Low-cost automotive insurance coverage Little Rock is a vital concern for Arkansans. Navigating the native market can really feel overwhelming, with a mess of things influencing charges. From site visitors patterns to driver demographics, understanding these parts is essential to discovering the perfect deal. This complete information will delve into the specifics of automotive insurance coverage in Little Rock, serving to you safe the protection you want with out breaking the financial institution.

This information covers all the pieces from figuring out cost-saving methods and evaluating insurance coverage firms to understanding protection choices and navigating the claims course of. We’ll additionally discover current tendencies within the Little Rock market and supply ideas for selecting the best supplier. By the tip of this information, you may be geared up to confidently discover the right low cost automotive insurance coverage in Little Rock.

Inexpensive Automotive Insurance coverage in Little Rock

Yo, peeps! Little Rock automotive insurance coverage is an actual factor, and it’s very vital to get the perfect deal you’ll be able to. Discovering low cost automotive insurance coverage on this metropolis is not rocket science, however realizing the ins and outs is essential. This rundown will provide help to navigate the entire course of, from understanding the market to evaluating completely different firms.The automotive insurance coverage scene in Little Rock, Arkansas, is fairly aggressive, with a mixture of large nationwide gamers and native firms.

Components like the world’s demographics, site visitors patterns, and accident charges all play a task in how a lot your premiums can be. For instance, areas with larger accident charges are inclined to have larger insurance coverage prices. Additionally, youthful drivers typically pay extra as a result of they’re statistically extra more likely to get into accidents. It is all about managing threat.

Automotive Insurance coverage Price Components

Various factors have an effect on how a lot you pay for automotive insurance coverage. Demographics like age and driving historical past are large. In the event you’re a brand new driver, you may most likely pay greater than a seasoned veteran. Site visitors patterns additionally affect charges. Areas with heavy site visitors and excessive accident charges could have larger premiums.

Accident charges are a big issue. Areas with larger accident charges sometimes have dearer automotive insurance coverage premiums.

Sorts of Automotive Insurance coverage Insurance policies

There are various kinds of automotive insurance coverage insurance policies, and realizing them is tremendous vital for getting the appropriate protection. Legal responsibility insurance coverage covers damages you trigger to different individuals or their property. Collision insurance coverage covers harm to your automotive in an accident, irrespective of who’s at fault. Complete insurance coverage covers harm to your automotive from issues aside from accidents, like climate occasions or vandalism.

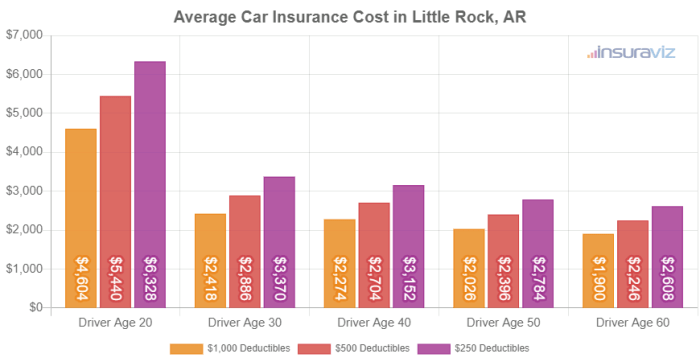

Common Automotive Insurance coverage Prices in Little Rock

The common price of automotive insurance coverage in Little Rock is mostly decrease than in some main US cities, nevertheless it varies extensively based mostly on the elements talked about earlier than. For instance, a 20-year-old with a brand new automotive in a high-accident space can pay greater than a 40-year-old with a dependable older automobile in a low-accident space. You gotta think about your private scenario!

Automotive Insurance coverage Firm Comparability

| Firm | Charges (Estimated) | Protection Choices | Buyer Evaluations |

|---|---|---|---|

| State Farm | $150-$250/month | Full protection, reductions for good drivers | Principally constructive, identified for good customer support |

| Geico | $125-$225/month | Good protection, reductions for bundling | Blended evaluations, some complaints about claims course of |

| Progressive | $140-$200/month | Reductions for secure driving habits | Constructive evaluations for on-line platform and reductions |

| Allstate | $135-$240/month | Varied protection ranges | Blended evaluations, some complaints about customer support |

| Farmers Insurance coverage | $160-$270/month | Robust in rural areas, reductions for owners | Typically constructive, good native assist |

Notice: Charges are estimated and may range significantly relying on particular person elements. All the time get quotes from a number of firms to match.

Figuring out Price-Saving Methods

Yo, peeps! Saving cash on automotive insurance coverage in Little Rock is completely doable. It is like getting a secret weapon to your pockets. We’re breaking down the best way to snag some severe reductions, so you’ll be able to maintain extra of your money.Getting cheaper automotive insurance coverage ain’t rocket science, however realizing the tips is essential. It is all about being a wise shopper and enjoying the sport proper.

Following the following tips can critically slash your premium, which is mainly like getting a increase with out working more durable.

Protected Driving Practices and Reductions

Protected driving habits are a significant factor in getting a decrease automotive insurance coverage charge. Insurance coverage firms love drivers who do not trigger accidents. This is sort of a reward system for accountable driving.

- Sustaining a clear driving file is essential. Zero accidents and violations imply severe financial savings. Consider it as a gold star for good habits.

- Defensive driving programs can additional scale back your threat and present insurance coverage firms you are dedicated to secure driving. Taking these programs is like getting additional coaching in your driving abilities.

- Following site visitors legal guidelines and laws constantly reveals accountability. It is like a promise to remain secure on the street.

Pupil Reductions and Advantages, Low-cost automotive insurance coverage little rock

Being a great pupil may also rating you main reductions on automotive insurance coverage. Insurance coverage firms acknowledge the worth of accountable younger drivers.

- Insurance coverage firms typically supply pupil reductions to drivers who keep a sure GPA. It is a win-win for each the coed and the insurance coverage firm.

- Some firms might present reductions to college students enrolled in driver’s education schemes. It is like a bonus for additional coaching.

Influence of Driving Historical past

Your driving historical past straight impacts your insurance coverage charges. A clear file equals decrease premiums, and vice versa. It is like a report card in your driving abilities.

- Accidents and violations improve your insurance coverage charges considerably. It is like a penalty for not following the foundations.

- Sustaining a clear file is essential for protecting premiums low. Consider it as investing in your driving future.

Bundling Insurance coverage Insurance policies

Bundling your automotive insurance coverage with different insurance policies like house or renters insurance coverage can prevent severe money. It is like a bundle deal in your insurance coverage wants.

- Insurance coverage firms typically supply reductions for bundling insurance policies. It is like getting a reduction for being a loyal buyer.

- Bundling insurance policies can prevent cash by combining your premiums into one fee. It is like having one invoice as an alternative of a number of.

Insurance coverage Supplier Low cost Packages

Totally different insurance coverage suppliers supply varied low cost applications. Evaluating these applications is essential to discovering the perfect deal.

- Some suppliers supply reductions for particular automotive options like anti-theft gadgets. It is like getting a reward for having a safe automotive.

- Insurance coverage firms might supply reductions for particular automobiles like fuel-efficient automobiles. It is like rewarding environmentally pleasant driving.

Low cost Comparability Desk

This desk reveals potential financial savings from varied low cost choices. It is a fast method to see the potential financial savings for various conditions.

| Low cost Class | Description | Potential Financial savings (Estimated) |

|---|---|---|

| Protected Driving | Clear driving file, defensive driving course | 5-15% |

| Pupil Low cost | Sustaining a particular GPA | 5-10% |

| Bundling | Combining automotive, house, or renters insurance coverage | 5-10% |

| Anti-theft Machine | Set up of safety features | 3-8% |

Evaluating Insurance coverage Corporations in Little Rock

Yo, discovering the appropriate automotive insurance coverage in Little Rock generally is a complete ache, nevertheless it does not need to be a headache. Totally different firms supply completely completely different offers, so that you gotta do your analysis to search out the perfect match in your wants. It is like selecting the best experience—you need one thing dependable and inexpensive, proper?Insurance coverage firms in Little Rock are all concerning the $$$, however some are approach higher than others on the subject of service and costs.

Determining which one’s the actual MVP is essential to saving some severe dough. Consider it as purchasing for the perfect deal on the newest tech—you need the perfect options on the lowest worth, proper?

Distinguished Automotive Insurance coverage Corporations

Little Rock’s acquired a bunch of main insurance coverage gamers, and realizing who they’re is step one to evaluating apples to apples. These firms are large within the space, so that you’re certain to search out one which works for you.

- State Farm: A complete traditional, State Farm is virtually a family identify. They’re tremendous established, so you understand they’re legit.

- Geico: Geico is understood for his or her super-low costs and catchy commercials. They’re fairly good at making it straightforward to match insurance policies.

- Progressive: Progressive is all the time attempting to shake issues up with new offers and on-line instruments. They’re tremendous user-friendly.

- Allstate: Allstate is a serious participant, providing a wide range of protection choices.

- Farmers Insurance coverage: Farmers Insurance coverage is one other dependable possibility, particularly if you happen to’re a farmer or reside in a rural space.

Evaluating Providers Provided

Totally different firms have completely alternative ways of doing issues. Some are all concerning the on-line expertise, whereas others are extra conventional. Figuring out that is essential when selecting.

- On-line Platforms: Some firms, like Progressive, have superb on-line instruments to match insurance policies and even handle your account. Others, like State Farm, may need extra of a standard method, however they’re nonetheless tremendous useful.

- Buyer Assist: Buyer assist is HUGE. When you have a query or need assistance, you need somebody who’s responsive and useful. Some firms have superb customer support, whereas others is perhaps just a little gradual to reply. Do your analysis on how every firm handles customer support complaints.

Buyer Evaluations and Scores

Studying evaluations is like getting a sneak peek at what different individuals suppose. Web sites like Yelp and the Higher Enterprise Bureau can provide you some perception into the experiences people have had with completely different firms. You wish to see what different individuals are saying about their experiences.

- Search for patterns: Are lots of people complaining about the identical factor? Perhaps that is a crimson flag.

- Contemplate the supply: Make certain the evaluations are from actual individuals and never faux accounts.

Significance of Studying the Superb Print

Do not simply skim over the wonderful print—it is the important thing to understanding precisely what you are paying for. The wonderful print has all of the vital particulars about protection, exclusions, and limits. It is just like the directions for a brilliant difficult online game—you gotta learn them to play proper.

- Search for hidden charges: Typically there are additional fees that are not apparent.

- Perceive protection limits: Make certain the protection you are getting is sufficient to shield you.

Protection Choices Comparability

Totally different firms supply varied protection choices. This desk summarizes the principle ones:

| Insurance coverage Firm | Legal responsibility Protection | Collision Protection | Complete Protection |

|---|---|---|---|

| State Farm | Glorious | Good | Good |

| Geico | Good | Common | Common |

| Progressive | Glorious | Good | Good |

| Allstate | Glorious | Good | Good |

| Farmers Insurance coverage | Good | Good | Good |

Understanding Insurance coverage Protection Choices

Yo, so that you tryna get the perfect automotive insurance coverage deal in Little Rock? Figuring out your protection choices is essential, fam. Totally different insurance policies have completely completely different stuff lined, so that you gotta know what you are stepping into. This ain’t rocket science, nevertheless it’s vital to know the fundamentals.

Totally different Sorts of Protection

Insurance coverage insurance policies often include a bunch of various protection sorts. Legal responsibility protection is like, if you happen to wreck another person’s experience, it covers their damages. Collision protection kicks in in case your automotive will get wrecked in an accident, irrespective of who’s at fault. Complete protection is for stuff like climate harm, theft, or vandalism. It is mainly additional safety in your experience.

Significance of Understanding Coverage Particulars

Learn the wonderful print, individuals! Insurance coverage insurance policies might be tremendous complicated, however understanding the small print is essential. Totally different firms have completely different guidelines and limits, so that you gotta pay shut consideration to the specifics of your coverage. That is the way you keep away from nasty surprises down the street. If you do not get it, ask a trusted grownup or insurance coverage agent that can assist you determine it out.

Implications of Totally different Protection Ranges

Totally different protection ranges imply completely different quantities of safety. Increased ranges often price extra, however they provide extra complete safety. Decrease ranges are cheaper, however they provide much less safety. Consider it like this: A fundamental coverage is sort of a low cost burger—it is fast and simple, however you may not get all of the fixings. A premium coverage is sort of a fancy steak—it prices extra, nevertheless it’s far more satisfying.

Examples of Protection Variations Between Insurance policies

Insurance coverage firms can completely range their protection choices. For instance, one coverage may need the next legal responsibility restrict than one other, or one would possibly embody roadside help, whereas one other does not. Some insurance policies may need larger deductibles, which implies you may pay extra out-of-pocket if you happen to file a declare. So, you gotta examine insurance policies side-by-side to search out the perfect match in your wants.

Protection Choices: Advantages and Drawbacks

| Protection Sort | Advantages | Drawbacks |

|---|---|---|

| Legal responsibility | Covers damages to different individuals’s property or accidents if you happen to’re at fault. | Would not cowl your individual automobile’s harm or accidents. |

| Collision | Covers harm to your automobile in an accident, no matter fault. | Could be costly, particularly with larger protection limits. |

| Complete | Covers harm to your automobile from issues like climate, theft, or vandalism. | Could be costly, particularly with larger protection limits. |

This desk offers a fast overview, however bear in mind, every coverage has its personal distinctive stipulations. You gotta dig deeper into every coverage to search out the perfect match in your pockets and desires. Do not simply accept the primary coverage you see!

Suggestions for Selecting the Proper Insurance coverage Supplier

Yo, discovering the appropriate automotive insurance coverage in Little Rock is essential, fam. It is like selecting the right experience – you gotta store round and discover the perfect deal. This ain’t no sport, you want safety, and inexpensive charges are a should.

Evaluating Quotes from A number of Suppliers

Evaluating quotes from a number of insurance coverage suppliers is important for locating the very best deal. Totally different firms have completely different pricing buildings, so evaluating apples to apples is essential. Consider it like going to completely different shops to see which one has the bottom worth on the identical merchandise.

Advantages of A number of Quotes

Getting a number of quotes from varied insurance coverage firms offers you a wider vary of choices. This lets you examine insurance policies, protection quantities, and premiums. You can spot the actual steals and avoid wasting severe money. It is like having an entire bunch of decisions whenever you’re selecting a brand new telephone – you are gonna discover the one which’s good for you.

Evaluating Insurance policies and Options

When evaluating insurance policies, look carefully on the protection particulars. Issues like legal responsibility limits, complete protection, and collision protection are tremendous vital. Additionally, take a look at the deductibles, and ensure they suit your price range. Understanding the specifics of every coverage will provide help to make the perfect determination.

Utilizing On-line Comparability Instruments

On-line comparability instruments are your greatest pal on the subject of discovering inexpensive automotive insurance coverage in Little Rock. They allow you to examine quotes from varied suppliers in a flash, saving you tons of effort and time. These instruments are tremendous user-friendly, and you’ll simply discover the perfect charges with just a few clicks.

Step-by-Step Information for Discovering the Greatest Automotive Insurance coverage

| Step | Motion |

|---|---|

| 1 | Collect your automobile info (12 months, make, mannequin, and many others.) and your driving historical past (accidents, violations). |

| 2 | Go to the web sites of varied insurance coverage suppliers in Little Rock. |

| 3 | Use on-line comparability instruments to get quotes from a number of firms. Enter your info, and let the software do the heavy lifting! |

| 4 | Fastidiously evaluation every coverage’s particulars, together with protection limits, deductibles, and premiums. |

| 5 | Examine the quotes side-by-side, paying shut consideration to the prices and options provided. |

| 6 | Select the coverage that most closely fits your wants and price range. |

Current Traits in Little Rock Automotive Insurance coverage

Yo, peeps! Little Rock automotive insurance coverage is completely altering, and it isn’t all the time clear what’s up. From new tech to bizarre climate, your charges are getting every kind of untamed. Let’s dive into the newest tendencies.Insurance coverage charges in Little Rock are feeling the warmth, fam. Typically they are going up, typically they’re down, nevertheless it’s not all the time a straight line.

It is all a couple of bunch of various elements which can be continuously shifting.

Influence of New Applied sciences on Pricing

Self-driving automobiles and all that fancy tech are completely messing with insurance coverage calculations. Corporations try to determine how a lot threat these new automobiles pose. If a self-driving automotive crashes, who’s accountable? It is an entire new ballgame, and that is affecting premiums. Some insurers are providing reductions for automobiles with superior security options, whereas others are charging extra for these which can be much less secure or are new in the marketplace.

Give it some thought: if a automotive can drive itself, is it reallythat* a lot safer? It is a difficult query, and it’s very impacting the costs you see.

Function of Insurance coverage Rules in Little Rock

Little Rock’s insurance coverage laws play an enormous position in setting charges. State legal guidelines about issues like minimal protection necessities and the way claims are dealt with can actually affect how a lot you pay. If the legal guidelines change, so can your charges. For instance, if there is a new legislation requiring all automobiles to have sure security options, insurance coverage firms must alter their calculations.

Typically these adjustments are for the higher, however typically they simply add extra prices to your coverage.

Affect of Climate Patterns and Native Occasions

Climate and native occasions, like main storms or accidents, are an enormous deal in Little Rock. Extreme climate occasions, like hailstorms or floods, can result in a spike in claims. Meaning insurers need to pay out extra, and that may drive up charges. Additionally, if a giant accident occurs, that may improve premiums for everybody within the space.

Take into consideration a giant fender bender on a busy freeway, that may influence the entire space’s charges.

Relationship Between Automobile Sorts and Insurance coverage Prices

Totally different automobiles have completely different dangers. A flowery sports activities automotive goes to price extra to insure than a fundamental sedan. The identical goes for vehicles or SUVs. Insurance coverage firms take a look at elements like how a lot the automotive is value, how simply it may be stolen, and the way secure it’s. It is all about calculating the potential threat.

Sports activities automobiles typically have larger insurance coverage charges due to their larger speeds and doubtlessly extra accidents.

Current Adjustments in Little Rock Automotive Insurance coverage Market Traits

| Development | Description | Influence on Charges |

|---|---|---|

| Elevated use of telematics | Drivers utilizing apps that observe driving habits | Probably decrease charges for secure drivers |

| Rising restore prices | Components and labor prices rising | Increased charges because of elevated declare prices |

| Give attention to accident prevention | Insurers selling security programs and applications | Potential for decrease charges with safer driving habits |

These tendencies present how Little Rock automotive insurance coverage is altering. It is not simply concerning the worth; it is concerning the dangers and the way firms are adjusting to them.

Navigating the Claims Course of in Little Rock: Low-cost Automotive Insurance coverage Little Rock

Yo, so that you wrecked your experience? Submitting a declare can appear to be a complete headache, nevertheless it does not need to be a complete drag. Figuring out the steps could make it approach much less tense. This rundown will break down the entire course of, from the preliminary report back to getting your dough again.

Steps in Submitting a Declare

Submitting a declare is like following a recipe. You gotta have all the appropriate elements to get the end result you need. First, you gotta contact your insurance coverage firm ASAP. Take pics of the harm, collect all of your paperwork, and be prepared to offer ’em all of the deets. That is tremendous vital for a easy course of.

Conditions Requiring a Declare

A declare is not only for fender benders. Suppose accidents, theft, and even harm from a freak climate occasion. In case your automotive’s totaled, you are gonna want a declare. Additionally, if you happen to’re concerned in an accident and another person’s insurance coverage must pay, that is a declare scenario, too. You would possibly even want a declare for harm attributable to a tree falling in your automotive, or if somebody hits your automotive in a parking zone.

Widespread Causes for Declare Denial

Insurance coverage firms aren’t simply attempting to be jerks. Typically, they deny claims due to lacking paperwork, like not having your proof of insurance coverage. Perhaps you did not report the harm instantly or did not cooperate absolutely. Additionally, in case your declare entails one thing that is not lined underneath your coverage, like intentional harm, that is a particular no-go.

Sustaining Correct Data

Maintaining good information is essential, fam. This implies saving all of your receipts, emails, and any notes concerning the incident. It is like having a time capsule of the entire thing. This helps your declare transfer alongside faster and reduces the probabilities of it getting rejected.

Function of Insurance coverage Adjusters

Insurance coverage adjusters are the middlemen within the claims course of. They examine the declare, take a look at the harm, and determine how a lot your declare is value. They will strive to determine what occurred and whether or not the declare is legitimate. They’re like detectives, however as an alternative of catching criminals, they’re attempting to determine the price of repairs.

Little Rock Claims Course of Abstract

| Step | Description |

|---|---|

| 1. Contact Insurance coverage Firm | Instantly report the accident or harm. |

| 2. Collect Info | Acquire particulars just like the date, time, location, and witnesses. |

| 3. Doc Injury | Take footage of the harm and notice the extent of the harm. |

| 4. Submit Declare | Fill out the required types and supply all required documentation. |

| 5. Adjuster Investigation | Insurance coverage adjuster investigates the declare and assesses the harm. |

| 6. Analysis and Settlement | Insurance coverage firm evaluates the declare and determines the settlement quantity. |

Final Level

In conclusion, securing inexpensive automotive insurance coverage in Little Rock entails cautious analysis, comparability, and understanding of native elements. By understanding the market dynamics, exploring cost-saving methods, and thoroughly evaluating insurance coverage suppliers, you’ll find the appropriate protection at a worth that matches your price range. This information serves as your roadmap to discovering low cost automotive insurance coverage Little Rock, empowering you to make knowledgeable selections and shield your self on the street.

Fast FAQs

What are the frequent elements influencing automotive insurance coverage charges in Little Rock?

A number of elements influence automotive insurance coverage premiums in Little Rock, together with driver demographics (age, historical past), native site visitors patterns, accident charges, and even automobile kind. Understanding these parts will provide help to perceive your potential charges.

What reductions are sometimes obtainable for automotive insurance coverage in Little Rock?

Many insurance coverage suppliers supply reductions for secure drivers, good college students, accident-free information, and bundling insurance policies (e.g., automotive and residential insurance coverage). Analysis completely different suppliers to see which reductions can be found and the way a lot they’ll prevent.

How can I examine automotive insurance coverage quotes in Little Rock successfully?

Use on-line comparability instruments to get quotes from a number of insurance coverage firms. Examine protection choices, premiums, and buyer evaluations to search out the perfect match in your wants. Do not hesitate to contact insurance coverage brokers straight for personalised help.

What are the steps concerned in submitting a automotive insurance coverage declare in Little Rock?

The claims course of often entails reporting the incident, offering documentation, and cooperating with the insurance coverage adjuster. Sustaining correct information and understanding the precise steps Artikeld by your supplier are essential.