Are you able to negotiate insurance coverage payout for totaled automotive – Are you able to negotiate insurance coverage payout for a totaled automotive? This information dives deep into the world of automotive insurance coverage claims, revealing the methods and techniques wanted to safe the very best payout when your trip meets its unlucky finish. From understanding the declare course of to mastering negotiation strategies, we’ll equip you with the data to get probably the most out of your insurance coverage settlement.

Get able to stage up your insurance coverage recreation!

Navigating the complexities of a totaled automotive declare can really feel overwhelming, however with the precise info, you possibly can confidently method the method. This complete information breaks down the steps concerned, serving to you perceive your rights and duties. Let’s uncover the secrets and techniques to a good and favorable settlement!

Understanding the Insurance coverage Declare Course of

Navigating the insurance coverage declare course of for a totaled car could be daunting, however understanding the steps concerned could make the expertise much less anxious. This course of, whereas various barely by insurer, usually includes a collection of actions that, if adopted appropriately, will result in a smoother and extra environment friendly decision. An intensive understanding of the documentation, timelines, and totally different coverage varieties is essential for a constructive consequence.

Submitting a Declare for a Totaled Automotive: A Step-by-Step Course of

The method for submitting a declare for a totaled car typically begins with quick documentation of the incident. This includes contacting your insurance coverage firm as quickly as potential, ideally inside 24-48 hours of the accident. They are going to doubtless require particulars in regards to the incident, together with the date, time, location, and an outline of the circumstances resulting in the overall loss.

Subsequently, a declare kind is initiated and submitted. A police report, if obtainable, is usually useful in supporting your declare and offering an official report of the incident. Following this, the insurance coverage adjuster will assess the injury and decide the car’s market worth. This usually includes a bodily inspection of the car and probably consulting with an impartial appraiser.

As soon as the car is deemed a complete loss, your insurance coverage firm will present an estimated settlement quantity, which is often primarily based on the car’s market worth on the time of the accident. After accepting the settlement, you may have to return the car’s title and any associated documentation to the insurance coverage firm.

Frequent Documentation Required for a Totaled Car Declare

A complete declare requires numerous types of documentation. This contains the police report (if relevant), the car’s title, proof of possession, and any pre-existing injury experiences. Images or movies of the injury to the car are essential proof. You might also want to supply restore estimates from a mechanic if you happen to tried repairs earlier than declaring the automotive a complete loss.

Additional documentation could embody pre-accident inspection experiences, if any exist. These paperwork serve to confirm the small print of the incident and the car’s situation earlier than the accident. The insurer might also require supporting paperwork like medical information or witness statements relying on the circumstances.

Typical Timeframe for Processing a Totaled Car Declare

The time required to course of a totaled car declare can differ significantly. It is dependent upon a number of components, such because the complexity of the declare, the insurance coverage firm’s procedures, and the supply of all required documentation. Usually, the method can take wherever from a couple of weeks to a number of months. An easy declare with available documentation could also be resolved inside a few weeks.

Nevertheless, claims involving disputes over legal responsibility or intensive documentation necessities might take significantly longer. Insurance coverage firms usually present estimates or timelines in the course of the preliminary declare evaluation.

Totally different Sorts of Insurance coverage Insurance policies Masking Totaled Autos

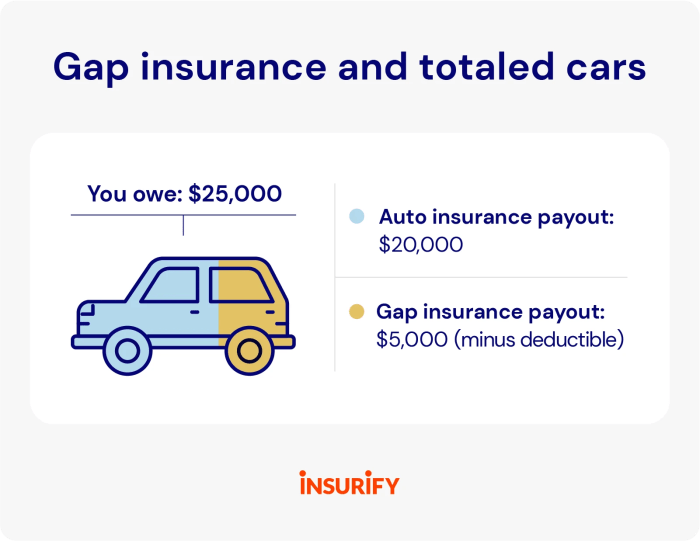

Various kinds of insurance coverage insurance policies supply various ranges of protection for totaled autos. Understanding the nuances of every coverage is important in maximizing your declare. Complete protection usually covers injury brought on by occasions not involving a collision, equivalent to fireplace, vandalism, or weather-related injury. Collision protection, however, covers injury ensuing from an accident with one other car or object.

Comparability of Frequent Coverage Clauses Associated to Totaled Autos

| Coverage Sort | Protection for Complete Loss | Deductibles | Extra Necessities |

|---|---|---|---|

| Complete | Covers complete losses because of non-collision occasions (e.g., fireplace, vandalism, hail). | Deductibles differ by coverage; usually a proportion of the car’s worth. | Could require proof of the occasion inflicting the injury, equivalent to a police report or injury evaluation. |

| Collision | Covers complete losses ensuing from collisions with one other car or object. | Deductibles differ by coverage; usually a proportion of the car’s worth. | Requires proof of the collision, usually a police report. |

Components Affecting Negotiation

Securing a good insurance coverage payout for a totaled car requires understanding the components that affect the settlement supply. Insurance coverage firms use established standards to find out the compensation quantity, and a radical data of those components empowers you to barter successfully. A complete understanding of those components, together with market worth, depreciation, and the car’s situation, is essential to attaining a passable consequence.

Car Market Worth

The market worth of a totaled car considerably impacts the negotiation course of. This worth is usually decided utilizing on-line assets, current gross sales information, and trade benchmarks. Insurance coverage adjusters usually use these assets to ascertain a baseline worth. For instance, a 2015 Honda Civic with excessive mileage and minor beauty injury might need a decrease market worth in comparison with a more recent mannequin or one in pristine situation.

The presence of fascinating options or distinctive attributes also can have an effect on the worth. Figuring out the exact market worth to your particular car mannequin, yr, situation, and site is important for a profitable negotiation.

Depreciation and Present Market Circumstances

Depreciation, the discount in a car’s worth over time, is a key consideration. Present market circumstances, equivalent to financial downturns or surges in used automotive costs, additionally play a task. A automotive that was value $20,000 two years in the past is likely to be value $15,000 in the present day because of depreciation. A sudden enhance in demand, probably triggered by provide chain points, might even end in larger than anticipated market values.

Insurance coverage firms usually use a mix of those components to reach at a settlement determine.

Situation of the Totaled Car

The situation of the totaled car is essential. Harm extent, together with structural injury, repairs, and general situation, straight impacts the settlement quantity. A automotive with important structural injury could have a decrease settlement than one with minor beauty injury. Images and detailed documentation of the injury are important. A complete report from a mechanic detailing the car’s pre-accident situation and the extent of the injury, can show extremely invaluable within the negotiation.

Restore Estimates and Appraisal Experiences

Restore estimates and appraisal experiences present essential proof to your case. These paperwork, created by certified professionals, current a transparent image of the car’s restore prices. An appraisal report is usually required by insurance coverage firms to validate the market worth of the automotive. Having detailed and professionally ready restore estimates and value determinations considerably strengthens your negotiation place.

These paperwork present goal proof to counter potential undervaluations.

Insurance coverage Adjuster Ways

Insurance coverage adjusters usually make use of techniques to scale back payouts. These techniques can embody undervaluing the car, disputing restore prices, and utilizing pre-existing circumstances as an argument to reduce compensation. Frequent techniques usually contain questioning the accuracy of restore estimates or suggesting different, lower-cost repairs. It’s important to be ready to counter these techniques with verifiable proof. This contains having detailed documentation of the car’s pre-accident situation, images, and impartial value determinations.

Methods for Negotiating a Truthful Payout: Can You Negotiate Insurance coverage Payout For Totaled Automotive

Negotiating a good insurance coverage payout for a totaled automotive requires a strategic method, combining data of the method with assertive communication. Understanding the worth of your car, gathering supporting proof, and presenting your case successfully are essential steps in attaining a passable settlement. This part delves into sensible methods for securing a simply compensation to your loss.Efficient negotiation hinges on a radical understanding of your rights and the insurance coverage firm’s practices.

Insurance coverage firms usually make use of standardized procedures to judge claims, however these procedures could be navigated efficiently with meticulous preparation and a transparent understanding of your car’s value.

Gathering Proof Supporting Car Worth

Thorough documentation is crucial to substantiate your declare. This contains sustaining information of all repairs, upkeep, and modifications to your car. This documentation, when correctly offered, considerably strengthens your argument for a good valuation. Unique gross sales receipts, upkeep information, and restore invoices are all important items of proof. As well as, contemplate acquiring value determinations from impartial, licensed automotive appraisers.

These value determinations present an unbiased valuation, which may bolster your negotiation. Moreover, photographs and movies of the broken car, taken from a number of angles, can supply a visible report of the extent of the injury.

Approaches to Presenting Your Case

Totally different approaches to presenting your case to the insurance coverage adjuster can yield various outcomes. A direct, assertive method could also be efficient with some adjusters, whereas a extra collaborative, evidence-based method is likely to be extra appropriate with others. Take into account your negotiation type and the adjuster’s demeanor to tailor your presentation for optimum outcomes. One essential method is to obviously and concisely articulate the worth of your car, emphasizing all components contributing to its value.

This contains detailing the car’s age, mileage, situation, and any aftermarket modifications that enhanced its worth.

Sturdy Arguments to Use Throughout Negotiation

Sturdy arguments throughout negotiation concentrate on offering clear and concise proof supporting the car’s worth. Highlighting current market tendencies for comparable autos in your space is a robust argument. Information from respected on-line automotive marketplaces and used automotive listings can help your assertion of truthful market worth. As well as, offering impartial value determinations or quotes from dealerships providing related autos can additional strengthen your case.

For instance, if the insurance coverage firm initially gives a considerably decrease valuation than the impartial appraisal, you should use the appraisal as proof of the car’s precise value. One other compelling argument is to current a complete breakdown of the car’s worth, itemizing all related components like mileage, options, and upkeep historical past.

Pattern Negotiation Script for a Totaled Car Declare

This pattern negotiation script demonstrates a structured method for presenting your case.

“Good morning/afternoon [Adjuster’s Name]. I am right here in the present day to debate the settlement for my totaled car, [Vehicle Year, Make, Model]. I’ve gathered supporting documentation, together with upkeep information, restore invoices, and an impartial appraisal, which locations the truthful market worth at [Appraised Value]. I’ve additionally researched current market tendencies for comparable autos in [Your Location], which additional helps this valuation. I am open to discussing a mutually agreeable settlement.”

Sustaining Detailed Data

Detailed information are essential all through all the course of. Sustaining correct information of all communications, correspondence, and gives acquired from the insurance coverage firm is crucial. This contains protecting copies of all emails, letters, and notes. These information present a transparent audit path of your declare’s progress and could be invaluable if disputes come up. This documentation might help you preserve a transparent understanding of all the negotiation course of.

Detailed information permit for a transparent and concise presentation of your case, making certain that each one related info is instantly accessible.

Authorized Concerns and Assets

Navigating a totaled car declare includes understanding your authorized rights and duties. This part delves into the authorized panorama surrounding insurance coverage claims, highlighting state legal guidelines, client safety, and when searching for authorized counsel is advisable. Comprehending these elements empowers you to successfully negotiate a good settlement and shield your pursuits.

Authorized Rights and Obligations

Your authorized rights throughout a totaled car declare negotiation are multifaceted. You’ve got the precise to truthful and correct assessments of your car’s worth and the precise to know the components influencing the payout. Understanding the phrases of your insurance coverage coverage is essential, because it Artikels your duties and the insurer’s obligations. Obligations could embody offering crucial documentation or cooperating with the insurer’s investigation.

These rights and duties are important for a easy and simply declare decision.

State Legal guidelines Concerning Insurance coverage Claims

State legal guidelines considerably affect the method of negotiating a totaled car declare. Every state has particular rules governing insurance coverage insurance policies, declare procedures, and dispute decision mechanisms. Variations exist within the timeframes for submitting claims, the required documentation, and the procedures for interesting choices. As an example, some states mandate particular varieties for appraisal or require mediation earlier than pursuing authorized motion.

This variance underscores the significance of researching your state’s explicit legal guidelines.

Shopper Safety Legal guidelines

Shopper safety legal guidelines exist to safeguard policyholders from unfair or misleading insurance coverage practices. These legal guidelines tackle points like misrepresentation of protection, unreasonable delay in processing claims, and refusal to pay reputable claims. Examples embody legal guidelines prohibiting insurers from denying protection primarily based on pre-existing circumstances (in some circumstances) or for fraudulent claims. Shopper safety legal guidelines are designed to make sure equitable remedy and forestall insurers from exploiting susceptible policyholders.

Position of Shopper Safety Businesses

Shopper safety companies play a important function in mediating disputes between customers and insurance coverage firms. These companies examine complaints, present info to customers, and facilitate settlements. They usually act as mediators, trying to resolve disputes earlier than they escalate to courtroom. For instance, they may assist decide if an insurer’s actions violate state legal guidelines or if a settlement is truthful and cheap.

The involvement of those companies could be essential in acquiring a passable decision.

Assets for Shoppers

Quite a few assets can be found to customers searching for help with insurance coverage claims. These embody state insurance coverage departments, client safety companies, and on-line assets. Contacting your state’s insurance coverage division is a elementary step for accessing related info and assets associated to your state’s particular legal guidelines. Shopper advocacy teams and authorized help organizations also can present invaluable help and steering.

These assets present a pathway for understanding your rights and acquiring crucial help.

When to Seek the advice of a Lawyer

Consulting a lawyer is suitable when the insurance coverage firm denies a reputable declare, refuses to barter pretty, or misrepresents coverage phrases. A lawyer can advise you in your authorized choices, overview the insurance coverage coverage and supporting documentation, and signify your pursuits in negotiations or courtroom. When disputes escalate past amicable decision or the insurance coverage firm’s actions appear egregious, searching for authorized counsel could be a important step in defending your rights and pursuits.

Various Dispute Decision

Navigating a totaled automotive declare can typically result in disagreements between you and your insurance coverage firm. Luckily, a number of different strategies exist to resolve these disputes exterior of a prolonged and probably expensive courtroom battle. These strategies, usually faster and fewer formal, might help each events attain a mutually agreeable settlement.

Totally different Strategies of Various Dispute Decision

Various Dispute Decision (ADR) encompasses numerous strategies for resolving conflicts with out litigation. Key strategies embody mediation and arbitration. Understanding these strategies and their nuances is essential for maximizing your probabilities of securing a good settlement.

Mediation

Mediation includes a impartial third celebration, the mediator, facilitating communication and negotiation between you and the insurance coverage firm. The mediator helps determine widespread floor and encourages either side to think about one another’s views. Mediation is usually much less formal than arbitration, permitting for extra flexibility within the course of.

- Mediation goals to foster a collaborative surroundings the place each events can actively take part in shaping the decision.

- The mediator guides the dialogue, making certain either side perceive one another’s considerations and positions.

- Mediation is usually a much less adversarial course of in comparison with litigation, fostering a spirit of compromise.

Arbitration

Arbitration includes a impartial third celebration, the arbitrator, who listens to either side of the case after which makes a binding choice. This choice is usually legally enforceable, just like a courtroom judgment. Arbitration usually includes a extra structured course of than mediation.

- Arbitration gives a extra formal setting, with particular guidelines and procedures to observe.

- The arbitrator acts as a choose, evaluating the proof and arguments offered by either side.

- The arbitrator’s choice is usually last and legally binding, that means the events are obligated to stick to the result.

Advantages and Drawbacks of ADR Strategies

Each mediation and arbitration supply benefits and drawbacks. The very best technique is dependent upon the particular circumstances of your totaled automotive declare.

| Technique | Description | Execs | Cons |

|---|---|---|---|

| Mediation | A impartial third celebration facilitates communication and negotiation. | Versatile, much less adversarial, probably sooner, and extra collaborative. Typically cheaper than litigation. | No assure of a decision, mediator’s solutions are usually not binding. The method might not be appropriate for complicated or extremely contentious circumstances. |

| Arbitration | A impartial third celebration renders a binding choice. | Sooner than litigation, usually cheaper than litigation, and binding choice. | Much less flexibility than mediation, the arbitrator’s choice is last and will not absolutely tackle all considerations. |

When ADR is Helpful in Totaled Automotive Claims

ADR strategies are sometimes useful when coping with totaled automotive claims. The power to resolve the dispute with out resorting to expensive and time-consuming litigation is a big benefit. For instance, if the worth of the totaled car is comparatively low or if the events have a historical past of amicable relationships, mediation might show extremely efficient. Equally, when a fast and decisive decision is desired, arbitration could be a invaluable instrument.

Using ADR in Totaled Automotive Claims

Within the context of a totaled automotive declare, mediation could be extremely useful. The method can facilitate a dialogue of the varied components contributing to the declare, together with the situation of the car, the market worth, and the potential for repairs. Arbitration, however, is likely to be appropriate for conditions the place there’s a important disagreement concerning the car’s worth or if the insurance coverage firm is unwilling to barter pretty.

Understanding these nuances is crucial in selecting the simplest technique.

Frequent Errors to Keep away from

Navigating the complexities of a totaled automotive declare could be difficult. Understanding potential pitfalls and the best way to keep away from them considerably improves the probabilities of securing a good payout. This part highlights widespread errors and supplies methods to keep away from them.The insurance coverage declare course of, whereas designed to be easy, can turn out to be convoluted if not approached with the precise data and techniques.

By recognizing and proactively addressing potential errors, you possibly can shield your pursuits and guarantee a smoother, extra favorable decision.

Pitfalls in Negotiation Methods, Are you able to negotiate insurance coverage payout for totaled automotive

Misunderstandings and miscalculations can simply derail negotiations, resulting in unsatisfactory settlements. Understanding these pitfalls permits you to put together successfully and confidently navigate the method.

- Failing to doc all the things meticulously.

- Neglecting to assemble all related supporting proof.

- Underestimating the significance of thorough analysis.

- Dashing the negotiation course of.

- Not searching for skilled authorized recommendation when acceptable.

These errors can result in a decrease payout than what’s rightfully owed. Thorough documentation and proof are essential to help your declare. A rushed course of usually leads to overlooking essential particulars or concessions.

Examples of Ineffective Negotiation Methods

A typical mistake is accepting the primary supply with out totally contemplating its equity. Failing to analysis comparable claims or the present market worth of comparable autos may end up in accepting a considerably decrease payout. For instance, if the insurance coverage firm gives a worth primarily based on an outdated appraisal, you is likely to be shedding out on a considerable quantity. Negotiation includes understanding the market worth and the insurance coverage firm’s typical payout practices.

Moreover, merely agreeing to the preliminary supply with out counter-arguments could also be detrimental to securing a good settlement.

- Accepting the primary supply with out counter-offer: This usually results in accepting a decrease payout than justified.

- Failing to analysis comparable claims: Lack of analysis may end in accepting an unfair supply primarily based on a low valuation in comparison with current claims for related autos.

- Ignoring knowledgeable opinions: Dismissing value determinations or estimates from impartial specialists can considerably hinder your capacity to justify the next settlement.

- Being overly emotional throughout negotiations: Letting feelings cloud judgment can negatively affect the negotiation course of and probably result in much less favorable phrases.

Penalties of Making Errors

The implications of constructing these errors can vary from a decrease payout to a protracted and probably anxious negotiation course of. Accepting an insufficient supply may end up in monetary loss. Ignoring essential proof or authorized elements can result in disputes and extended decision.

- Monetary Loss: Failing to barter successfully may end up in a settlement considerably decrease than the car’s precise worth.

- Extended Dispute: Lack of preparation or improper negotiation techniques can delay the declare course of and add to emphasize.

- Authorized Points: Misunderstanding authorized concerns or neglecting to hunt acceptable authorized counsel can escalate the dispute.

Avoiding Negotiation Pitfalls

Thorough preparation and a strategic method are important to keep away from these errors. Constructing a powerful case with complete documentation, analysis, and knowledgeable help considerably improves the probability of a positive consequence.

- Detailed Documentation: Doc each communication, expense, and piece of proof associated to the declare.

- Market Analysis: Analysis comparable claims and present market values for related autos.

- Search Skilled Recommendation: Take into account consulting with a authorized skilled if the declare turns into complicated.

- Keep Professionalism: Keep an expert demeanor all through the negotiation course of.

- Persistence: Permit ample time for the negotiation course of.

Flowchart for Avoiding Frequent Errors

(A visible illustration of steps to keep away from widespread errors will not be offered right here, because it’s past the scope of text-based content material.)

Ultimate Wrap-Up

In conclusion, negotiating a good insurance coverage payout for a totaled automotive requires a strategic method. By understanding the declare course of, analyzing the components affecting the settlement, and mastering negotiation strategies, you possibly can considerably enhance your probabilities of securing a positive consequence. Bear in mind to doc all the things, be ready to assemble proof, and do not hesitate to hunt skilled recommendation when wanted.

This information equips you with the data to navigate the complexities of a totaled automotive declare, in the end empowering you to guard your pursuits.

Knowledgeable Solutions

Can I negotiate if the injury is clearly my fault?

Sure, you possibly can nonetheless negotiate. Whereas legal responsibility is evident, you possibly can nonetheless negotiate for a good payout quantity that considers the present market worth, not simply the declared injury.

What if I do not agree with the insurance coverage adjuster’s evaluation?

You’ve got the precise to problem the evaluation. Collect supporting documentation like restore estimates, appraisal experiences, and market worth information. Be ready to current your case.

How lengthy does the negotiation course of usually take?

The timeframe varies, nevertheless it often takes a number of weeks to succeed in a settlement. Persistence and persistence are key.

What if I am unable to attain a settlement by way of negotiation?

Various dispute decision strategies, equivalent to mediation or arbitration, could also be crucial. These strategies can present a impartial platform to resolve the disagreement.