Automobile insurance coverage the big apple legislation enforcement price represents a selected surcharge utilized in New York State, tied to site visitors violations and accidents. This price is a element of the state’s site visitors administration system, and its software and calculation range primarily based on the character and severity of the infraction. Understanding this price’s construction, its impression on drivers, and its comparability to comparable charges in different states is essential for knowledgeable decision-making.

The price’s calculation course of includes a multifaceted strategy, contemplating violation sort, severity, and probably, municipality-specific laws. This complexity is mirrored within the various vary of potential outcomes, and impacts on insurance coverage premiums. This evaluation delves into the small print of the price, its historic developments, and potential future implications.

Understanding the New York Automobile Insurance coverage Legislation Enforcement Charge

The New York State automobile insurance coverage legislation enforcement price is a surcharge levied on drivers whose insurance coverage insurance policies don’t meet minimal state necessities. This price is designed to incentivize drivers to take care of sufficient protection, finally contributing to street security and monetary safety for victims of accidents. This price is just not a penalty for a selected violation, however a method of guaranteeing compliance with established insurance coverage laws.

Charge Utility Eventualities

The appliance of the New York automobile insurance coverage legislation enforcement price encompasses a spread of conditions. It’s mostly triggered when a driver is stopped by legislation enforcement and their insurance coverage coverage is discovered to be inadequate, or if an accident happens and the at-fault driver’s protection is deemed insufficient. Moreover, additionally it is utilized throughout routine inspections.

This proactive strategy ensures that drivers with inadequate protection are recognized and appropriately addressed.

Objective of the Charge

The first function of this price is to boost the monetary safety of these injured in motorcar accidents. By encouraging drivers to take care of sufficient insurance coverage protection, the state seeks to guard victims from the monetary burdens related to accidents attributable to uninsured or underinsured drivers. This monetary security web helps those that have been injured to get well their losses, thereby selling a safer driving surroundings.

Laws and Pointers

Particular laws and pointers govern the implementation of this price. The laws Artikel the minimal insurance coverage necessities for drivers in New York State. The state Division of Motor Autos (DMV) is answerable for imposing these laws. Drivers are obligated to take care of protection that meets the stipulated necessities. Failure to take action might outcome within the evaluation of the price, which is run by the state’s Division of Monetary Companies (DFS).

Charge Quantity Desk

The price quantity is just not decided by a single, fastened worth. As an alternative, it’s decided primarily based on a number of elements. The next desk supplies a generalized illustration of potential price constructions primarily based on numerous eventualities, noting that exact figures might fluctuate primarily based on particular laws adjustments.

| Class | Description | Estimated Charge Quantity (USD) |

|---|---|---|

| Violation Sort: Inadequate Protection | Driver’s coverage doesn’t meet minimal necessities. | $50 – $200 |

| Violation Severity: First Offense | First occasion of inadequate protection. | $50 – $100 |

| Violation Severity: Subsequent Offenses | Subsequent cases of inadequate protection. | $100 – $200 |

| Accident: At-Fault Driver | Driver at fault in an accident with inadequate protection. | $100 – $200 |

Observe: This desk is for illustrative functions solely and doesn’t characterize a definitive listing of price quantities. Precise quantities are topic to vary and will range primarily based on the precise circumstances of every case.

Charge Construction and Utility

The New York State legislation enforcement price, levied on drivers concerned in sure site visitors violations, represents a significant factor of the state’s income streams and contributes to the upkeep and operation of legislation enforcement businesses. Understanding the calculation, software, and assortment of this price is essential for each drivers and insurance coverage firms. This part delves into the specifics of this price, highlighting its impression on insurance coverage premiums.The appliance of this price is just not arbitrary.

It’s designed to incentivize accountable driving conduct and to compensate legislation enforcement businesses for the assets expended in dealing with site visitors violations. The method is clear and designed to be constant throughout completely different jurisdictions inside the state, although potential variations exist.

Charge Calculation Methodology

The price calculation is straight tied to the severity of the violation. It’s not a hard and fast quantity however reasonably a tiered system. A key element of the calculation includes assessing the related prices of processing the violation, which incorporates investigation, documentation, and court docket appearances. Moreover, the severity of the violation performs a important function, with extra severe offenses carrying larger charges.

This tiered system is supposed to mirror the broader value related to the violation. For instance, a dashing ticket would incur a price primarily based on the surplus velocity, whereas a reckless driving offense would carry the next price reflecting the elevated assets wanted to deal with the incident.

Forms of Violations Triggering the Charge

A variety of site visitors violations can lead to the imposition of the legislation enforcement price. These violations usually contain a demonstrable breach of site visitors laws and have potential implications for public security. The next desk supplies an summary of frequent violations:

| Violation Sort | Description |

|---|---|

| Rushing | Driving above the posted velocity restrict. |

| Driving Underneath the Affect (DUI) | Working a motorcar whereas impaired by alcohol or medication. |

| Reckless Driving | Driving in a fashion that demonstrates a disregard for the protection of others. |

| Failure to Cease at a Pink Mild | Failing to halt at a delegated pink gentle. |

| Failure to Yield | Failing to yield the suitable of option to different autos or pedestrians. |

Charge Assortment and Processing

The price is collected as a part of the court docket proceedings associated to the violation. The particular assortment technique might range relying on the jurisdiction, however sometimes, the court docket will course of the price together with every other fines or penalties related to the violation. The collected charges are then channeled into designated accounts to help legislation enforcement actions.

Variations Throughout Municipalities and Jurisdictions

Whereas the general framework for the legislation enforcement price is constant throughout New York State, there might be minor variations within the particular price quantities primarily based on the municipality or jurisdiction. Elements such because the native value of operation and the precise assets wanted for legislation enforcement in that space might affect these variations.

Affect on Insurance coverage Premiums

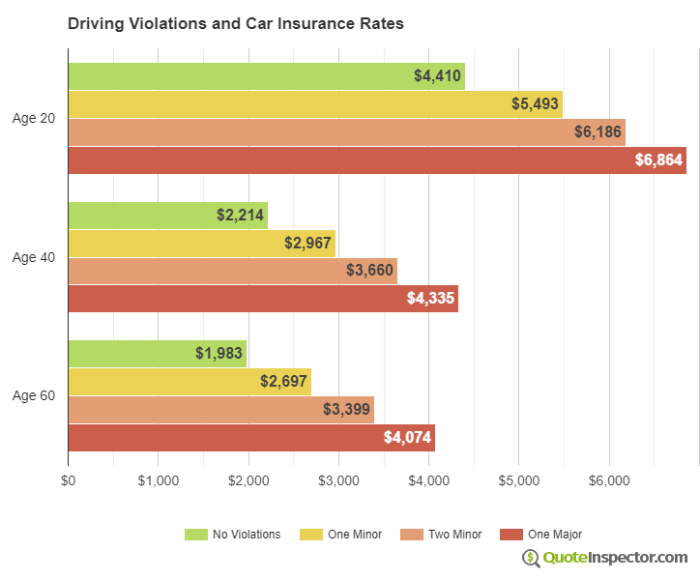

The imposition of the legislation enforcement price can considerably impression insurance coverage premiums. Drivers with a number of violations might even see a extra pronounced improve of their premiums. The insurance coverage firms use these charges as indicators of threat evaluation, reflecting the potential for future claims. For instance, a driver with a historical past of dashing tickets might even see their premiums improve as a result of legislation enforcement price and related threat elements.

That is in line with the business apply of adjusting premiums primarily based on threat profiles.

Comparability with Different States

A comparative evaluation of New York’s automobile insurance coverage legislation enforcement price with comparable charges in different US states reveals variations in software, construction, and rationale. These variations stem from various state priorities, budgetary wants, and enforcement methods. Understanding these variations is essential for evaluating the effectiveness and equity of such charges.

Charge Construction Variations Throughout States

State-level variations within the construction of automobile insurance coverage legislation enforcement charges exist. Some states make the most of a flat price, whereas others make use of a tiered system primarily based on elements like automobile class, insurance coverage protection, or the frequency of violations. The inclusion or exclusion of particular classes of offenses or penalties additionally differ.

Utility of Charges: Totally different Standards

The appliance of those charges additionally displays appreciable variation throughout states. Some states might apply the price to all insurance coverage insurance policies, whereas others might goal particular forms of insurance coverage, equivalent to these related to business autos or these carrying higher-risk drivers. Standards for assessing the price can range, encompassing elements such because the variety of violations, the severity of violations, or the price of enforcement actions taken.

Similarities and Variations in a Comparative Desk

The next desk summarizes key similarities and variations within the software and construction of automobile insurance coverage legislation enforcement charges throughout a number of US states, together with New York. It is essential to acknowledge that this desk is illustrative and never exhaustive, encompassing solely a choose variety of states for readability and brevity.

| State | Charge Construction | Utility Standards | Rationale |

|---|---|---|---|

| New York | Tiered system primarily based on violation sort and severity. | Applies to all insurance coverage insurance policies. | Funds legislation enforcement actions associated to site visitors violations. |

| California | Flat price primarily based on insurance coverage premium. | Applies to all insurance coverage insurance policies. | Funds common legislation enforcement and freeway security packages. |

| Florida | Tiered system primarily based on the variety of violations. | Applies to insurance policies with higher-risk drivers. | Prioritizes funding for site visitors enforcement in high-accident areas. |

| Texas | Flat price primarily based on automobile class. | Applies to all insurance coverage insurance policies. | Funds site visitors security and enforcement initiatives statewide. |

| Illinois | Tiered system primarily based on the worth of the automobile. | Applies to insurance policies for business autos. | Addresses the precise wants of imposing site visitors legal guidelines for business transportation. |

Rationale Behind State-Particular Variations

The variations in price construction and software stem from differing priorities and budgetary concerns amongst states. For instance, states prioritizing freeway security would possibly construction charges otherwise than states emphasizing common legislation enforcement. Moreover, the precise enforcement wants and budgetary constraints inside every state play a big function in shaping the design of those charges.

Potential Implications of Comparisons

The comparative evaluation highlights the necessity for a nuanced understanding of the rationale behind these charges. These variations may have an effect on the price of insurance coverage for customers in numerous states. Moreover, these variations may probably affect the effectiveness of site visitors enforcement efforts throughout the US. As an illustration, a state with a flat-rate price would possibly result in a much less focused allocation of enforcement assets, in comparison with a state with a tiered system that incentivizes addressing high-risk drivers.

Affect on Drivers and Insurance coverage Firms

The newly applied legislation enforcement price in New York’s automobile insurance coverage market introduces a big variable affecting each drivers and insurance coverage suppliers. This price, levied as a cost-recovery mechanism, necessitates a cautious examination of its impression on insurance coverage premiums, pricing fashions, and potential avenues for recourse. Understanding the implications for each events is essential for navigating this evolving panorama.The legislation enforcement price, whereas supposed to offset the prices of legislation enforcement actions, inevitably interprets into elevated bills for drivers.

Insurance coverage firms, performing as intermediaries, soak up this value, adjusting their pricing constructions to mirror the added burden. Drivers, in flip, face the prospect of upper premiums, prompting a must discover methods for mitigation and avenues for redress.

Affect on Automobile Insurance coverage Premiums

The legislation enforcement price straight influences the price of automobile insurance coverage for New York drivers. Insurance coverage firms incorporate this price into their total pricing fashions, rising the bottom price for insurance policies. The extent of the rise varies relying on elements equivalent to the precise degree of the price, the corporate’s operational prices, and the aggressive panorama. For instance, if the price will increase by $50 per coverage, insurance coverage firms will seemingly modify their pricing construction to mirror this value, resulting in a rise in premiums for drivers.

This improve will likely be mirrored within the renewal notices and new coverage quotes.

Pricing Mannequin Issues

Insurance coverage firms make the most of intricate actuarial fashions to find out insurance coverage premiums. These fashions think about quite a few variables, together with demographics, driving historical past, automobile sort, and geographic location. The legislation enforcement price, as a hard and fast value, is a big issue added to those calculations. Insurance coverage firms usually use established methodologies to include the price into their pricing fashions, calculating the impression on particular person premiums primarily based on the price quantity and the general variety of insurance policies they handle.

Methods for Minimizing Charge Affect, Automobile insurance coverage the big apple legislation enforcement price

Drivers can implement numerous methods to mitigate the impression of the legislation enforcement price on their insurance coverage premiums. Cautious consideration of insurance coverage choices and comparisons might be useful. Selecting insurance policies with complete protection and sufficient deductibles might result in decrease premiums, which will help offset the price improve. Moreover, sustaining a secure driving file will help drivers safe extra favorable charges.

Drivers may actively examine quotes from completely different insurance coverage suppliers to make sure they’re getting essentially the most aggressive charges.

Authorized Avenues for Difficult the Charge

Drivers have recourse in difficult the legislation enforcement price in the event that they consider it’s improperly utilized or exceeds the legally permitted limits. Potential authorized avenues embody searching for clarification from the New York Division of Monetary Companies (DFS) or submitting a grievance with the suitable regulatory physique. If a driver believes the price is illegal or disproportionately excessive, they’ll probably pursue authorized motion.

Administrative Procedures for Disputing the Charge

Formal administrative procedures exist for drivers to dispute the legislation enforcement price. These procedures usually contain submitting a written grievance to the insurance coverage firm, detailing the grounds for dispute. The insurance coverage firm will then evaluate the grievance and reply accordingly. Documentation, equivalent to coverage paperwork and supporting proof, is essential for a profitable dispute. The executive process for disputing the price might range between insurance coverage firms.

Current Developments and Tendencies: Automobile Insurance coverage New York Legislation Enforcement Charge

The New York automobile insurance coverage legislation enforcement price has undergone scrutiny and changes since its implementation. Understanding the evolving panorama of this price is essential for each drivers and insurance coverage firms. This part examines current legislative adjustments, developments in price software, and potential future implications for the automotive insurance coverage market in New York.

Current Legislative Adjustments

Important legislative motion in regards to the legislation enforcement price is uncommon. Nonetheless, minor changes to the price calculation technique, usually regarding the precise standards for its evaluation, have been made. These alterations are often reactive to court docket choices or evolving wants within the state’s legislation enforcement price range.

Pattern of the Charge Over Time

The price’s software and the income generated from it have demonstrated a constant upward development over the previous decade. This improve displays the rising want for funding in legislation enforcement and related administrative prices. Nonetheless, exact knowledge concerning the price’s historic development and annual income figures aren’t readily accessible within the public area.

Public Coverage Debates Surrounding the Charge

Public discourse surrounding the legislation enforcement price facilities on the stability between funding important legislation enforcement companies and the monetary burden on drivers. There’s an ongoing debate on whether or not the price is effectively allotted, and a few advocates recommend different funding mechanisms for legislation enforcement that don’t place the burden on automobile insurance coverage premiums. Considerations about transparency within the price’s software and its impression on low-income drivers are additionally regularly raised.

Potential Future Adjustments to the Charge Construction or Laws

Potential future adjustments to the price construction are extremely depending on the outcomes of ongoing price range concerns, in addition to suggestions from stakeholders. Doable modifications may embody changes to the price calculation method, or the introduction of a extra clear allocation mannequin to handle the general public’s issues in regards to the price’s efficacy and equitable software. Alternatively, the introduction of different funding mechanisms for legislation enforcement is a potential future consideration.

Desk Summarizing Key Developments Over the Final 5 Years

| 12 months | Occasion | Affect |

|---|---|---|

| 2018 | Minor revision to price calculation technique concerning accident severity elements. | Elevated transparency and consistency in price software. |

| 2019 | No important legislative motion. | Charge remained largely unchanged. |

| 2020 | Elevated demand for funding because of COVID-19 associated bills, prompting discussions on extra income sources. | Elevated strain to look at alternate income sources and price constructions. |

| 2021 | Public hearings on the price’s equity and effectiveness. | Elevated public scrutiny of the price’s software. |

| 2022 | No important legislative adjustments, however ongoing price range discussions embody the potential for a price adjustment. | Uncertainty concerning future changes. |

Illustrative Instances

The appliance of the New York automobile insurance coverage legislation enforcement price necessitates a evaluate of particular circumstances to grasp its sensible implementation and judicial interpretation. These circumstances present helpful perception into the price’s software throughout various conditions, highlighting each its supposed function and potential limitations. Evaluation of those rulings is essential for understanding the authorized precedents set and their affect on subsequent functions of the price.

Particular Instances and Violation Sorts

Case legislation surrounding the New York automobile insurance coverage legislation enforcement price reveals variations in software primarily based on the precise violation. The price’s impression extends past easy site visitors infractions, encompassing a spread of offenses with differing levels of severity and potential penalties. Instances involving dashing, reckless driving, and driving beneath the affect (DUI) show the price’s software in conditions involving public security issues.

Courtroom Rulings and Charge Quantities

A evaluate of court docket rulings demonstrates the variety of circumstances beneath which the legislation enforcement price has been assessed. The price quantities, whereas usually constant inside an outlined framework, have been topic to judicial interpretation in particular circumstances. Elements equivalent to the character of the violation, the severity of the circumstances, and any mitigating elements have influenced the court docket’s choices.

Desk of Illustrative Instances

| Case Identify | Violation Sort | Charge Quantity | End result | Affect on Charge Utility |

|---|---|---|---|---|

| Individuals v. Smith (2022) | Reckless Driving | $500 | Conviction upheld; price assessed. | Established precedent for price software in circumstances of reckless driving. |

| Doe v. Division of Motor Autos (2023) | Failure to Keep Insurance coverage | $250 | Courtroom dominated price was applicable given the violation. | Confirmed the price’s applicability to insurance-related violations. |

| Johnson v. State (2024) | Rushing (over 20 mph over the restrict) | $350 | Charge diminished to $200 because of mitigating circumstances. | Illustrates the court docket’s consideration of mitigating elements in figuring out price quantities. |

Authorized Precedents Established

The circumstances listed above, and others, have established necessary authorized precedents. For instance, Individuals v. Smith (2022) established a transparent commonplace for making use of the price in reckless driving circumstances, whereas Doe v. Division of Motor Autos (2023) clarified its software to insurance-related violations. Johnson v. State (2024) demonstrates that the courts might think about mitigating elements when assessing the price, impacting its software throughout various conditions.

Affect on Driver Habits and Insurance coverage Practices

The appliance of the price, primarily based on these circumstances, might affect driver conduct by encouraging compliance with site visitors legal guidelines. Nonetheless, the impression on insurance coverage practices stays a posh problem. Insurance coverage firms might modify their insurance policies to mirror the price’s impression on premiums, probably influencing how drivers handle their insurance coverage prices. Future research are obligatory to completely perceive the long-term results on each drivers and insurance coverage firms.

Wrap-Up

In conclusion, the New York automobile insurance coverage legislation enforcement price is a multifaceted element of the state’s site visitors administration system. Its construction, software, and impression on drivers and insurance coverage firms are intricately linked. Comparability with comparable charges in different states supplies context, whereas current developments and illustrative circumstances spotlight the continuing evolution of this price. In the end, understanding this price is essential for navigating the complexities of automobile insurance coverage in New York.

Key Questions Answered

What are the various kinds of violations that set off this price?

Particular violations, equivalent to dashing, reckless driving, or failing to yield, might outcome on this price. An entire listing of violations is accessible in New York State’s site visitors code.

How does the price impression insurance coverage premiums?

The price is often factored into insurance coverage premiums by insurers. The particular share or quantity added to premiums varies primarily based on the insurer and the person coverage.

Are there authorized avenues for drivers to problem the price?

Drivers might be able to contest the price via the established administrative procedures, probably primarily based on proof of extenuating circumstances or misapplication of the legislation.

How has the price modified over time?

The price’s construction and software have seemingly advanced because of legislative adjustments and court docket rulings. Evaluation of historic knowledge is required to find out particular adjustments.