Open care closing expense insurance coverage is an important software for guaranteeing your family members are protected after you are gone. This complete information dives into the specifics of this protection, serving to you perceive the advantages, drawbacks, and the important particulars wanted to make an knowledgeable determination. We’ll discover the nuances of open care insurance policies, evaluating them to conventional closing expense choices and illuminating the important thing variations.

From protection choices to pricing methods, we’ll cowl all the things to make navigating this essential determination simpler.

Open care closing expense insurance coverage supplies monetary safety for funeral and burial prices once you go away. This protection generally is a nice useful resource for these going through sudden closing bills. This complete information explores the intricacies of open care insurance policies, evaluating them to conventional closing expense insurance coverage to supply readability and ease of understanding.

Understanding Open Care Closing Expense Insurance coverage

Hey there, fellow vacationers on the journey of life! Ever puzzled concerning the little issues that may make an enormous distinction when the time comes? Open Care Closing Expense Insurance coverage is one such factor. It is about guaranteeing that your family members aren’t burdened by the prices of your closing preparations, letting them deal with the reminiscences relatively than the bills.

Defining Closing Expense Insurance coverage

Closing expense insurance coverage is a kind of insurance coverage designed to cowl the prices related to dying. This often contains funeral bills, cremation prices, burial plots, and different related charges. It is a essential security web, guaranteeing that your family members will not need to shoulder this monetary burden.

Defining “Open Care” in Closing Expense

“Open care” within the context of ultimate expense insurance coverage refers back to the flexibility it provides in selecting the kind of care and companies. As an alternative of being restricted to pre-arranged choices, you are typically given the liberty to pick the funeral house, the particular companies, and the kind of burial or cremation that greatest aligns along with your or your loved ones’s preferences.

This implies you may have a extra personalised and significant closing association.

Advantages and Protection Choices

Open care closing expense insurance coverage insurance policies sometimes provide a variety of protection choices, permitting you to tailor the coverage to your particular wants. These insurance policies typically embrace protection for funeral companies, burial plots, cremation prices, memorial companies, and typically even transportation prices. The quantity of protection will be personalized to match the anticipated bills.

Benefits and Disadvantages In comparison with Conventional

Open care closing expense insurance coverage usually supplies extra flexibility in selecting the companies you need, making the method extra personalised. Nevertheless, it’d include the next premium in comparison with conventional insurance policies. Conventional closing expense insurance policies typically have extra simple protection choices with probably decrease premiums, however they won’t provide the identical stage of customization. Basically, open care is a bit more tailor-made, whereas conventional is a extra simple strategy.

Comparability with Different Life Insurance coverage Sorts

Open care closing expense insurance coverage differs considerably from different life insurance coverage sorts. Whereas some life insurance coverage insurance policies could provide a dying profit that may assist with closing bills, the first focus of open care is on protecting these prices particularly. Different life insurance coverage insurance policies are sometimes designed to supply monetary assist to beneficiaries, relatively than immediately protecting the prices of funeral and burial companies.

It is a distinct class, serving a singular goal.

Frequent Misconceptions

One widespread false impression is that open care closing expense insurance coverage is just for these with particular preferences or wants. In actuality, it is a invaluable software for anybody trying to make sure their closing preparations are dealt with with care and respect, no matter their particular needs. One other false impression is that the open care possibility is just for high-end companies. In truth, the customization typically permits for selecting a variety of companies that match numerous budgets.

Comparability Desk

| Function | Open Care | Conventional |

|---|---|---|

| Protection Choices | Versatile, customizable companies (funeral properties, companies, burial/cremation) | Usually fastened set of companies |

| Eligibility Necessities | Usually just like conventional, with some variations based mostly on well being and life-style components | Related eligibility necessities, however can range based mostly on well being components |

| Coverage Sorts | Sometimes supplied as a standalone coverage or inside a broader insurance coverage bundle | Sometimes a standalone coverage |

Coverage Options and Advantages: Open Care Closing Expense Insurance coverage

So, you are enthusiastic about closing expense insurance coverage? It is like a security web, somewhat bit like a life insurance coverage coverage however with a extra… quick focus. Think about a clean transition on your family members once you’re gone. Open Care closing expense insurance policies provide a variety of advantages, from protecting the prices of a correct send-off to creating positive your legacy is not buried beneath a mountain of payments.

Let’s dive in and see what these insurance policies have to supply.

Particular Advantages Provided

Open Care closing expense insurance coverage insurance policies are designed to ease the monetary burden on your loved ones throughout a troublesome time. They sometimes cowl a variety of prices related to the end-of-life course of, providing peace of thoughts for each you and your family members. These advantages are often tailor-made to your wants, so you may select a coverage that matches your funds and circumstances.

Forms of Bills Lined

These insurance policies often cowl a large spectrum of bills. Assume funeral companies, burial preparations, cremation companies, and even memorial companies. It is not simply concerning the coffin, however about all the things that accompanies the ultimate farewell. This might embrace issues like viewing, embalming, transportation, and even the prices of a funeral service. They are often as complete as you want them to be, catering to your particular person needs and desires.

Conditions The place Open Care Closing Expense Insurance coverage is Useful

Image this: you’ve got labored arduous your complete life, constructing a snug life for your self and your loved ones. However what occurs once you’re gone? Open Care closing expense insurance coverage helps to minimize the monetary pressure in your family members throughout this time. Think about your loved ones coping with the emotional and sensible facets of your passing with out the added burden of funeral bills.

This insurance coverage could make an enormous distinction in easing their burden. It is like having a security web, ensuring that your family members haven’t got to fret concerning the monetary facets of claiming goodbye.

Protection Choices

| Protection Kind | Description | Instance |

|---|---|---|

| Funeral Bills | Covers prices related to the funeral service, together with the service itself, embalming, transportation of the physique, and the officiant. | Paying for the chapel rental, the funeral director’s companies, the price of the hearse, and the minister’s payment. |

| Burial Bills | Covers prices associated to burial, such because the burial plot, the casket, and any related permits or charges. | Buying a burial plot, the casket, and any related authorities permits or charges. |

| Cremation Bills | Covers prices related to cremation, together with the cremation course of itself, cremation urn, and any obligatory permits. | The price of cremation, an urn, and any obligatory permits or paperwork. |

Pre-Want Planning Help, Open care closing expense insurance coverage

Open Care closing expense insurance coverage insurance policies are nice instruments for pre-need planning. You’ll be able to select a coverage that aligns along with your particular wants and preferences, guaranteeing that your family members know precisely what to anticipate by way of prices. It is like having a roadmap on your closing preparations, making issues simpler for your loved ones. This helps to remove a few of the stress and uncertainty, permitting your loved ones to deal with the emotional facets of your passing relatively than the monetary ones.

Eligibility and Software Course of

So, you are enthusiastic about securing that closing expense insurance coverage, huh? It is a sensible transfer, like prepping your wardrobe for an extended journey. Understanding the eligibility and software course of is essential, like understanding the precise baggage dimension on your journey. Let’s dive in!

Eligibility Standards

Open care closing expense insurance coverage is not a one-size-fits-all deal. Like garments, it wants to suit your wants. Eligibility standards sometimes embrace age limits, well being situations, and typically even pre-existing medical points. The specifics rely upon the person insurance coverage supplier, so it is a good suggestion to verify with the corporate immediately.

Software Course of

Making use of for open care closing expense insurance coverage is simple, like ordering a meal on-line. It sometimes includes filling out an software type, offering obligatory paperwork, and going by an underwriting course of. Consider it as your insurance coverage profile, outlining your particulars for the corporate to overview.

Required Documentation

To make the applying course of clean, collect the required paperwork. These would possibly embrace proof of age, proof of residency, and presumably particulars about your well being historical past. It is like presenting your credentials to the insurance coverage firm to confirm your eligibility and to evaluate the dangers.

Underwriting Course of

The underwriting course of is the insurance coverage firm’s means of evaluating your software, similar to a retailer checking your credit score earlier than approving a purchase order. They overview your software, well being info, and different particulars to resolve if they will give you protection. This step ensures that the corporate’s danger evaluation aligns with the coverage’s phrases.

Software Course of Steps

| Step | Description |

|---|---|

| Step 1 | Collect all obligatory paperwork. That is like packing your luggage for a visit—you want all the things so as. |

| Step 2 | Full the applying type precisely. That is the core of your software, so fill it out with care and a spotlight to element. |

| Step 3 | Submit the applying type together with the required paperwork. Consider it as dropping off your accomplished software on the publish workplace—it is the ultimate step earlier than overview. |

| Step 4 | Await the underwriting course of. The insurance coverage firm evaluations your software to find out for those who qualify for the coverage. It is like ready for the shop to approve your buy. |

| Step 5 | Obtain notification of the choice. The corporate will inform you of their determination relating to your software, whether or not authorised or declined. It is like receiving a notification about your order. |

Pricing and Value Issues

Navigating the world of ultimate expense insurance coverage can really feel like navigating a maze, particularly with regards to the value tag. Understanding the components that affect premiums is essential to discovering the precise coverage on your wants and funds. Like selecting the proper novel, you need a coverage that is each inexpensive and supplies the protection you need.

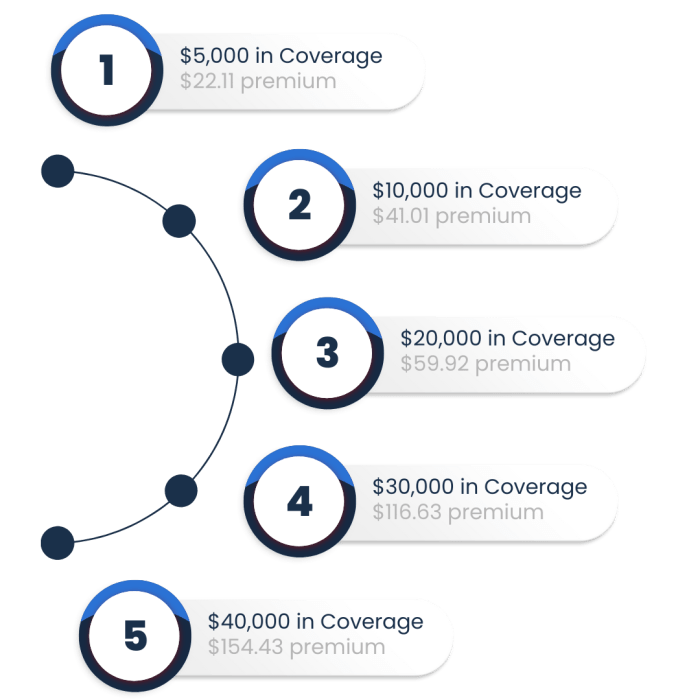

Pricing Fashions for Open Care Closing Expense Insurance coverage

Open care closing expense insurance coverage, in its essence, provides a extra versatile strategy to funeral preparations in comparison with conventional insurance policies. This flexibility typically interprets to different pricing fashions. Insurers sometimes use a mixture of things, together with your age, well being, and desired protection quantity, to calculate premiums. The premiums themselves are designed to mirror the danger an insurer takes on when insuring your wants.

Components Influencing Open Care Closing Expense Insurance coverage Prices

A number of components considerably impression the price of an open care closing expense insurance coverage coverage. Age is a serious consideration, because the older you might be, the upper the danger of needing the protection, which naturally leads to the next premium. Well being situations may affect the value, with pre-existing medical points probably growing premiums. The chosen protection quantity is one other essential issue.

Bigger protection quantities sometimes include increased premiums. Lastly, the particular advantages and add-ons included within the coverage can have an effect on the general value.

Pricing Methods Utilized by Insurers

Insurers make use of numerous pricing methods to make sure profitability whereas providing aggressive charges. Some widespread methods embrace tiered pricing fashions, the place completely different protection ranges correspond to completely different premium brackets. Others would possibly use a point-based system, assigning factors to numerous components, reminiscent of age, well being, and desired protection, to calculate a closing premium. Some insurers additionally provide reductions for bundling insurance policies or for sustaining a wholesome life-style.

Pricing Tiers for Open Care Closing Expense Insurance coverage

| Tier | Premium (per yr) | Protection (USD) |

|---|---|---|

| Tier 1 | $200 – $400 | $5,000 – $10,000 |

| Tier 2 | $400 – $800 | $10,000 – $20,000 |

| Tier 3 | $800 – $1,500 | $20,000 – $30,000+ |

This desk supplies a simplified illustration of how pricing tiers would possibly work. Precise premiums will range considerably based mostly on particular person circumstances.

Comparability with Conventional Closing Expense Insurance coverage

Conventional closing expense insurance coverage insurance policies typically have a hard and fast, predetermined set of advantages. Open care insurance policies, in distinction, provide higher flexibility in selecting the kind and extent of care. This flexibility can lead to premiums which might be both increased or decrease than conventional insurance policies, relying on the particular choices chosen. A key differentiator is the power to customise the kind of funeral preparations, together with the choice of house care or hospice care, influencing the value.

The pricing construction is mostly extra dynamic and nuanced than conventional fashions.

Buyer Service and Assist

Navigating the complexities of ultimate expense insurance coverage can typically really feel like wading by a swamp. However worry not, intrepid reader! Open Care is right here to supply a transparent path, guaranteeing your family members are taken care of when the time comes. Our customer support is designed to be as simple and useful as potential, making all the course of much less daunting and extra manageable.Open Care’s dedication to glorious customer support extends from coverage buy to say settlement.

We perceive that coping with closing expense issues will be emotionally difficult, and we attempt to make the expertise as clean and supportive as potential.

Buyer Service Channels

Open Care provides a number of avenues for reaching our customer support crew, catering to numerous preferences and desires. These channels are designed to make communication seamless and environment friendly, guaranteeing you will get the solutions and assist you require promptly.

- Telephone Assist: Direct and quick help is on the market by our toll-free cellphone quantity. That is preferrred for pressing questions or conditions requiring quick decision.

- E-mail Assist: For much less pressing inquiries or conditions the place an in depth rationalization is required, e-mail assist is a handy possibility. Emails permit for a document of communication, facilitating extra in-depth dialogue and offering a everlasting document of your correspondence.

Assist Assets for Policyholders

Open Care supplies complete assets to assist policyholders perceive their protection and make the most of their advantages successfully. These assets empower you to navigate the method with confidence and ease.

- On-line Portal: A devoted on-line portal provides entry to coverage paperwork, declare kinds, FAQs, and different important info. This self-service strategy permits you to shortly discover the solutions you want with out ready on a cellphone name.

- Continuously Requested Questions (FAQ) Part: This part addresses widespread questions relating to insurance policies, protection, and claims, offering available solutions to continuously requested questions. This part goals to be a invaluable useful resource for fast solutions to your commonest questions.

Claims Course of Overview

Understanding the claims course of is essential for a clean expertise when the time comes. Our crew is dedicated to processing claims effectively and pretty.

- Declare Initiation: Provoke the declare course of by contacting our customer support crew utilizing the popular methodology (cellphone or e-mail). This primary step ensures that your declare is registered correctly and units the stage for a clean and environment friendly course of.

- Supporting Documentation: Present the mandatory supporting paperwork as requested. This ensures the declare is processed precisely and promptly. Examples of paperwork would possibly embrace the dying certificates, coverage particulars, and different requested info.

- Declare Evaluation: Our crew assesses the declare in opposition to the phrases of your coverage to make sure all necessities are met. This course of could contain verifying the coverage particulars and validating the submitted paperwork.

- Fee Processing: As soon as the declare is authorised, the fee is processed in keeping with the phrases of your coverage. This course of ensures well timed fee to the designated beneficiary.

Steps in Submitting a Declare

The declare submitting course of is designed to be as simple as potential, minimizing the burden on you throughout a troublesome time.

- Contact Open Care: Start by contacting Open Care by the popular channel, both cellphone or e-mail. This initiates the declare course of and permits for preliminary communication and steering.

- Collect Required Paperwork: Compile the mandatory paperwork, together with the dying certificates, coverage particulars, and another supporting paperwork requested. Having these paperwork available will streamline the declare course of.

- Full Declare Kind: Fill out the declare type precisely and utterly. Present all requested info to make sure a immediate and correct declare evaluation.

- Submit Paperwork: Submit the finished declare type and all supporting paperwork to Open Care. This closing step ensures that each one obligatory info is on the market for overview and processing.

Contact Info and Procedures

For any inquiries or help, please make the most of the next assets:

Buyer Service Contact Info:Telephone: 1-800-XXX-XXXXEmail: assist@opencare.com

Ending Remarks

In conclusion, open care closing expense insurance coverage provides a singular strategy to pre-need planning, offering peace of thoughts for each you and your family members. Understanding the assorted protection choices, eligibility necessities, and pricing components is essential. By rigorously contemplating your wants and evaluating open care with conventional choices, you can also make an knowledgeable determination that greatest aligns along with your monetary targets and ensures a clean transition for your loved ones.

Keep in mind to totally analysis and examine completely different insurance policies to seek out the very best match on your circumstances.

FAQ Useful resource

What are the standard advantages of open care closing expense insurance coverage?

Open care insurance policies typically embrace protection for funeral preparations, burial bills, cremation companies, and memorial companies. Some insurance policies may cowl further prices like transportation and grief counseling.

What are some widespread misconceptions about open care closing expense insurance coverage?

A typical false impression is that open care closing expense insurance coverage is just for these with pre-existing situations. That is incorrect; eligibility standards range based mostly on the insurer.

How does open care closing expense insurance coverage differ from conventional closing expense insurance coverage?

Open care insurance policies typically have broader protection choices, together with help with pre-need planning and probably higher flexibility in selecting funeral preparations. Conventional insurance policies sometimes focus extra on the quick prices of burial and funeral preparations.

What components affect the price of an open care closing expense insurance coverage coverage?

Components reminiscent of age, well being, protection quantity, and the particular advantages chosen can affect the price of an open care coverage. Insurers sometimes use actuarial tables to evaluate danger and decide pricing.