Low-income automotive insurance coverage Florida is a vital subject for a lot of Floridians. Navigating the complexities of reasonably priced insurance coverage can really feel overwhelming, however this information gives a transparent path towards discovering the precise protection. We’ll discover the challenges, out there assets, and essential steps to securing the absolute best coverage.

This complete useful resource supplies a roadmap to reasonably priced automotive insurance coverage choices particularly designed for low-income people in Florida. Understanding the laws, out there reductions, and monetary help packages will empower you to make knowledgeable selections about your protection.

Overview of Low-Earnings Automotive Insurance coverage in Florida

Securing reasonably priced automotive insurance coverage is usually a vital problem for low-income people in Florida, as in lots of different states. Excessive premiums, restricted entry to protection choices, and an absence of economic help can create a barrier to proudly owning and working a automobile. This overview examines the difficulties confronted by low-income Floridians and explores out there assets to mitigate these obstacles.Florida’s regulatory panorama, whereas aiming to make sure accountable driving, can generally inadvertently influence the affordability of insurance coverage.

Strict necessities for minimal protection quantities and particular standards for figuring out premiums might disproportionately have an effect on these with decrease incomes, resulting in increased out-of-pocket bills. Moreover, the state’s market construction and competitors amongst insurance coverage suppliers play a task in the associated fee and availability of insurance policies.

Challenges Confronted by Low-Earnings People

The first problem is the excessive value of automotive insurance coverage, usually exceeding the monetary capability of low-income people. This excessive value is commonly exacerbated by elements just like the state’s excessive price of visitors accidents or the price of medical care in case of an accident. The absence of tailor-made insurance coverage merchandise or reductions designed for lower-income brackets contributes to this subject.

Rules and Legal guidelines Impacting Inexpensive Automotive Insurance coverage

Florida laws, whereas meant to advertise security, can influence affordability. Minimal legal responsibility insurance coverage necessities, although important for highway security, is usually a vital monetary hurdle for people with restricted monetary assets. Additional, the absence of particular laws addressing low-income insurance coverage choices might result in increased premiums and restricted protection choices.

Monetary Help Packages for Low-Earnings Floridians

Varied initiatives and packages present monetary assist to low-income people searching for automotive insurance coverage. These usually embody subsidies, reductions, and monetary help from state or native authorities packages. Examples embody the Florida Division of Freeway Security and Motor Autos (FLHSMV) help packages for low-income drivers and partnerships with neighborhood organizations providing monetary assist or help. These assets is probably not broadly publicized, requiring proactive efforts from low-income people to find and make the most of them.

Varieties of Automotive Insurance coverage Reductions

Insurance coverage firms ceaselessly supply reductions to encourage accountable driving habits and promote buyer loyalty. Understanding these reductions may help people get monetary savings on their premiums.

| Low cost Kind | Description |

|---|---|

| Multi-Automotive Low cost | A discount in premiums for people insuring a number of automobiles below the identical coverage. This will present vital financial savings for households or people who personal multiple automobile. |

| Scholar Low cost | A reduction for college kids who reveal a historical past of accountable driving and are enrolled in academic establishments. These packages usually reward secure driving habits amongst college students. |

| Good Driver Low cost | A reduction primarily based on a driver’s accident-free driving document. A historical past of accountable driving can considerably decrease premiums. |

| Bundled Providers Low cost | A reduction supplied for combining insurance coverage with different companies corresponding to house insurance coverage. This can be a frequent follow by insurance coverage firms to incentivize clients to decide on their companies. |

| Navy Low cost | A reduction for active-duty army personnel or veterans, acknowledging their service and contribution to the neighborhood. |

Evaluating Insurance coverage Suppliers

Discovering reasonably priced automotive insurance coverage in Florida, particularly for low-income people, requires cautious comparability of various suppliers. Understanding the elements influencing pricing and the strategies used to evaluate affordability is essential for securing the absolute best protection at a manageable value. This part particulars the method of evaluating insurance coverage suppliers and acquiring quotes.Insurance coverage suppliers in Florida, like these nationwide, make use of varied methods to find out premiums.

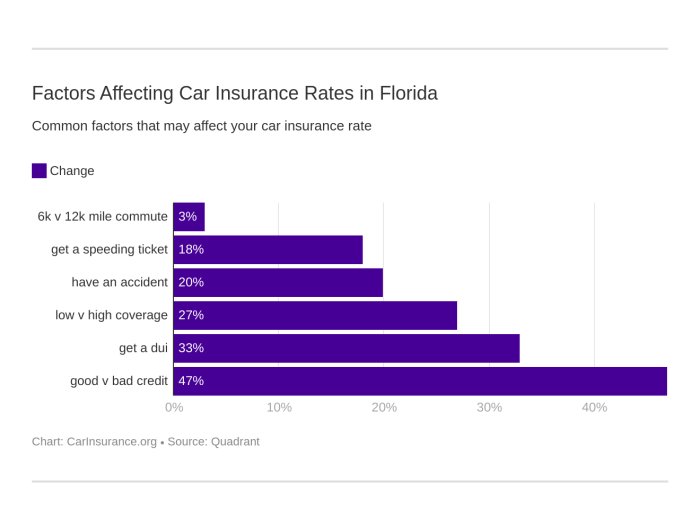

These elements can differ considerably amongst insurers, impacting the ultimate value for policyholders. Elements influencing the price of a coverage can embody driving historical past, automobile sort, location, and particular protection decisions. Understanding these elements helps customers make knowledgeable selections when choosing an insurance coverage supplier.

Elements Influencing Worth Variations

A number of elements contribute to the value discrepancies amongst insurance coverage suppliers. These elements embody, however will not be restricted to, the insurer’s monetary stability, underwriting practices, and the precise protection packages supplied. Moreover, the insurer’s market share and the quantity of insurance policies they handle also can influence their pricing methods.

Strategies for Assessing Affordability, Low-income automotive insurance coverage florida

Insurance coverage suppliers make use of varied strategies to guage the affordability of insurance policies for low-income candidates. These strategies might embody contemplating elements such because the applicant’s credit score rating, employment standing, and earnings documentation. Some suppliers may additionally supply reductions or fee plans to make insurance policies extra accessible.

Acquiring Quotes from A number of Suppliers

Acquiring quotes from a number of suppliers is important to match costs and protection choices. On-line comparability instruments can facilitate this course of, permitting customers to enter their info and obtain quotes from varied insurers. This technique can save vital effort and time within the comparability course of.

Comparability of Protection Choices and Premiums

| Insurance coverage Supplier | Protection Choices (Instance) | Premium (Instance) |

|---|---|---|

| Insurer A | Legal responsibility, Collision, Complete, Uninsured Motorist | $1,200 per 12 months |

| Insurer B | Legal responsibility, Collision, Complete, Uninsured Motorist, roadside help | $1,500 per 12 months |

| Insurer C | Legal responsibility, Collision, Complete, Uninsured Motorist, rental automotive | $1,100 per 12 months |

| Insurer D | Legal responsibility, Collision, Complete, Uninsured Motorist, accident forgiveness | $1,350 per 12 months |

Notice: Premiums are examples and should differ primarily based on particular person circumstances. This desk illustrates a simplified comparability. The protection choices and premiums offered are examples and is probably not the precise protection choices or premiums out there from every insurer. Particular person circumstances will have an effect on the precise premium and out there protection choices.

Understanding Protection Choices

Choosing the proper automotive insurance coverage protection is essential for safeguarding your self and your automobile in Florida. Understanding the assorted choices out there and their implications will empower you to make knowledgeable selections. Completely different protection ranges present various levels of economic safety, and your best option relies on your particular person circumstances and finances.Complete and collision protection are important elements of a complete insurance coverage coverage.

These coverages shield you towards injury to your automobile from incidents like accidents, vandalism, or climate occasions. Legal responsibility protection, however, protects you towards monetary accountability for injury triggered to a different particular person or their property. It is very important perceive the nuances of every protection sort to pick out probably the most appropriate plan.

Complete and Collision Protection

Complete protection safeguards your automobile towards damages past accidents, corresponding to hail injury, fireplace, theft, or vandalism. Collision protection, however, protects your automobile within the occasion of an accident, no matter who’s at fault. Each are important for guaranteeing monetary safety in case your automobile is broken. A complete coverage with each complete and collision protection supplies vital safety in your automobile.

For instance, in case your automotive is stolen, complete protection will assist substitute it. In case your automotive is broken in a collision, collision protection will assist restore or substitute it.

Legal responsibility vs. Uninsured/Underinsured Motorist Protection

Legal responsibility protection is remitted in Florida and protects you towards monetary accountability for injury you trigger to a different particular person or their property. It is essential to grasp the boundaries of your legal responsibility protection, as exceeding these limits might result in vital private monetary burdens. Uninsured/underinsured motorist protection protects you if you’re concerned in an accident with a driver who lacks insurance coverage or whose insurance coverage protection is inadequate to cowl the damages.

This protection is important in your security and monetary safety, particularly in states with increased charges of uninsured drivers. As an illustration, if you’re in an accident with a driver who has no insurance coverage, your uninsured/underinsured protection would step in to assist compensate for damages.

Widespread Varieties of Automotive Insurance coverage Protection in Florida

| Protection Kind | Description |

|---|---|

| Legal responsibility Protection | Protects you from monetary accountability for those who trigger injury to a different particular person or their property. |

| Collision Protection | Covers injury to your automobile in an accident, no matter who’s at fault. |

| Complete Protection | Covers injury to your automobile from occasions aside from collisions, corresponding to theft, vandalism, or climate. |

| Uninsured/Underinsured Motorist Protection | Protects you if you’re concerned in an accident with an uninsured or underinsured driver. |

Implications of Selecting Completely different Protection Ranges

The selection of protection degree instantly impacts the premium you pay and the monetary safety you obtain. Decrease protection ranges might end in decrease premiums, however in addition they restrict the quantity of economic help out there in case of an accident. Increased protection ranges supply higher safety however often include increased premiums. Fastidiously evaluating your monetary state of affairs and potential dangers is essential when choosing the suitable protection degree.

For instance, in case you have a beneficial sports activities automotive, you may want increased collision and complete protection to make sure a full alternative value in case of harm or theft.

Eventualities Requiring Completely different Coverages

Choosing the proper protection relies on your distinctive circumstances. If you’re concerned in an accident the place the opposite driver is at fault, legal responsibility protection will shield you. In case your automobile is broken by a storm, complete protection is critical. If you’re concerned in an accident with a driver who has inadequate insurance coverage, uninsured/underinsured motorist protection is essential.

Understanding these completely different eventualities and their implications can result in a extra knowledgeable choice when buying insurance coverage. This ensures you might be adequately protected in varied conditions and might safeguard your monetary well-being.

Navigating the Software Course of

Securing low-income automotive insurance coverage in Florida requires cautious navigation of the applying course of. Understanding the steps, documentation necessities, and potential pitfalls will assist guarantee a clean and profitable utility. This part particulars the important thing elements of the applying course of, together with important documentation and customary points to keep away from.

Software Steps and Procedures

The applying course of for low-income automotive insurance coverage in Florida sometimes entails a number of key steps. Every step is essential to the profitable completion of the applying. These steps usually require cautious consideration and adherence to particular procedures to make sure a well timed and environment friendly utility.

- Preliminary Inquiry and Analysis: Start by researching completely different insurance coverage suppliers providing low-income choices. Examine protection choices, premiums, and buyer critiques to make knowledgeable selections. Contacting suppliers instantly for clarification on particular necessities and out there reductions is extremely beneficial.

- Gathering Vital Documentation: Documentation necessities differ relying on the insurer and the precise utility. Usually, candidates might want to present proof of id, proof of Florida residency, and monetary documentation demonstrating their low-income standing. Examples embody pay stubs, tax returns, or different related monetary information.

- Finishing the Software Kind: Fastidiously overview and full the insurance coverage utility kind precisely and completely. Present all requested info and guarantee accuracy in particulars corresponding to automobile info, driving historical past, and private particulars. Incomplete or inaccurate types can considerably delay the applying course of.

- Submission of Documentation: Submit the required documentation together with the finished utility kind. Be sure that all paperwork are correctly organized and within the right format as specified by the insurance coverage supplier. Hold copies of all submitted paperwork in your information.

- Evaluation and Approval: The insurance coverage supplier will overview the applying and supporting documentation to evaluate eligibility for low-income automotive insurance coverage. The supplier might contact you for additional clarification or extra info if mandatory. A immediate response to any inquiries is important for a clean utility course of.

Important Documentation Examples

The kinds of documentation required for low-income automotive insurance coverage functions differ relying on the insurer and particular person circumstances. Usually, documentation ought to confirm the applicant’s id, residency, and monetary standing.

- Proof of Id: Legitimate Florida driver’s license, state-issued identification card, or passport are typical types of proof of id. Guarantee these paperwork are present and legitimate.

- Proof of Florida Residency: Utility payments (electrical energy, water, gasoline), lease agreements, or mortgage statements can function proof of Florida residency. Current payments or statements are usually most well-liked.

- Monetary Documentation: Pay stubs, tax returns, or different monetary paperwork are generally requested to confirm low-income standing. These paperwork ought to mirror the applicant’s present earnings and monetary state of affairs.

Coverage Phrases and Circumstances

Understanding coverage phrases and circumstances is vital for making knowledgeable selections. Evaluation the whole coverage doc rigorously, paying shut consideration to protection limits, deductibles, and exclusions.

Make clear any unclear phrases with the insurance coverage supplier earlier than signing the coverage.

Widespread Pitfalls and Potential Points

Widespread pitfalls throughout the utility course of embody offering inaccurate info, failing to submit all required documentation, or misinterpreting coverage phrases. Fastidiously reviewing the applying course of and documentation necessities may help stop these points.

- Inaccurate Data: Be sure that all info offered on the applying kind is correct and up-to-date. Inaccurate info can result in denial of the applying or subsequent points.

- Incomplete Documentation: Submitting all required documentation is essential for a profitable utility. Guarantee all mandatory paperwork are full and correct.

- Coverage Misinterpretation: Fastidiously overview the coverage phrases and circumstances. If any phrases are unclear, contact the insurance coverage supplier for clarification earlier than signing the coverage.

Step-by-Step Software Information

| Step | Motion |

|---|---|

| 1 | Analysis and examine low-income insurance coverage suppliers. |

| 2 | Collect mandatory documentation (proof of id, residency, and monetary standing). |

| 3 | Full the applying kind precisely. |

| 4 | Submit the applying kind and required documentation. |

| 5 | Evaluation and reply to any follow-up inquiries from the insurance coverage supplier. |

| 6 | Fastidiously overview the coverage phrases and circumstances. |

Sources and Help

Securing reasonably priced automotive insurance coverage might be difficult, particularly for low-income people in Florida. Thankfully, varied assets and help packages can be found to assist navigate this course of and make insurance coverage extra accessible. Understanding these choices can considerably ease the monetary burden and guarantee accountable automobile possession.

Organizations Providing Monetary Help

A number of organizations present monetary help or subsidies for automotive insurance coverage premiums. These organizations usually work with people going through monetary hardship, making automotive insurance coverage extra manageable. This help can embody direct monetary assist, reductions, or referrals to reasonably priced insurance coverage suppliers.

- Group-Based mostly Organizations: Many neighborhood facilities, non-profit organizations, and social service companies in Florida supply monetary help packages tailor-made to low-income people. These organizations might have partnerships with insurance coverage suppliers or supply grants and subsidies to offset insurance coverage prices. They usually have a deep understanding of native wants and might present customized help to assist people entry out there assets.

- State Businesses: Florida’s Division of Monetary Providers (DFS) might supply packages to help low-income drivers. Their assets might embody details about eligibility standards and out there help choices. These assets might present direct monetary help or referrals to different assist packages.

- Insurance coverage Corporations: Some insurance coverage firms have particular packages or initiatives for low-income people. These packages usually present reductions or help with premiums to make sure that people have entry to mandatory protection.

Advantages of Using These Sources

Using these assets gives a number of benefits. These advantages embody decreasing the monetary burden of automotive insurance coverage, guaranteeing entry to mandatory protection, and selling accountable automobile possession.

- Lowered Monetary Pressure: Monetary assist can considerably scale back the price of automotive insurance coverage, making it extra reasonably priced and accessible for low-income people. This enables people to allocate funds in direction of different important wants.

- Entry to Protection: These assets can present entry to automotive insurance coverage protection which will in any other case be unattainable on account of monetary constraints. This protection ensures security and protects people and their belongings.

- Selling Accountable Possession: Entry to reasonably priced insurance coverage encourages accountable automobile possession by permitting people to take care of insurance coverage protection, thus decreasing dangers and complying with Florida’s authorized necessities.

Accessing Monetary Help

The method for accessing monetary help varies relying on the group. Usually, people must reveal monetary want and eligibility via utility types and supporting documentation.

- Documentation: Supporting paperwork might embody proof of earnings, identification, and different related monetary info. The particular necessities might differ relying on the group.

- Software Course of: Every group has a singular utility course of. These processes sometimes contain filling out types, offering required paperwork, and present process an eligibility evaluation. People ought to rigorously overview the directions offered by every group to make sure they submit the proper documentation.

- Contact Data: Direct contact with the group is commonly required to provoke the applying course of and inquire in regards to the eligibility necessities. This info is often out there on the group’s web site or via their contact particulars.

Authorities Packages

Florida has a number of authorities packages that present help to low-income people. These packages might cowl bills associated to varied companies, together with automotive insurance coverage. It’s vital to analysis the packages out there in Florida to find out if any match the person’s wants.

| Group | Contact Data | Providers Offered |

|---|---|---|

| Florida Division of Monetary Providers (DFS) | (Contact info to be included) | Details about eligibility standards and help choices. Could embody referrals to different assist packages. |

| [Example Community-Based Organization] | (Contact info to be included) | Monetary assist packages, subsidies, and referrals to reasonably priced insurance coverage suppliers. |

| [Example Insurance Company] | (Contact info to be included) | Particular packages or initiatives for low-income people, together with reductions or help with premiums. |

Illustrative Case Research: Low-income Automotive Insurance coverage Florida

Navigating the complexities of automotive insurance coverage might be daunting, particularly for low-income people in Florida. Understanding the out there choices, evaluating suppliers, and efficiently navigating the applying course of can really feel overwhelming. Nonetheless, with cautious planning and analysis, people can safe reasonably priced protection that meets their wants. This part presents illustrative case research to reveal the challenges and options encountered by low-income Floridians.These examples spotlight the significance of economic literacy in making knowledgeable insurance coverage selections, emphasizing that even with restricted assets, securing ample protection is achievable.

The tales showcase the precise challenges confronted by low-income people, the options they employed, and the optimistic influence of the chosen insurance coverage choices.

Case Examine 1: Maria’s Journey to Inexpensive Protection

Maria, a single mom working a number of part-time jobs in Miami, confronted vital monetary constraints. She wanted automotive insurance coverage to commute to work, however the conventional insurance coverage choices appeared prohibitively costly. She researched varied choices, together with reductions for secure drivers, usage-based insurance coverage, and reasonably priced protection via specialised suppliers. She found a program that offered reductions for low-income drivers in Florida.

By bundling her insurance coverage with different companies, Maria was capable of safe a complete coverage at a a lot cheaper price than she anticipated. This resolution not solely protected her financially but additionally gave her peace of thoughts, permitting her to give attention to her profession and household.

Case Examine 2: A Household’s Alternative for Funds-Pleasant Safety

The Rodriguez household, a small household dwelling in Orlando, had a budget-conscious strategy to automotive insurance coverage. They understood the significance of safety however acknowledged the monetary burden of conventional protection. After thorough analysis, they found a specialised insurance coverage firm centered on offering reasonably priced charges. This firm supplied varied protection choices, permitting the Rodriguez household to decide on protection ranges that aligned with their particular wants and finances.

Their choice to give attention to important protection, coupled with usage-based reductions, resulted in a major discount of their month-to-month insurance coverage premiums, enabling them to allocate funds to different vital household bills.

Case Examine 3: Navigating the Software Course of with Restricted Sources

This hypothetical case examine demonstrates the method a low-income particular person would possibly face when making use of for insurance coverage. A younger skilled, David, lives in Tampa and commutes each day for work. His finances restricts him to probably the most reasonably priced insurance coverage choices. David’s state of affairs highlights the significance of understanding varied insurance coverage choices and making the most of assets that may help with the applying course of.

Through the use of on-line instruments and assets particularly designed for low-income people, David efficiently utilized for and obtained protection. This demonstrates the essential function of accessibility and assets in making the insurance coverage utility course of manageable for these with restricted monetary assets.

Hypothetical Case Examine: David’s Software

David, a younger skilled dwelling in Tampa, commutes each day for work. His finances is tight, and he prioritizes reasonably priced insurance coverage choices. David wants complete protection that features legal responsibility, collision, and complete insurance coverage. His automobile is a used automotive, including an element to the insurance coverage choice. Accessible choices embody:

- Conventional Insurance coverage Suppliers: These suppliers might supply reductions for secure driving or bundled companies, however premium prices may be excessive.

- Specialised Low-Earnings Insurance coverage Suppliers: These suppliers supply tailor-made insurance policies for people with decrease incomes, usually with accessible utility processes and decrease premiums.

- Utilization-Based mostly Insurance coverage: These packages reward secure driving habits with decrease premiums, probably saving David cash if he maintains a secure driving document.

David’s selection relies on his driving historical past, automobile sort, and desired protection ranges. The particular protection ranges might be essential for figuring out his premiums and affordability.

Future Tendencies in Florida’s Low-Earnings Automotive Insurance coverage

The Florida automotive insurance coverage market is consistently evolving, presenting each challenges and alternatives for low-income people. Understanding these future tendencies is essential for navigating the complexities of buying reasonably priced protection. Predicting exact outcomes is tough, however analyzing rising patterns and potential regulatory shifts gives beneficial insights into the way forward for insurance coverage accessibility.

Potential Adjustments within the Automotive Insurance coverage Panorama

The automotive insurance coverage panorama in Florida is topic to varied elements, together with modifications in state laws, developments in expertise, and shifts in client preferences. Insurance coverage suppliers are more likely to adapt to those influences, probably resulting in each optimistic and unfavorable outcomes for low-income drivers. Competitors amongst suppliers will proceed to form pricing methods, whereas the usage of expertise might streamline the claims course of.

Authorities intervention, although unsure, might play a task in addressing affordability points.

Rising Tendencies and Applied sciences Affecting Accessibility

A number of tendencies are impacting insurance coverage accessibility for low-income people. Telematics-based insurance coverage packages, which make the most of driver habits knowledge to evaluate threat, are gaining reputation. Whereas probably providing decrease premiums for secure drivers, these packages might create a barrier for these missing entry to expertise or constant web connectivity. Moreover, the rise of usage-based insurance coverage (UBI) fashions, the place premiums are adjusted primarily based on precise driving habits, presents each benefits and drawbacks for low-income drivers.

Predictions About Potential Authorities Rules or Insurance policies

Authorities laws play a major function in shaping the insurance coverage market. Potential future insurance policies might embody initiatives geared toward rising competitors amongst insurance coverage suppliers, offering subsidies for low-income drivers, or implementing stricter laws on pricing practices. Florida has a historical past of addressing insurance coverage affordability points, and the longer term may even see comparable actions geared toward defending weak populations. These actions might vary from monetary help packages to legislative modifications geared toward guaranteeing equity in pricing.

The Function of Know-how in Streamlining the Insurance coverage Course of

Know-how gives vital potential to streamline the insurance coverage course of for low-income people. On-line platforms and cell functions can simplify the applying course of, permitting people to entry quotes and handle their insurance policies from wherever with an web connection. Improved digital instruments might considerably improve entry to insurance coverage, significantly for these with restricted mobility or entry to conventional insurance coverage places of work.

Additional improvement of user-friendly on-line portals and cell functions will probably make insurance coverage extra accessible.

Projected Adjustments in Insurance coverage Prices (Subsequent 5 Years)

| 12 months | Projected Change in Price (Estimate) | Reasoning |

|---|---|---|

| 2024 | Slight Enhance (2-3%) | Elevated accident charges and potential inflationary pressures on associated prices. |

| 2025 | Average Enhance (3-5%) | Potential rise in restore prices, increased demand for insurance coverage, and elevated claims frequency. |

| 2026 | Average Lower (1-3%) | Anticipated growth of telematics-based packages providing reductions for secure drivers and elevated competitors amongst insurers. |

| 2027 | Slight Enhance (1-2%) | Potential for increased gasoline costs impacting restore prices and claims frequency. |

| 2028 | Slight Lower (1-2%) | Additional developments in expertise and probably favorable legislative modifications that incentivize affordability for low-income drivers. |

Notice: These are estimates and precise modifications might differ. Elements like financial circumstances, accident charges, and legislative actions can considerably affect these projections.

Finish of Dialogue

In conclusion, securing low-income automotive insurance coverage in Florida is achievable with the precise information and assets. By understanding the out there choices, monetary assist, and utility processes, you may confidently shield your self and your automobile. This information empowers you to make the perfect decisions in your monetary state of affairs, and we encourage you to hunt help from the assets offered.

FAQs

What are the frequent challenges confronted by low-income people searching for automotive insurance coverage in Florida?

Excessive premiums, restricted entry to protection choices, and issue assembly the monetary necessities for varied insurance policies are sometimes vital hurdles.

What monetary help packages can be found for low-income Floridians?

Varied organizations and authorities packages supply monetary assist and help to assist offset the price of automotive insurance coverage. These assets might embody sponsored insurance coverage packages, help with down funds, and reductions on premiums.

What documentation is often required for low-income automotive insurance coverage functions?

Documentation might differ relying on the supplier and program. Nonetheless, generally required paperwork usually embody proof of earnings, identification, and automobile particulars.

How can I examine insurance coverage suppliers providing low-income automotive insurance coverage in Florida?

Examine protection choices, premiums, and buyer critiques to establish probably the most appropriate suppliers. Search for suppliers particularly designed for lower-income people, and think about using on-line comparability instruments to streamline this course of.