection: This safeguards you and your passengers should you’re hit by somebody with insufficient or no insurance coverage. It steps in when the opposite driver’s coverage is not sufficient to cowl all of the damages.

Particular Laws for Automotive Insurance coverage

South Dakota’s insurance coverage legal guidelines Artikel the specifics of what is required and the way it’s enforced. These laws guarantee equity and shield everybody on the highway.

- Minimal Protection Limits: South Dakota units minimal protection quantities for BI and PD legal responsibility. You will want to make sure your coverage meets these requirements or face authorized repercussions.

- Proof of Insurance coverage: You are legally required to hold proof of insurance coverage. This often includes displaying a legitimate insurance coverage card or the same doc.

- Monetary Accountability Legal guidelines: These legal guidelines intention to stop reckless driving by requiring drivers to show they’ll pay for damages they trigger. Failing to stick to those legal guidelines can result in your license being suspended or your car impounded.

Implications of Non-Compliance

Ignoring South Dakota’s insurance coverage laws can result in vital penalties. It is best to keep away from these pitfalls.

- Suspension of Driving License: Non-compliance can lead to your driving license being suspended, which means you may’t function a car legally.

- Car Impoundment: In some instances, your car could be impounded should you’re discovered to be driving with out correct insurance coverage.

- Monetary Penalties: Fines and different monetary penalties are sometimes imposed for violating insurance coverage laws.

State’s Insurance coverage Client Safety Company

South Dakota has a devoted company to take care of the pursuits of insurance coverage customers. This physique is significant in making certain equity and stopping fraudulent practices.

South Dakota’s Division of Insurance coverage is accountable for imposing insurance coverage laws and defending customers from unfair practices. They supply sources and knowledge that will help you navigate the insurance coverage course of successfully.

Key South Dakota Insurance coverage Legal guidelines Abstract

| Legislation | Description |

|---|---|

| Minimal Legal responsibility Protection | South Dakota mandates minimal quantities of Bodily Harm and Property Injury legal responsibility protection. |

| Proof of Insurance coverage | Drivers should carry proof of insurance coverage, sometimes within the type of a card or certificates. |

| Monetary Accountability Legal guidelines | These legal guidelines guarantee drivers can financially compensate for damages precipitated in accidents. |

| Uninsured/Underinsured Motorist Protection | This protection protects you should you’re concerned in an accident with an uninsured or underinsured driver. |

Illustrative Eventualities: Low cost South Dakota Automotive Insurance coverage

Navigating the murky waters of South Dakota automobile insurance coverage ain’t simple, however understanding how various factors play out could make an actual distinction in your pocket. Understanding what to anticipate out of your driving report, car, location, and protection decisions is essential to securing an honest fee. This part breaks down some frequent situations that will help you plan forward.Various factors considerably impression your automobile insurance coverage premiums.

These examples reveal how varied conditions can have an effect on the price of your coverage.

Driving File Impacts on Premiums

A clear driving report is a significant factor in securing a low premium. A historical past of accidents or violations, nonetheless, will enhance your charges significantly.

- A driver with a clear report, no site visitors violations, and a spotless driving historical past, will usually benefit from the lowest premiums.

- A driver with a minor dashing ticket or a parking violation will probably see a slight enhance of their premium, although not essentially a catastrophic one.

- Drivers with a number of accidents or at-fault collisions will face considerably larger premiums because of the elevated threat of claims and payouts.

- Teen drivers with restricted expertise on the highway typically pay extra on account of their larger threat profile. Insurance coverage corporations typically require extra protection, which can inevitably inflate the value.

Car Kind Influences on Charges

The kind of car you drive straight impacts your insurance coverage prices. Excessive-performance automobiles and luxurious autos sometimes include larger premiums.

- A primary, compact sedan will sometimes have decrease premiums than a high-performance sports activities automobile or a luxurious SUV.

- Excessive-value autos typically require larger premiums to mirror the potential for larger declare payouts.

- Older, much less dependable autos may include larger premiums, notably if they don’t seem to be well-maintained. Poor car upkeep can contribute to larger restore prices in case of accidents.

- Electrical autos (EVs) usually have decrease premiums than gasoline-powered autos in lots of areas, on account of their decrease accident threat and probably diminished restore prices.

Location Impacts on Insurance coverage Prices

Your location performs a big position in your insurance coverage charges. Areas with larger crime charges or accident frequencies often have larger premiums.

- Areas with larger charges of theft or vandalism sometimes have larger premiums.

- Rural areas may need decrease charges than densely populated city areas on account of fewer accidents.

- Areas with larger charges of extreme climate, equivalent to hailstorms or flooding, may see larger premiums.

- Particular neighbourhoods inside a metropolis also can see variations in premiums on account of native elements.

Protection Choices Impression on Charges

The protection choices you select considerably impression your premium. Complete and collision protection can add substantial prices.

- A primary liability-only coverage is often the most affordable possibility however gives the least safety.

- Including complete protection for injury from issues like climate or vandalism will enhance your premiums.

- Collision protection, which covers injury from an accident, provides much more to the associated fee.

- Uninsured/underinsured motorist protection is essential for defense towards accidents involving drivers with out insurance coverage.

Case Research on Decreasing Premiums

Implementing sure methods can considerably cut back your insurance coverage prices. Take into account these examples:

- Bundling your auto insurance coverage with different insurance policies (like owners or renters) typically results in reductions.

- Sustaining a superb driving report and avoiding accidents or violations will hold your charges decrease.

- Elevating your deductible can typically cut back your month-to-month premiums.

- Selecting a decrease protection stage, equivalent to a better deductible, can decrease your month-to-month premium.

Final Phrase

In conclusion, securing low-cost South Dakota automobile insurance coverage includes a mix of understanding the market, evaluating your wants, and proactively searching for reductions. By evaluating suppliers, analyzing protection choices, and sustaining a superb driving report, you may considerably cut back your insurance coverage prices. This information has geared up you with the information to navigate the complexities of South Dakota automobile insurance coverage and discover the very best protection on your wants.

Person Queries

What are the everyday elements that affect automobile insurance coverage premiums in South Dakota?

Components like your driving report (together with accidents and violations), the sort and age of your car, your location inside South Dakota, your age and gender, and the chosen protection choices all have an effect on your premium.

What are some frequent reductions supplied by insurance coverage suppliers in South Dakota?

Many suppliers supply reductions for secure driving, bundling a number of insurance policies, having good credit score, and for sure car sorts or options. You’ll want to ask about particular reductions from every supplier you are contemplating.

What are the obligatory protection necessities in South Dakota?

South Dakota requires legal responsibility insurance coverage, which protects you from monetary accountability should you trigger an accident. Test with the South Dakota Division of Insurance coverage for particular particulars on present necessities.

How can I evaluate totally different insurance coverage suppliers in South Dakota?

On-line comparability instruments and web sites are glorious sources to check totally different suppliers and their charges. It’s also possible to request quotes straight from insurance coverage corporations within the state.